The development of DeFi and other protocols on the Ethereum blockchain over the past year cannot be ignored.

With Ethereum rapidly becoming the go-to asset for DeFi applications, a majority of users believe that ETH’s valuation will rise as well in the long-term as well.

In fact, with the tokenization of assets on Ethereum becoming a trend, Fitzner Blockchain Consulting’s Lucas Campbell’s recent post discussed whether tokenized BTC would be bullish for Ethereum or not.

Right off the bat, the post highlighted that DeFi could never be built on Bitcoin because it lacked Ethereum’s comparability; the ability to combine variable concepts under the same network.

With respect to tokenized BTC on Ethereum, the upcoming launch of tBTC was highlighted, which is a trust minimized version of Bitcoin on Ethereum. Although tBTC could basically serve as a relatively trustless economic bandwidth, there are immense risks related to price oracles, technical risks, and economic incentive risks.

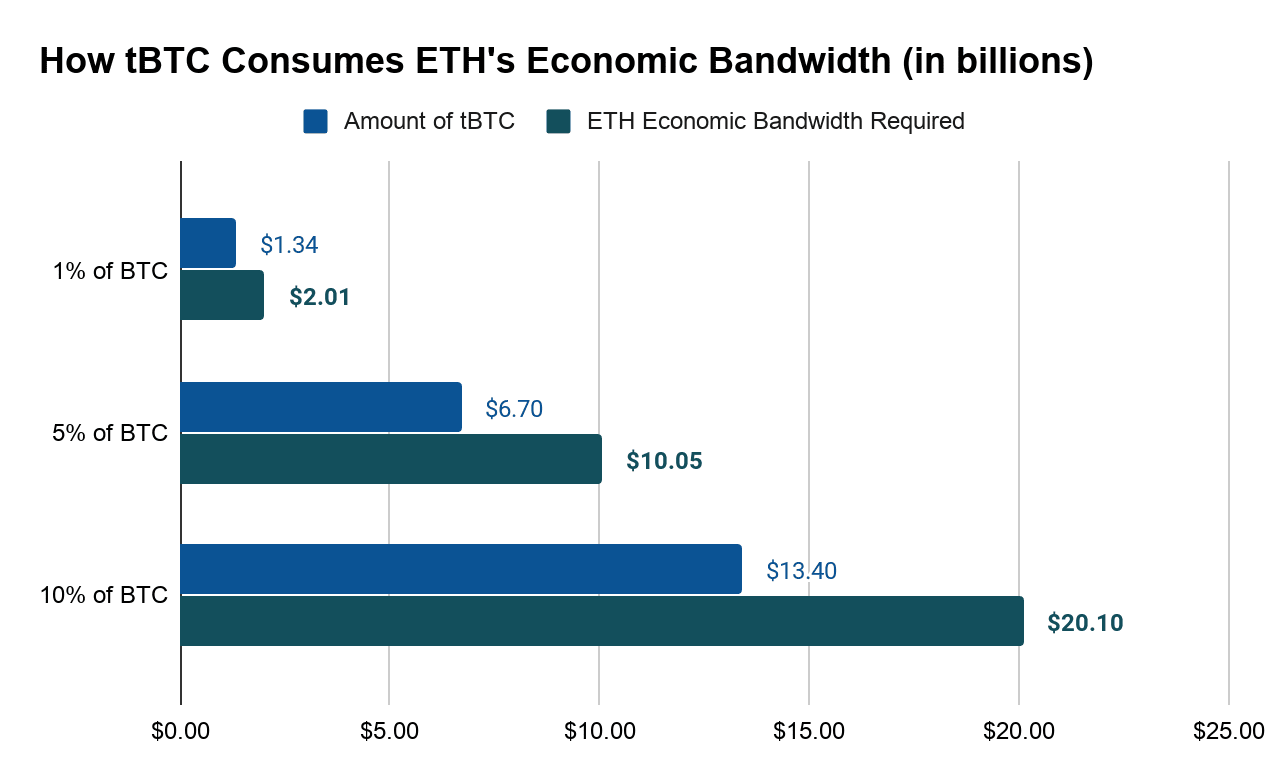

However, the catch is that tBTC would consume a significant amount of economic bandwidth. According to Campbell,

“The design behind tBTC relies on over-collateralizing Ether to secure every tBTC on the network (a proposed 150%). In other words, for every $100 of tBTC on Ethereum, it will require at least $150 in Ether locked away in a “tBTC Vault” netting at minimum negative $50 in economic bandwidth on Ethereum.”

Source: Bankless

Therefore, when comparing Bitcoin’s press time market cap of roughly $134 billion to Ethereum’s $19 billion, it would roughly take around 10 percent of Bitcoin’s liquid market cap to be trustlessly tokenized, a figure which will consume Ether’s current economic bandwidth.

Hence, rather than overtaking Ether on Ethereum, Bitcoin would indirectly drive Ether’s value in the ecosystem.

However, tBTC is yet to be launched, and its performance after 27 April would only further explain if there is any demand for BTC’s liquidity in Ethereum.

Keeping in mind the fact that Bitcoin has the most liquid form of economic bandwidth, a demand for trustless economic bandwidth on Ethereum can be foreseen as it would allow users to proliferate their BTCs for Ethereum’s money protocols.

Further, the growth of WBTC can also be taken as an example of BTC’s liquidity on Ethereum having an inherent demand in the market.