Key Takeaways

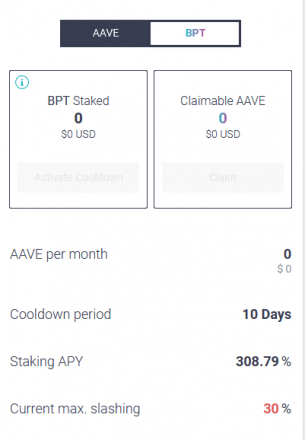

- Aave has launched a pool on Balancer which offers 300% APY.

- This pool acts as a safety backup in case of a shortfall event.

- Aave is now offering 1,100 AAVE per day in total to both stakers and LPs.

The DeFi news category was brought to you by Ampleforth, our preferred DeFi partner

Share this article

Aave has passed a governance proposal and launched a Balancer pool. Users who provide liquidity to this pool will earn AAVE and BAL tokens along with trading fees. The staking APY is currently over 300%.

Aave Adds New Token Incentives

The governance proposal earned 498,757.966 votes in favor and 2,519.079 votes against, with 62 addresses participating in the process.

This pool is used to help secure the Aave network. The pool’s token is called Aave Balancer Pool Token (ABPT). Users will need to deposit AAVE and ETH tokens in the ratio of 80:20, after which they will acquire the ABPT liquidity provider (LPs) token.

The team has allocated 550 AAVE per day to incentivize LPs.

Users will earn three distinct rewards: AAVE tokens, Balancer’s governance token BAL, and the trading fees generated from the pool. The risk that users bear is that LPs can get up to 30% of their ABPT tokens slashed in case of a shortfall event. MakerDAO’s Black Thursday incident is an example of such an event.

Currently, the pool has $35.6 million in liquidity and processes $2.2 million in 24-hour volume.

At the time of press, the staking reward was 308.79% APY.

In Conjunction with the staking rewards, the DeFi project is now handing out 1,100 tokens per day in total. Half of this total goes to stakers and the other half to ABPT LPs.

All the metrics indicate that the savings platform is doing exceedingly well. According to DeFi Pulse, the protocol currently has $6.12 billion locked into the platform. It holds the second spot on the DeFi Pulse ranking, behind MakerDAO.

Share this article

DeFi Protocol Aave to Offer More Rewards for Risky Stakers

An Aave Improvement Proposal (AIP) has been executed successfully. This AIP adds stake slashing, thus securing the protocol in case of a shortfall. Previously, the stakers were not liable in…

Looking Back on 2020 and 2021 Predictions

Happy New Year from all of us at Crypto.com Research! 2020 was an unprecedented year for the world and for crypto. Before we fully plunge into 2021 predictions, we will…

DeFi Staple Aave Hits Key Record Highs as Niche Breaches $26 Billion

Aave is up 185% this year. Following the rise, the number of new addresses holding the AAVE token is at an all-time high. Aave Moons on Multiple Metrics Activity related…

Beginner’s Guide: How to Use Matcha, the DEX Aggregator on Ether…

One of the most groundbreaking developments in the decentralized finance landscape today is the steady rise of Automated Market Makers (AMMs). But with so many AMMs, the need for aggregators…