Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Ethereum pushes upward but nears higher timeframe resistance levels

- Bulls can look to ride the trend upward but must also be keen on booking profits

A week ago, Ethereum [ETH] flipped the $1,485 mark from resistance to support. Since then, it has posted gains of 10.9% and rising at press time. With Bitcoin [BTC] also looking bullish, it looked like the entire crypto market had a bullish outlook in the coming days.

Here’s AMBCrypto’s Price Prediction for Ethereum [ETH] in 2022-2023

NFT trading volumes also took a hit in October, but the number of unique traders rose by 18% in October. This suggested demand was still going strong in the NFT market.

So far, so good for the bulls who can now watch out for $1800 and $1950

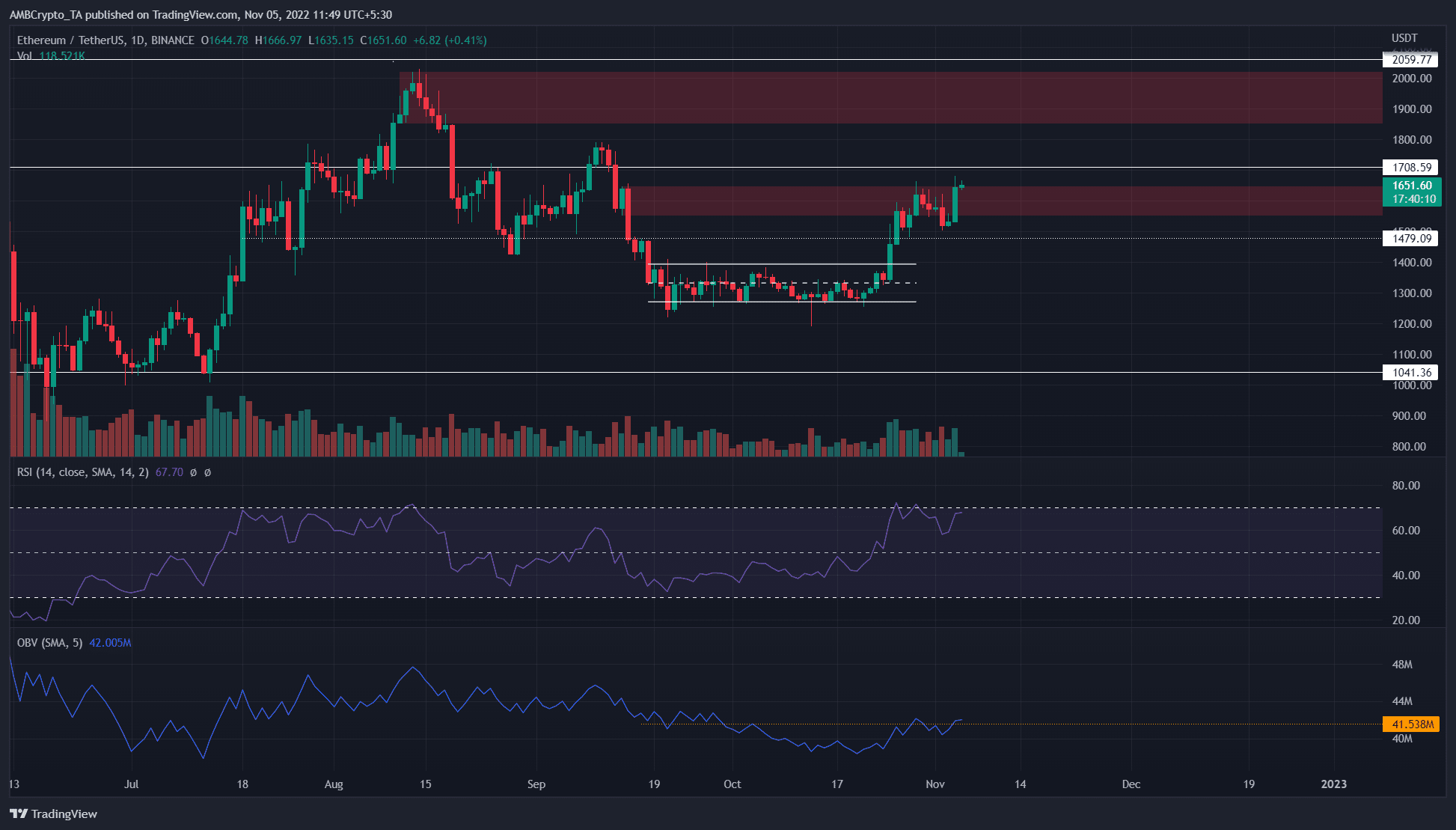

Ethereum formed a range (white) between $1,270 and $1,390 in September and October. The breakout from this range saw ETH surge to $1,600, but the trading volume was not particularly high. The On-Balance Volume (OBV) did not see a sharp move upward either, which suggested that buying pressure might not be strong enough to reverse the higher timeframe downtrend.

