- Gas fees on the Ethereum network have dropped to levels last seen in December 2020

- However, social sentiment towards Ethereum remains at historic lows

- Ethereum is once again trading above $2k with $2,400 to $2,500 a likely short-term target

- There is a death cross forming on the daily ETH/USDT chart

Gas fees on the Ethereum network have decreased significantly since their peak value in mid-May when ETH hit an all-time high of $4,372. According to a recent analysis by the team at Santiment, the average gas fees on the Ethereum network now stands at $3.76. The chart below, courtesy of Santiment, further illustrates the drop in ETH gas fees since May.

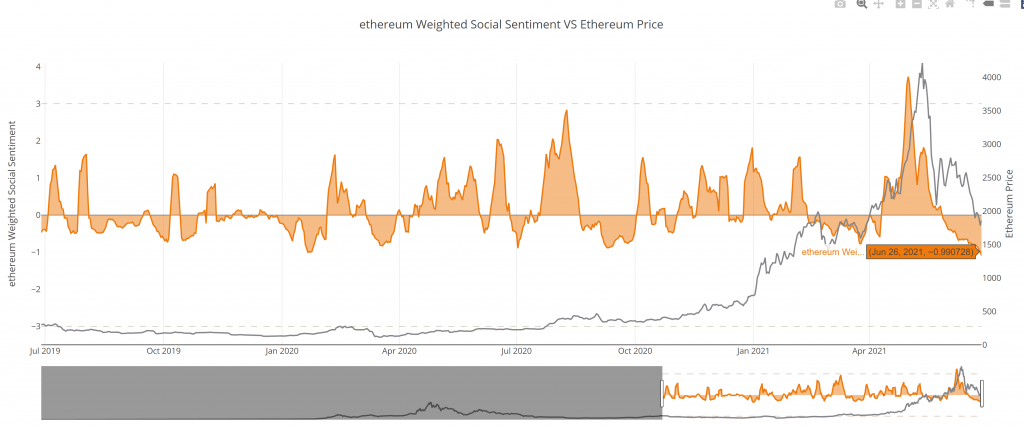

Social Sentiment Towards Ethereum Hits Historic Lows

The analysis by the team at Santiment went on to point out that the social sentiment towards Ethereum continues to decline and has hit historic lows. The chart below further demonstrates how low the crowd sentiment towards Ethereum has dropped in the last few weeks.

Ethereum Reclaims $2k, ETH Retesting $2,400 Possible in the Short Term

With respect to price action, Ethereum is once again trading at the $2k support zone and has also regained the 200-day moving average (green) as support as seen in the following daily ETH/USDT chart.

Also from the chart, it can be observed that Ethereum’s daily trade volume is in the green. Furthermore, Ethereum’sdaily MACD is hinting at a bullish cross with the signal line below the baseline. The daily MFI and RSI are also in oversold territory thus indicating a likely reversal as we roll into the month of July.

In terms of possible resistances moving forward, Ethereum has the following price areas to contend with:

- $2,050

- $2,130

- $2,200

- $2,270

- $2,340

- $2,400

- $2,500 – which is also around the 100-day MA (yellow)

A Death Cross Looms for Ethereum (ETH)

To note is that Ethereum faces a possible death cross that should occur within the first half of the month of July. Therefore, caution is advised when longing Ethereum in the next few days as the death cross might bring additional selling pressure back to levels below $2k.