The latest CoinShares report shows global turmoil is not stopping crypto capital. Despite heightened geopolitical uncertainty, crypto inflows hit a 10th consecutive week, reflecting investor resilience in the face of volatility.

Meanwhile, the heightened volatility comes amid exacerbated tensions in the Middle East, with superpowers like the US, Russia, and China now taking sides.

Bitcoin and Ethereum Continue to Lead as Crypto Inflows Hit $1.2 Billion

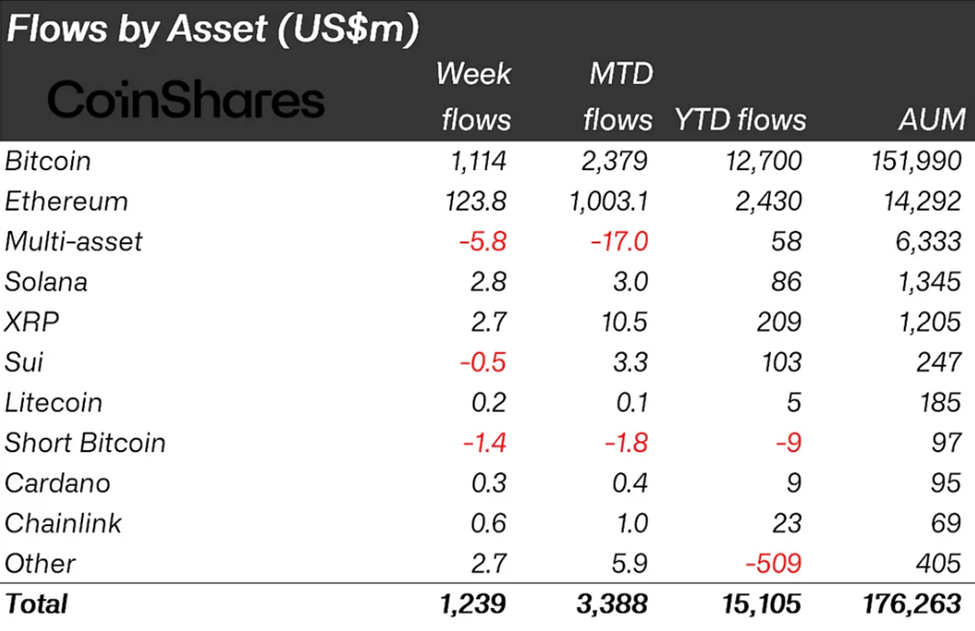

According to CoinShares’ latest weekly report, crypto inflows totaled $1.24 billion over the past week, pushing year-to-date (YTD) inflows to a record $15.1 billion.

While that marks a pullback from the $1.9 billion seen the previous week, it still represents a strong continuation of bullish sentiment.

“Digital asset investment products recorded their 10th consecutive week of inflows, totaling US$1.24 billion last week and pushing year-to-date (YTD) inflows to a new high of US$15.1 billion,” CoinShares’ James Butterfill noted.

The report pointed to a slowdown in inflows during the latter part of the week, attributed to the US Juneteenth holiday and emerging reports of US involvement in the Iran conflict.

Based on the report, Bitcoin continued to dominate crypto inflows, pulling in $1.1 billion despite a recent price correction.

“Bitcoin saw a second consecutive week of inflows… indicating that investors were buying on weakness,” Butterfill added.

Notably, short-Bitcoin products recorded minor outflows of $1.4 million, further reinforcing the bullish positioning. Ethereum maintained its momentum with $124 million inflows, marking its ninth week of gains.

This brings Ethereum’s cumulative inflows over that period to the shortest run since mid-2021.

Two weeks ago, BeInCrypto reported that Ethereum had its strongest inflow streak since the US elections, contributing significantly to the $224 million total that week. The week before that, crypto inflows reached $286 million, led once more by Ethereum.

Other altcoins showing modest inflows include Solana with $2.78 million and XRP with $2.69 million. This outcome reflects a broader appetite for major layer-1 assets beyond Bitcoin and Ethereum.

Analysts say the uncertainty due to geopolitical tension has investors pivoting to cryptos with strong fundamentals.

Regional Flows Reflect Diverging Sentiment

More closely, the report shows that the US overwhelmingly led regional inflows with $1.25 billion. This suggests strong domestic demand, likely linked to the recent rally in institutional interest.

While this week’s total was lower than last week’s $1.9 billion, the continued inflows amid macroeconomic and geopolitical factors mean investors are still positioning for long-term gains.

Bitcoin and Ethereum continue to attract steady institutional and retail demand, a bullish signal for the broader market. With $15.1 billion already recorded YTD, 2025 may be on course to surpass previous records for crypto inflows, provided market momentum and macro conditions remain stable.

The post Crypto Inflows Extend 10-Week Streak to $1.2 Billion Despite Geopolitical Tensions appeared first on BeInCrypto.