Key Takeaways

- Yield farming is the process of earning a return on capital by putting it to productive use

- Money markets offer the simplest way to earn reliable yields on your crypto

- Liquidity pools have better yields than money markets, but there is additional market risk

- Incentive schemes can sweeten the deal, giving yield farmers an added reward

Share this article

Interested in yield farming but not sure where to start? Here’s an overview of the top DeFi protocols and how you can get started.

What is Yield Farming?

The hottest buzzword in crypto today is “yield farming,” which allows people to earn fixed or variable interest by investing crypto in a DeFi market. Investing in ETH is not yield farming; lending out ETH on Aave for a return beyond the ETH price appreciation is yield farming.

As the newest trend in crypto, investors in the space need to understand what it is and how it works.

But before hashing out the specifics, it’s important to note that given the amount of competition between investors and high gas prices, yield farming is only profitable if you’re willing to put a significant sum of money to work. Yield farming with $100-1,000 in crypto will result in a net loss. If you’re tinkering with small amounts to understand how it all works, that’s okay, but the strategy isn’t profitable.

How and Where to Farm DeFi Yields

Money Markets: Compound and Aave

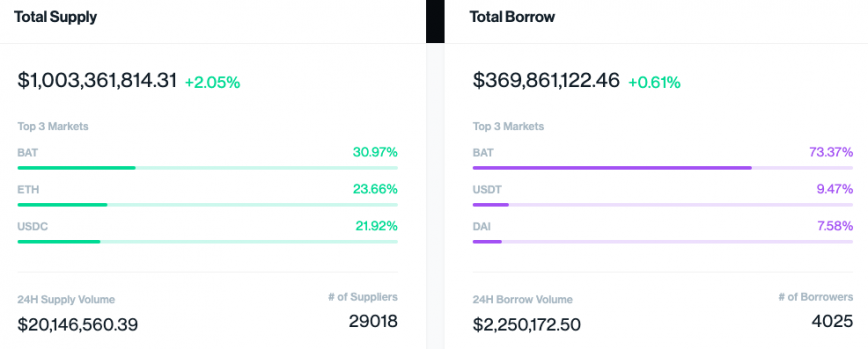

Compound and Aave are DeFi’s primary lending and borrowing protocols. The two together account for $1.1 billion of lending and $390 million of borrowing.

Lending capital on a money market is the easiest way to earn a return in DeFi. Deposit a stablecoin to either of the two and start earning returns immediately.

Aave generally has better rates than Compound, because it offers borrowers the ability to choose a stable rate of interest rather than a variable rate. The stable rate tends to be higher for borrowers than the variable rate, increasing the marginal return to lenders.

However, Compound introduced a new incentive for users through the issuance of its native token COMP. Anyone that lends or borrows on Compound earns a certain amount of COMP. 2,880 COMP is issued to Compound users per day. At $250 per COMP at press time, this translates to $720,000 in extra rewards per day.

Security from Financial Risk

DeFi money markets employ over-collateralization, meaning a borrower must deposit assets with more value than their loan. When the collateralization ratio (value of collateral / value of the loan) falls below a certain threshold, the collateral is liquidated and repaid to lenders.

This setup is optimal for financial speculators who want to obtain leverage. But it also ensures that lenders don’t lose money when borrowers default. Smart contract hacks are still a significant risk, but Aave and Compound have avoided this risk so far.

Yield Farming Liquidity Pools

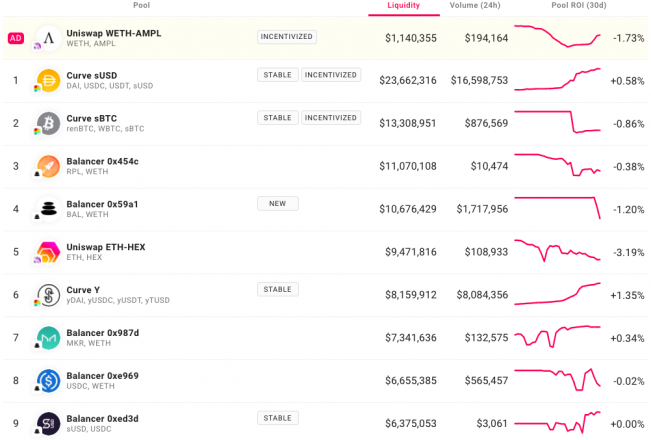

Uniswap and Balancer are the two largest liquidity pools in DeFi, offering liquidity providers (LPs) with fees as a reward for adding their assets to a pool. Liquidity pools are configured between two assets in a 50-50 ratio in Uniswap. Balancer allows for up to eight assets in a liquidity pool with custom allocations across assets.

