Quick take:

- The amount of Ethereum locked in DeFi continues to rise.

- Approximately 3.5 million ETH is locked in DeFi.

- Majority of the Ethereum is locked up in the DeFi apps of Maker and Compound Finance.

- Yield farming is the reason why more Ethereum keeps getting locked up in DeFi.

The amount of Ethereum locked up in DeFi platforms has hit a new milestone of 3.5 Million ETH. This marks a new all-time high in terms of the amount of ETH locked up in Decentralized Finance applications since DeFi hit the crypto scene. This fact was highlighted by the team at DeFi Pulse via the following Tweet.

— DeFi Pulse

(@defipulse) July 15, 2020

Maker and Compound Finance Dominate DeFi

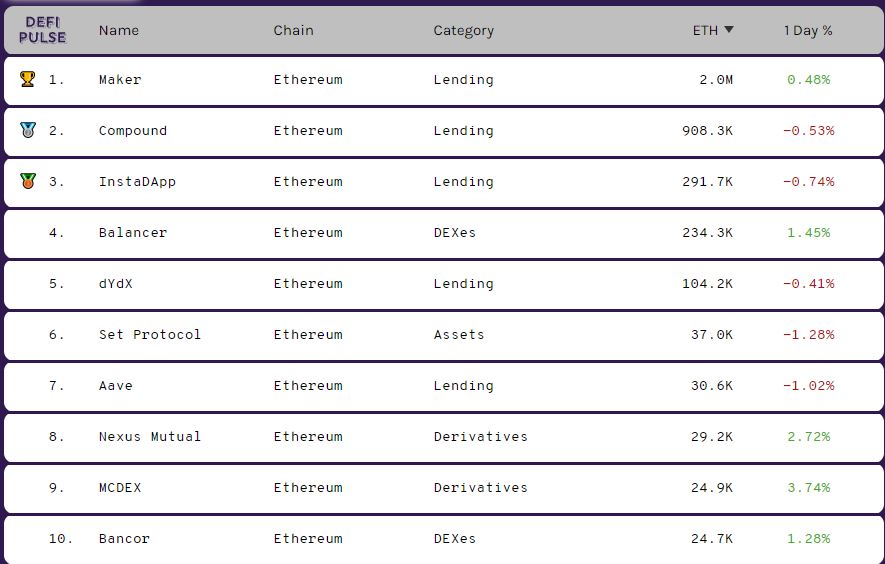

Further checking the DeFi Pulse website, it can be concluded that the majority of the Ethereum is locked up in the two DeFi applications of Maker (MKR) and Compound Finance (COMP). Approximately 2 Million in ETH is locked up in Maker whereas 908,300 ETH is locked up in Compound Finance. Below is a list of the top 10 DeFi applications in terms of the amount of Ethereum locked up in them by investors.

The Rise of Yield Farming in DeFi

To note is that the popularity of DeFi has exploded with the entry of Compound Finance less than a month ago. Furthermore, the COMP token experienced a meteoritic rise in the crypto markets upon listing. The digital asset rose in value from approximately $71 to its all-time high of $383 within a week of listing on Poloniex. COMP is currently valued at $171.

The Compound Finance project has ushered in a new era of Yield Farming with several DeFi projects following in its footsteps. Yield Farming is achieved when investors lock up their crypto on DeFi platforms and lend it out while earning interest on it.

Each of these DeFi platforms has several lending pools and the investor moves his funds in whichever pool is offering the best interest rates. In a sense, Yield Farming can be compared to crop rotation where the farmer picks to plant the most profitable crop. On top of the interest earned, investors are rewarded with tokens for providing liquidity on the platforms.