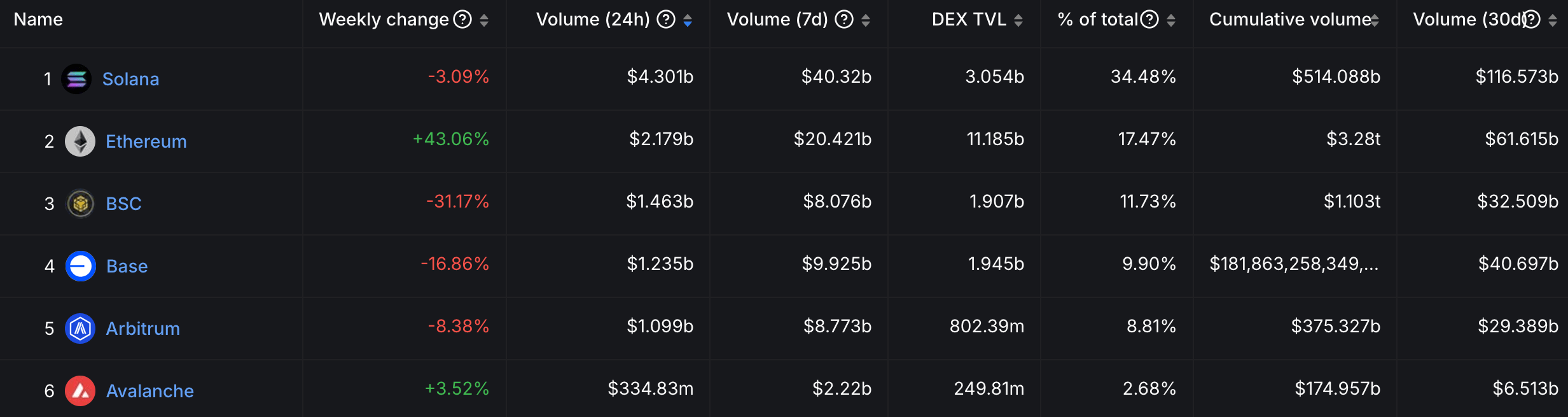

Solana (SOL) decentralized finance (DeFi) activity has gained significant momentum, with its decentralized exchanges (DEX) surpassing Ethereum (ETH) DEX in monthly trading volume. So far in November, Solana-based DEXes have recorded over $100 billion in trading volume, marking a major milestone for the ecosystem.

Solana DeFi Ecosystem Gains Momentum, Outshines Ethereum DeFi

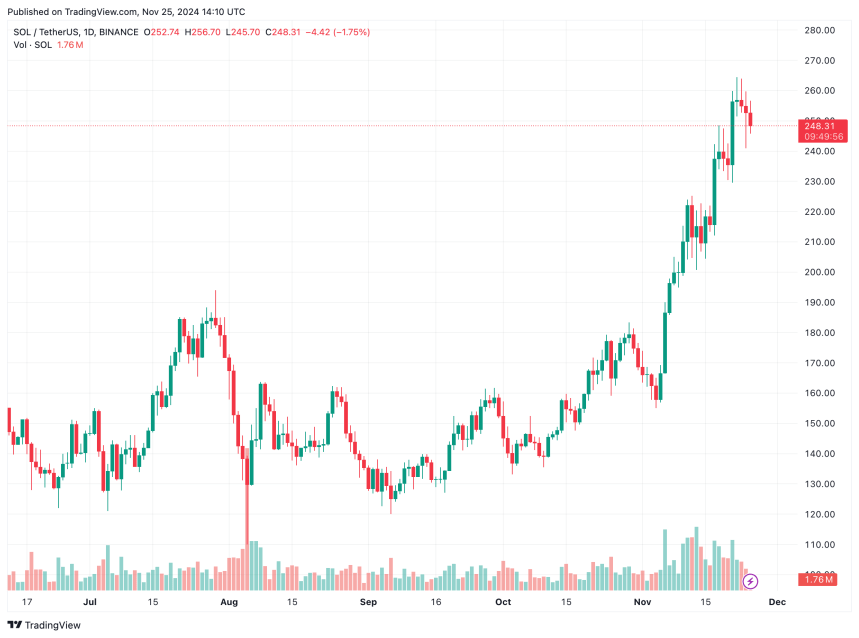

Solana, the fourth-largest cryptocurrency with a reported market cap of $118.34 billion has been on a record-breaking price trajectory. Recently, the digital asset established a new all-time-high (ATH) of $263 after having hit as low as $8 at the peak of the FTX fiasco.

Now, the layer-1 blockchain has achieved another milestone as Solana-based DEXes surpassed $100 billion for the first time in monthly trading volume. According to data from DefiLlama, the 30-day cumulative trading volume recorded by Solana DEXes stands at $116.51 billion.

In comparison, Ethereum mainnet-based DEXes saw $61.61 billion in trading volume during the same period. This means Solana’s DEX trading volume was more than double that of Ethereum’s.

On a month-over-month (MoM) basis, Solana’s DEX volume surged over 100% from October, which stood at $52.5 billion. Meanwhile, the total value locked (TVL) in Solana’s DeFi ecosystem has increased to $9.30 billion, up from $6.23 billion a month ago.

The unprecedented rise in Solana-based DEX trading volume can be attributed to several factors. These include the ongoing memecoin frenzy, the blockchain’s low transaction fees, and an intuitive user interface.

It is worth highlighting that Solana’s TVL has yet to surpass its ATH TVL of $10.02 billion, which was recorded almost three years ago in November 2021. In January 2023, the blockchain’s TVL hit a low of $210 million, dragged down by the wider crypto bear market exacerbated by the downfall of FTX exchange.

At the time of writing, $3.58 billion of Solana’s TVL is tied to the liquid staking protocol Jito, while Jupiter DEX holds $2.4 billion. Another prominent Solana-based DEX, Raydium, accounts for $2.37 billion of TVL.

Where Is SOL Headed?

Solana’s growing user adoption has played a crucial role in driving the recovery of its native token, SOL. On a year-to-date (YTD) basis, SOL has gained over 157%, rising from $101 on January 1 to $263 on November 23.

Despite such extraordinary returns, crypto experts remain bullish on SOL, expecting further gains for the digital asset. According to a recent analysis by Titan of Crypto, SOL may hit $400 as it appears to be breaking out from a prolonged cup-and-handle pattern.

Additional bullish factors, such as the declining Bitcoin (BTC) dominance and the rising likelihood of a Solana exchange-traded fund (ETF), could further propel SOL to new highs. SOL trades at $248.31 at press time, up 0.5% in the past 24 hours.