Bitcoin halving hype has faded and the coin hasn’t had any violent price swings since the event. Over the past few weeks leading up to the halving, BTC accumulation rose to record levels as hodlers increased their position.

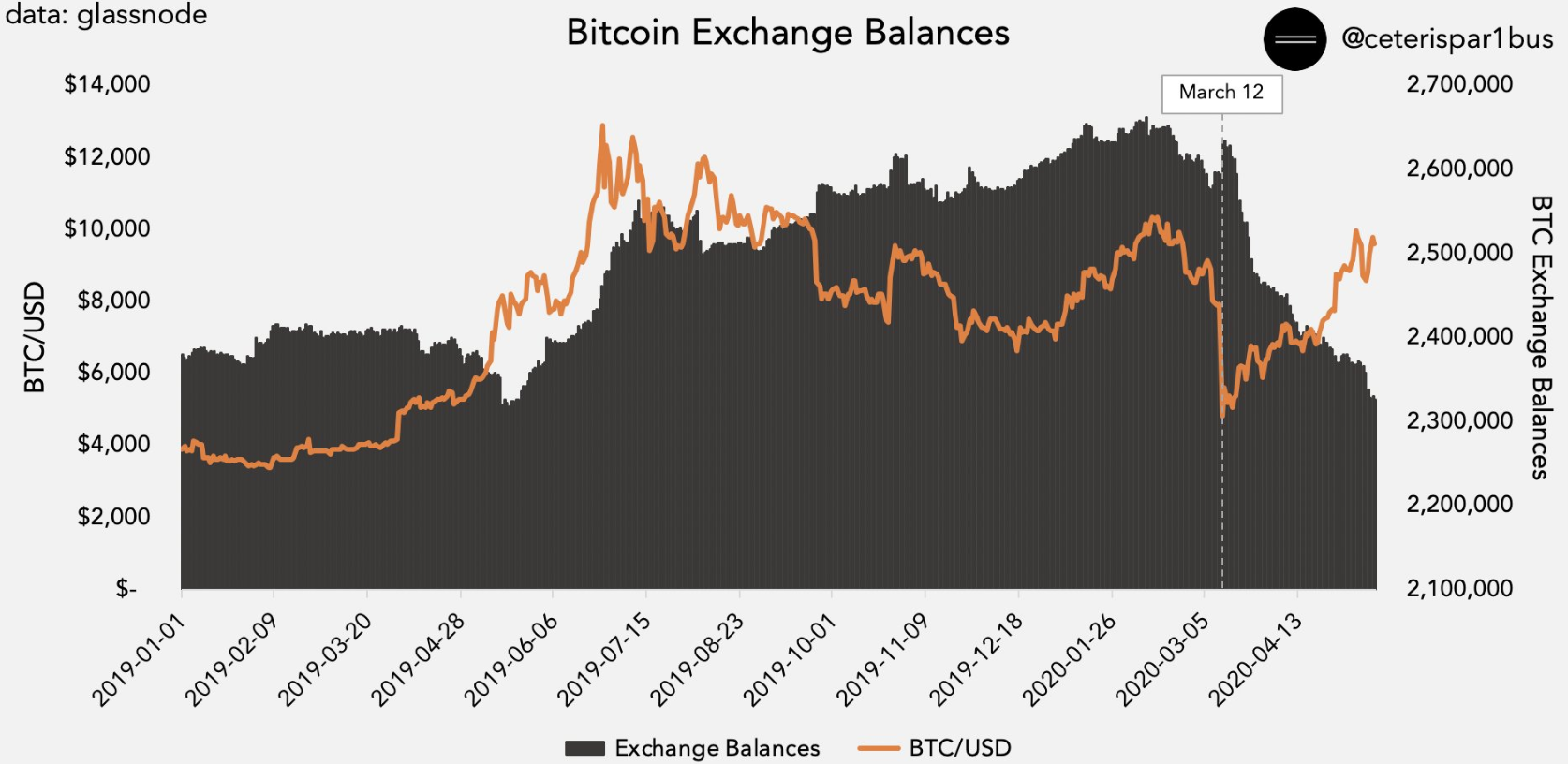

Bitcoin exchange withdrawals dropped substantially on 12th March which coincided with the falling price. Interestingly, this trend has picked up once again after the halving despite its steady price rise. According to the crypto market analyst Ceteris Paribus, exchange balances were down by 300,000 BTC since the 12th March crash. This is the lowest figure since 22nd May 2019.

BitMEX saw a withdrawal of 100,000 BTC or nearly one-third of its reserve, while other exchanges such as Huobi and Bifinex also saw nearly the same amount of figures. Hours after Bitcoin’s block reward was halved, Glassnode noted a significant decline in exchange net flows.

It was speculated that the funds were being moved to the users’ cold wallets, thus strengthening Bitcoin’s ‘store of value’ narrative as the hodlers’ eye to profit from capital gains while simultaneously making their coins less prone to exchange hacks.

