This week in crypto was marked by major exchange updates and political shifts influencing digital assets. Taken together, the highlights display how the global cryptocurrency ecosystem continues to advance.

The following is a recap of the biggest stories that happened this week in crypto and will continue to shape the sector.

Pi Network’s PI on CoinMarketCap

Pi Network’s PI token made headlines this week when it successfully secured a listing on CoinMarketCap. The milestone will certainly increase the project’s visibility.

However, the excitement remains dampened by continued delays regarding its listing on Binance. The Pi Network community remains optimistic after significant voter support among the exchange’s community members.

The prolonged wait raises concerns about when and if Binance will approve its listing. Despite the setbacks, the token continues to attract a huge following. As BeInCrypto reported, Pi Network now boasts a followership of over 4 million on X (Twitter).

Trump Announced the US Crypto Reserve

US President Donald Trump shook the crypto space by proposing the establishment of a US Crypto Reserve. As BeInCrypto reported, he named XRP, Cardano (ADA), and Solana (SOL) as potential assets in the reserve.

This move aimed to boost the country’s positioning in the blockchain sector and provide a more stable framework for integrating cryptocurrencies into national financial structures. The announcement triggered both excitement and skepticism.

Analysts debated whether this proposal was feasible. On the other hand, experts predicted more altcoins could be added to the crypto reserve. As it happened, however, Commerce Secretary Howard Lutnick revealed Bitcoin would get preferential treatment.

US to Establish Strategic Bitcoin Reserve

It turned out that Donald Trump signed an executive order to establish a Strategic Bitcoin Reserve, funded with seized BTC, aiming to secure the US’ digital asset strategy.

“Bitcoin, the original cryptocurrency, is referred to as “digital gold” because of its scarcity and security, having never been hacked. With a fixed supply of 21 million coins, there is a strategic advantage to being among the first nations to create a Strategic Bitcoin Reserve,” the order read.

The order also authorized budget-neutral strategies for potentially acquiring more Bitcoin. Yet, critics argue that the reserve lacks substantive impact.

To some, however, Trump’s latest executive order presents as a rebranded version of past initiatives rather than a transformative step for crypto regulation. While the order emphasizes the potential of a national Bitcoin reserve and greater integration of blockchain into financial systems, critics argue that it repackages previously suggested policies without offering tangible steps forward.

This has led to speculation about whether the administration is taking genuine action or merely capitalizing on crypto’s popularity for political leverage.

Binance Delisting Concerns: 10 Tokens at Risk

In exchange-related news, Binance placed ten altcoins under review, signaling potential delistings due to regulatory concerns and insufficient liquidity. The uncertainty surrounding these tokens has led to market volatility, with investors closely watching for Binance’s final decision.

In the latest update, GoPlus Security (GPS) has joined the list, following the incorporation of a monitoring tag. It comes only days after it was listed on Binance.

“The Monitoring Tag has been applied to GoPlus Security (GPS) due to a significant price drop immediately following the spot listing and certain market-making behavior of one of GPS’ market makers,” Binance said in a statement.

In the immediate aftermath of this announcement, GPS saw an immediate 49% decline in price. The sharp drop reflects the market’s sensitivity to Binance’s listing and delisting decisions.

Trump Hosts First-Ever White House Crypto Summit

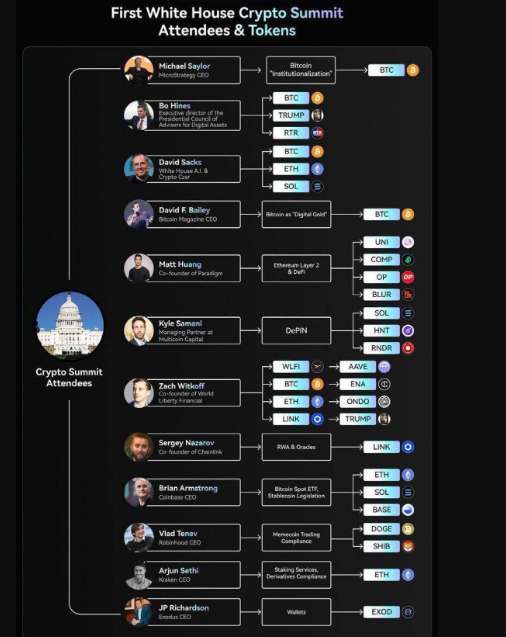

Another of the top crypto news this week is the much-anticipated White House Crypto Summit. The event, which will take place today, marks the first event of its kind. Reports suggest that key topics will include regulatory frameworks, the role of crypto in national security, and the future of decentralized finance (DeFi).

Industry leaders, policymakers, and blockchain innovators will gather to discuss the path forward. However, many are waiting to see whether tangible policy changes will emerge from the discussions. Analysts suggest that while the event is a step in the right direction, the long-term impact depends on how the administration follows up with actionable measures.

A notable controversy at the summit was Ethereum’s indirect representation. Many in the Ethereum community expressed concerns that their blockchain was not given a direct platform, despite its critical role in the crypto ecosystem.

Following the summit, the crypto market could see increased volatility, with projects tied to summit attendees likely to experience price swings. Ted, a crypto investor, shared a list of altcoins poised for impact.

Notwithstanding, this week demonstrated how politics, regulation, and exchange activities shape the crypto playing field. With ongoing debates over listings, delistings, executive orders, and policy shifts, today’s Crypto Summit has the industry in flux.

The post This Week in Crypto: Pi Network on CoinMarketCap, White House Crypto Summit, Binance Delistings, and More appeared first on BeInCrypto.