The OBV was able to crest a resistance level from the past six weeks, which supported the rally of the past two weeks. At the time of writing, the price was above the bearish order block formed in early September. This would likely encourage buyers, and another move higher was likely.

But how much higher? The $1,800 level also rests near a resistance region and has a bearish order block on the daily timeframe. The $1,950 mark also represented an area where sellers can be dominant. Although the Relative Strength Index (RSI) suggested a buyer dominated market and the structure was bullish, $1,800 and $1,950 might be levels to watch out for.

Prudent traders can consider taking profit in these regions, while lower timeframe traders can look for a flip of these resistances to enter long positions.

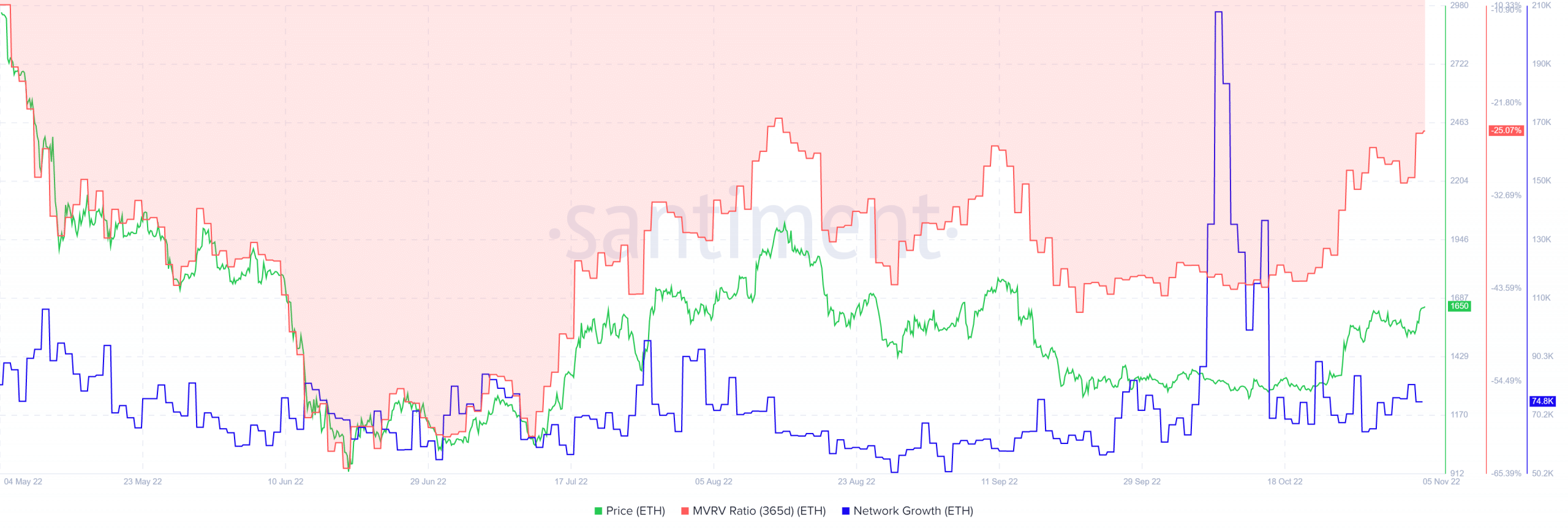

MVRV on the rise in the past five months

Source: Santiment

The 365-day Market Value to Realized Value (MVRV) touched a near four-year low at -60% in June 2022. Since then, the MVRV ratio has slowly climbed higher, even though Ethereum did not establish a strong trend yet. This suggested that a good portion of the buyers of the past year were still at a loss, but some accumulation has occurred in recent months.

Network growth also formed a series of higher lows in recent months, which showed that user adoption was on the rise. This was a positive finding for the longer-term investors.