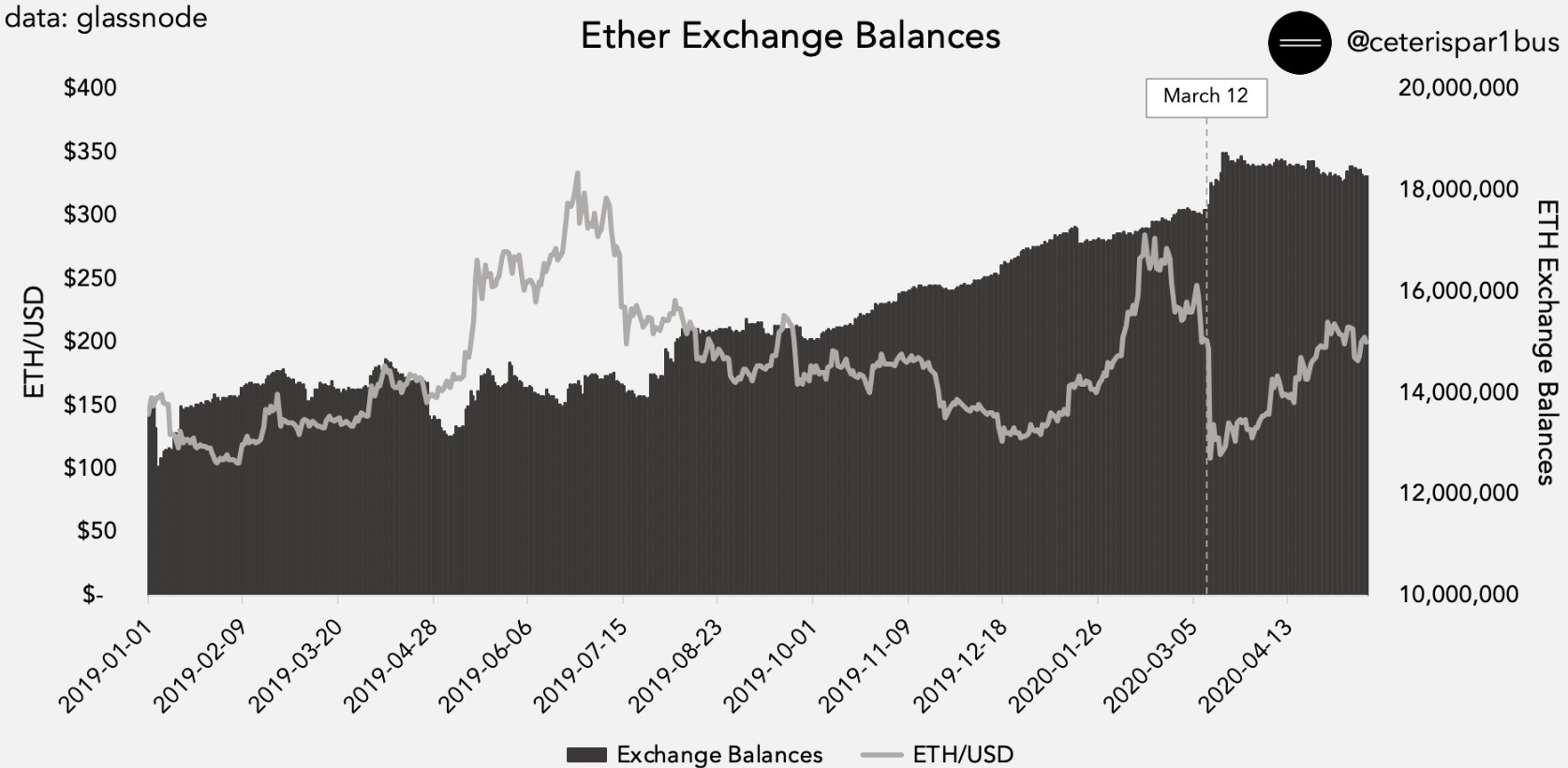

A consistent increase in this trend was expected to further extend a positive case for the coin. However, this wasn’t the case with the world’s largest altcoin Ethereum. The balances for Ethereum, on the other hand, were at its all-time-highs and the exchange balance was up by 132,ooo ETH since the fateful crash in the second week of March.

Source: Twitter | Ceteris Paribus

Along the same line, Ceteris Paribus tweeted,

“My interpretation here is that it’s bullish for btc; bearish eth, but I want to know if anyone has another angle to this.”

While Bitcoin awaits another extended price rally, the crypto trader was bearish about Ethereum. Despite closely following Bitcoin’s price movements, Ethereum has started to exhibit a decoupling pattern from the king coin. With respect to Bitcoin’s price action, Ethereum was observed to be pulling its price away as it muted despite the former’s rise in valuation. AMBCrypto had earlier reported that ETH’s price as a percentage of Bitcoin has dropped to 2.1 percent, its lowest in over a month, a trend that started two weeks before Bitcoin’s halving.