Ethereum has been one of the better-performing assets among major cryptos. The second-largest crypto has recorded 45% in gains in 2020 and has been striding upwards for the sixth consecutive week. As the coin’s value escalated to $208, at press time, ETH derivatives have been recording immense growth in momentum.

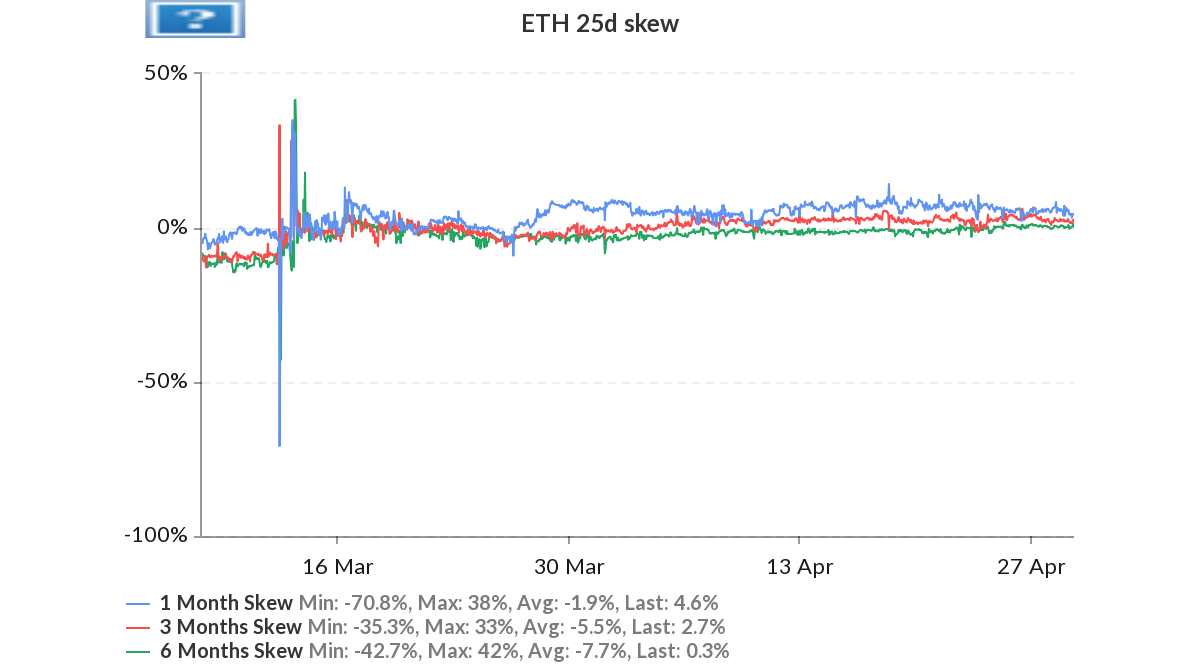

According to the data provider Skew, Ethereum was also hit by great volatility in March and noted a panic-led sell-off. However, with the trust re-instating in the market, the metric ETH 25-d skew, the 1-month skew turned immediately positive. The metric indicated the options contracts for Ethereum with different strike prices but which had the same expiration, will have different implied volatility.

As the traders returned to the market after the coin’s consolidation period, the skew across all time frames turned positive. At press time, the 1-month skew was at 4%, while the 3-month skew was at 2%, and the 6-months skew was at 0.1%.

The positive movement of the metric indicated that there was a growing demand for Etheruem options. It also speculated that the traders may go long on Ethereum, which was already a trend witnessed on Bitfinex.

Source: ETH/USD longs on Trading View

Bitfinex has been a major source of ETH liquidity and has a vast list of traders. The excitement in the market has been associated with not one but multiple events. BTC halving is obviously looked upon as one the reasons; the market could rally, but, ETH 2.0 launch is a close second. According to the data available on TradigView, the traders have been long on ETH and may continue this trend.

However, the aggregated Open Interest was as low as $505k on 28 April, OKEx took the cake for the highest interest of $148 million while taking the second position in terms of volume of $887 million.