Ethereum (ETH) outperformed Bitcoin by 6% in Q2 2025. The analysis from the on-chain research platform DeFi Report reveals strong bullish signals for ETH.

The report indicates that Ethereum is on the verge of a breakout, driven by institutional investment, stablecoin growth, and the potential of the GENIUS Act.

Ethereum’s Q2 2025

The DeFi Report provides a comprehensive overview of the network’s developments in the past quarter, highlighting positive factors and growth potential.

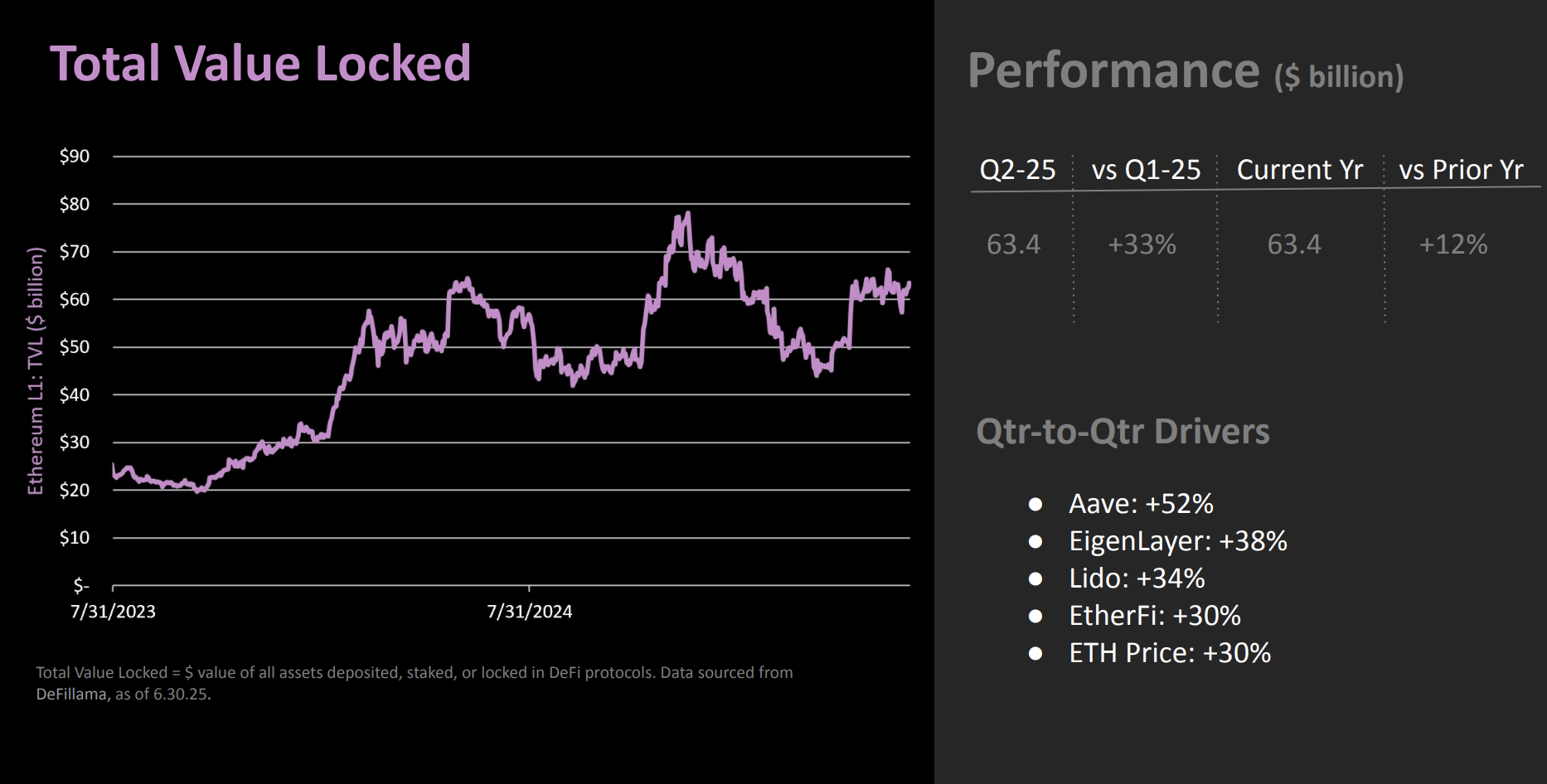

According to the report, Ethereum’s total value locked (TVL) surged 33% from the previous quarter, reaching $63.4 billion. This growth was fueled by a significant increase in stablecoins and real-world assets (RWA).

