13 February saw the market take a nosedive as Bitcoin’s price fell under $10,500 after surging for a few hours. This 3.63% fall within hours, resulted in the fall of altcoins, especially the highly-correlated asset to Bitcoin, Ethereum. Ethereum observed a 5.31% fall within 3 hours, pulling the price of the second-largest crypto-asset to $258.79.

Source: ETH/USD on Trading View

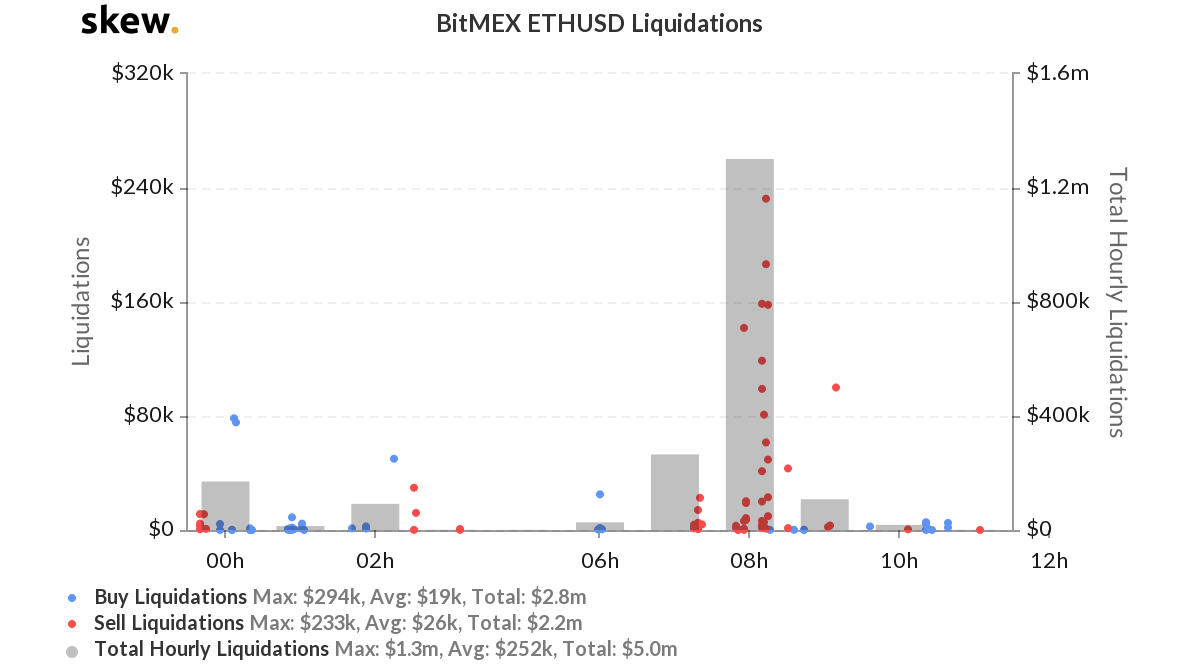

This 3.31% drop was followed by a total liquidation of $5 million. The buy and sell liquidations in a way balanced each other out, going by the data provided by Skew markets. According to the data provider, the sell liquidations amounted to at least $2.2 million and was closely followed by buy liquidations of $2.8 million, at press time.

Source: Skew

The sell liquidations could have been the long positions held by the traders to opt-out of the market before incurring major losses. On the other hand, the buying momentum also increased, highlighting the optimism for future profits from traders entering the market at this point in time.