Every time someone takes a trade through a liquidity pool, LPs that contributed to that pool earn a fee for helping to facilitate this. Uniswap pools have offered LPs healthy returns over the past year as DEX volumes picked up. However, optimizing profits requires investors also consider impermanent loss, which is the loss created by providing liquidity for an asset that rapidly appreciates.

Read more about impermanent loss in our guide about yield farming on Uniswap.

Balancer pools can mitigate some impermanent loss, as pools don’t need to be configured in a 50-50 allocation. They can be set up in an 80-20 or 90-10 allocation to minimize, but not entirely eliminate, impermanent loss. Additionally, users can earn Balancer’s governance token, BAL, by providing liquidity on a Balancer pool.

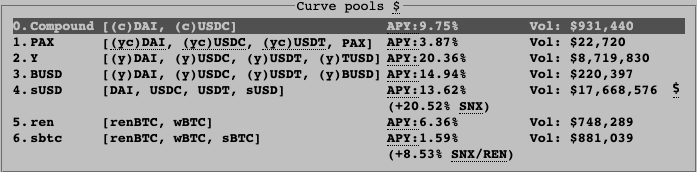

There’s another kind of liquidity pool that eliminates impermanent loss. Curve Finance facilitates trading between assets pegged to the same value. For example, there is a Curve pool with USDC, USDT, DAI, and sUSD: all USD pegged stablecoins. There’s also a liquidity pool with sBTC, RenBTC, and wBTC: all pegged to the price of BTC.

Since all of the assets are worth the same amount, there’s no impermanent loss. However, trading volumes will always be lower than general-purpose liquidity pools like Uniswap and Balancer.

Ironically, yields for Curve Finance LPs rocketed in the last week as the yield farming narrative led to excess demand for stablecoin-to-stablecoin trades. Bottom line: Curve Finance eliminates impermanent loss, but Uniswap and Balancer result in higher fee collection.

Special Mention: Incentive Schemes

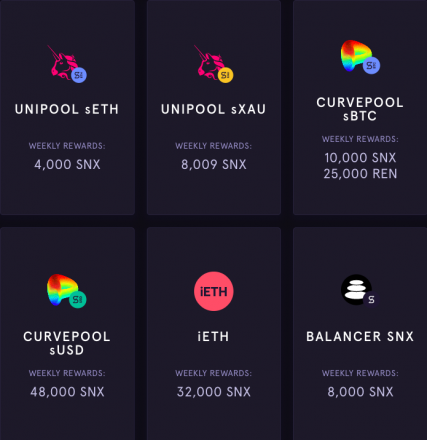

The example, as mentioned earlier of Compound introducing COMP as an incentive for people to use the protocol, is straight out of the Synthetix playbook.

As the original incentives scheme, Synthetix first introduced an sETH-ETH pool that offers LPs an added incentive of SNX rewards. While this pool has been deprecated, this expanded to other liquidity pools. Synthetix currently has two substantial liquidity incentives: an sBTC pool and an sUSD pool on Curve that give LPs an added reward in SNX.

Following in Synthetix’s footsteps, Ampleforth launched “Geyser,” which rewards LPs in Uniswap’s AMPL-WETH pool with an added reward in AMPL.

Taking advantage of these incentives can be incredibly lucrative. But investors should ensure they aren’t earning a dud token. Nobody wants to partake in an incentive scheme that rewards them in BitConnect tokens.

Choosing an Appropriate Farm

For the slightly risk-averse who just want to earn a yield on their stablecoins, money markets or providing liquidity on Curve Finance is the best option for lower-risk interest. For those who have large cryptocurrency holdings and want to put them to productive use, liquidity pools like Uniswap or Balancer are a good choice. Added incentives are just the icing on the cake.

That said, the perfect yield farm for each individual varies based on the amount of capital they have, their investment time horizon, and their desired level of risk.