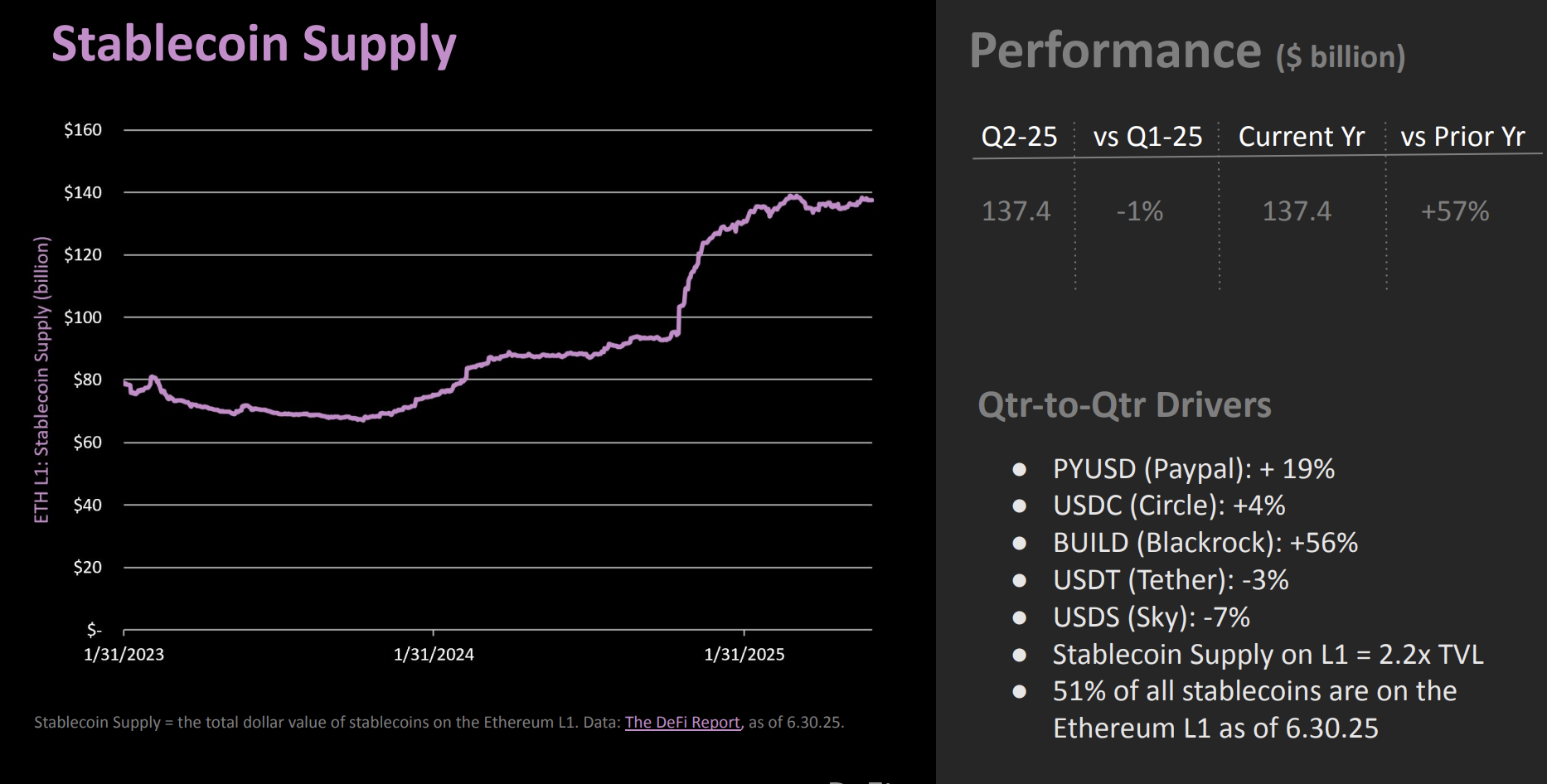

The stablecoin supply hit $137.4 billion, with major institutional players like BlackRock and PayPal contributing the majority of the Layer-1 TVL. DeFi activity exploded, with active loans on Ethereum and L2s rising 43% to $23.9 billion, led by Maple Finance (up 291%) and Euler Finance (up 174%).

In addition, ETH staking demand hit a new high of 35.6 million ETH in Q2, up 4% from the previous quarter. The staked ETH ratio of total circulating supply reached 29.5% (an all-time high), creating deflationary pressure.