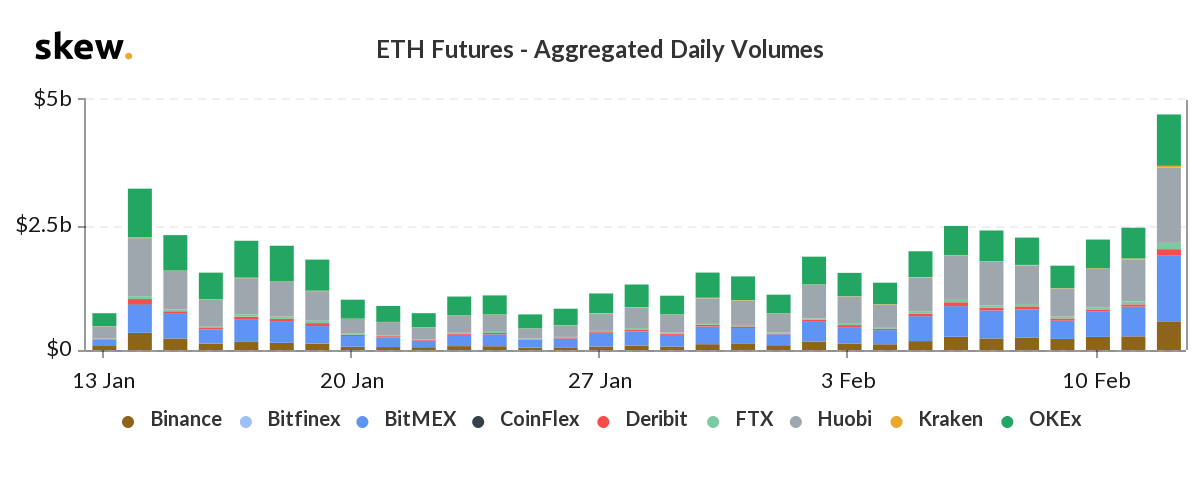

The activity among market traders became evident on 12 February and was visible in the aggregated daily volumes chart presented by Skew.

Huobi, BitMEX, and OKEx were the three exchanges where the daily volumes surged above $1 billion. Huobi registered the most daily volume of $1.5 billion, followed by BitMEX and OKEx, exchanges that recorded a daily volume of $1.3 billion and $1 billion, respectively.

Source: Skew

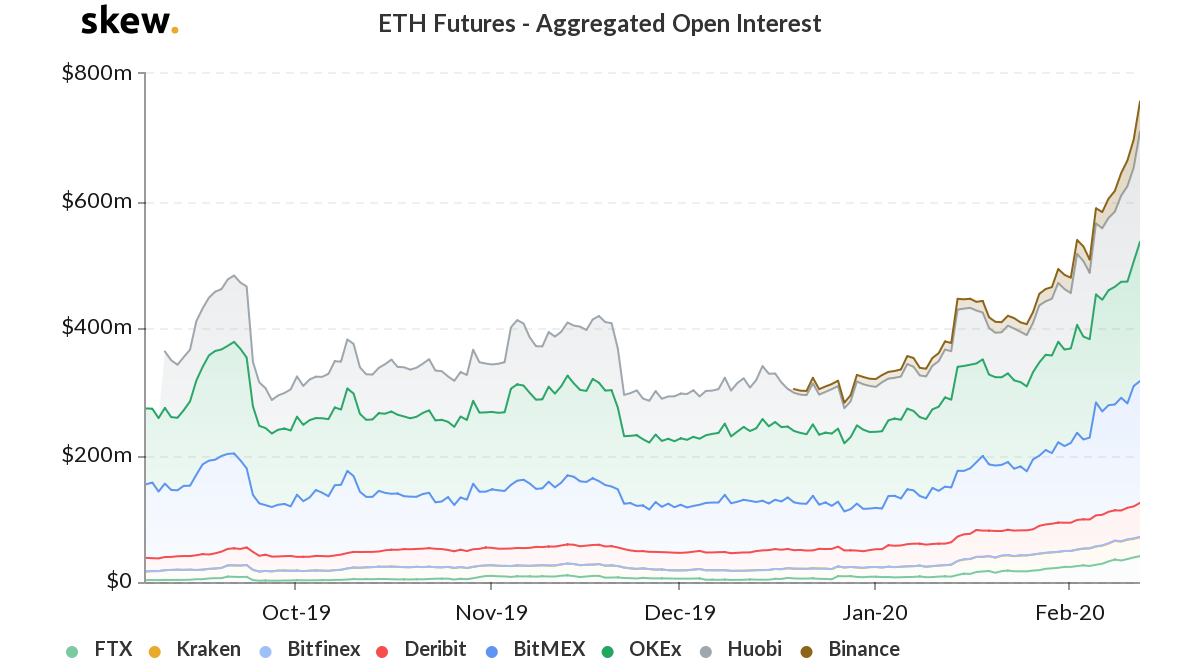

Similarly, the perpetual swap contracts for ETH Futures were still on the move as the market expected a reversal, an upward trend. On the other hand, the aggregated Open Interest for ETH Futures noted an ATH as it reached $750 million. OKEx reported the highest number of open contracts on its platform amounting to $219 million, while the aggregated Open Interest on BitMEX was reported to be $192 million. Huobi was not far behind, with $173 million accounting for the open contracts.