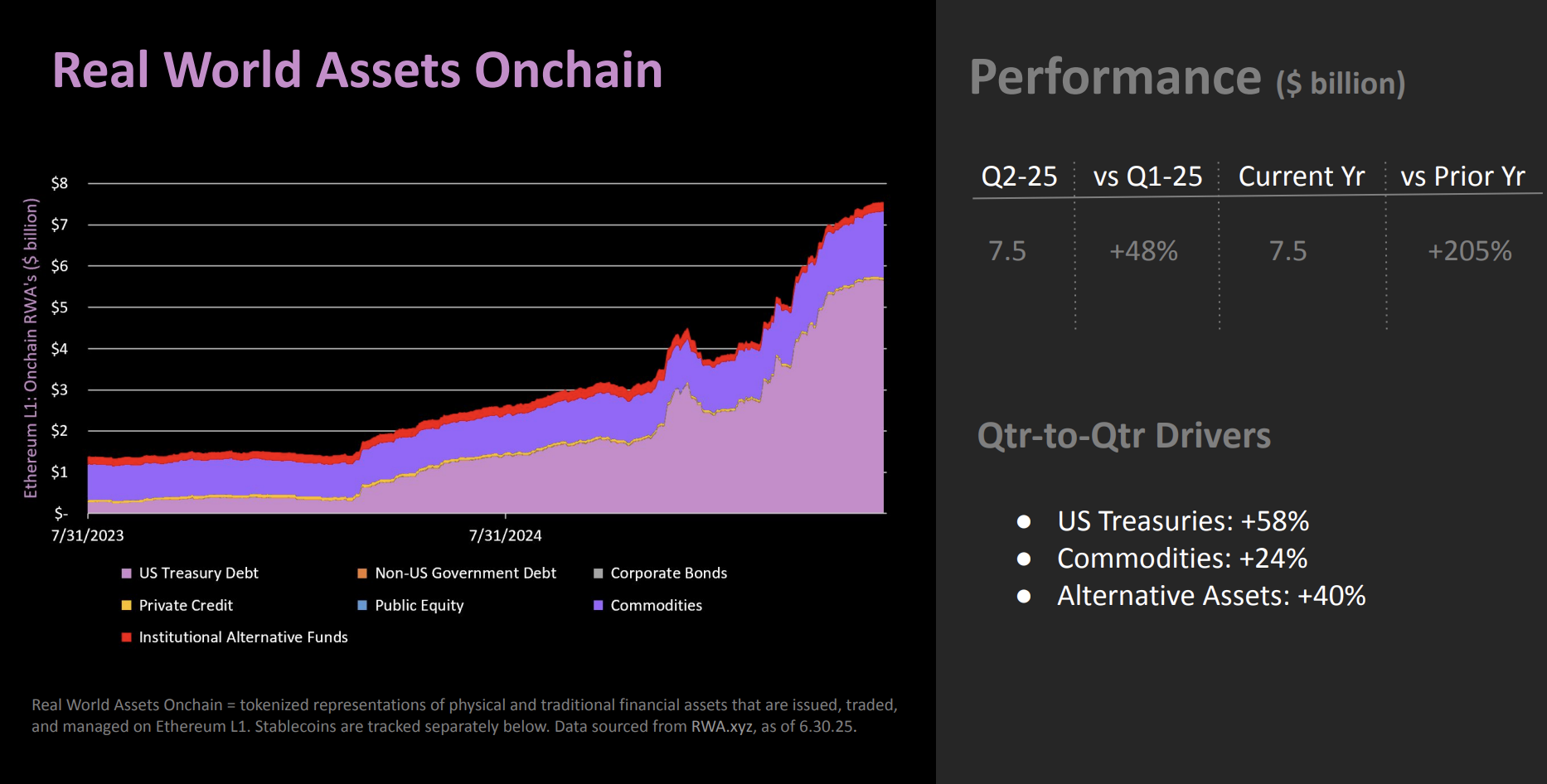

Real-world assets (RWA) on Ethereum grew 48% to $7.5 billion, driven by US Treasury bonds (up 58%) and commodities (up 24%). The report also noted institutional accumulation, with a 5.829% increase in ETH held in public treasuries during Q2.

This increase brought the total to 216,000 ETH from SharpLink Gaming and 100,000 ETH from BitDigital.

Regarding valuation, ETH’s Market Cap/TVL ratio recovered to 1.2 (up 19%), indicating a promising potential for price appreciation.

Impact of the GENIUS Act

The anticipated passage of the GENIUS Act this week could catalyze a significant ETH price surge. If successful, the act will legalize stablecoins in the US, enhancing liquidity and confidence in the Ethereum ecosystem.

“The GENIUS act will bring trillions of stablecoins to Ethereum – all the world’s largest banks will use Ethereum. If GENIUS act passes ETH goes up.” crypto investor Ryan commented.

However, the report warns of risks from global regulations, particularly the EU’s MiCA framework, set to take effect in Q3 2025. This could impact non-compliant stablecoins, as evidenced by Sky’s USDS dropping 7% this quarter. This poses challenges for stablecoin growth but also presents an opportunity for Ethereum to strengthen its position if it maintains compliance.

The post Ethereum Surges in Q2: Record Staking, Stablecoin Boom, and $63 Billion TVL appeared first on BeInCrypto.