Ethereum (ETH) price is trading below $1,150, charting a decrease of around 7.20% in the past 24 hours as the FTX hacker continued dumping.

The global crypto market still isn’t over the bloodbath that continued to pull large-cap altcoins down. Ethereum price, in particular, was significantly affected after the FTX hacker started to dump ETH for Bitcoin.

As the dumping ensued, ETH prices saw a significant drawdown dropping to a multi-week low of $1,116.84 at press time. With the ETH price losing momentum, many in the market expected ETH to retest the lower $1000 mark. So, would Ethereum make another visit below $1000?

ETH Dumping Takes a Toll on Ethereum Price

On Sunday, the FTX hacker reportedly sold over 30,000 ETH, converting a large part of the holdings into Bitcoin. Updates from PeckShieldAlert suggested that the FTX Accounts Drainer continued to swap ETH for renBTC.

In the most recent update on Nov. 21, the FTX Accounts Drainer 0x8059 swapped nearly 4,999 ETH worth $5.57 million for 338.97 renBTC worth around $5.465 million.

The FTX Accounts Drainer, who holds nearly $235.50 million worth of ETH, climbed to the 36th largest holder of Ethereum on Monday.

The consistent ETH dumping and conversion to renBTC put significant pressure on the Ethereum spot price, which had pulled back by around 7.52%.

Odds of ETH Price Dipping to $1,000

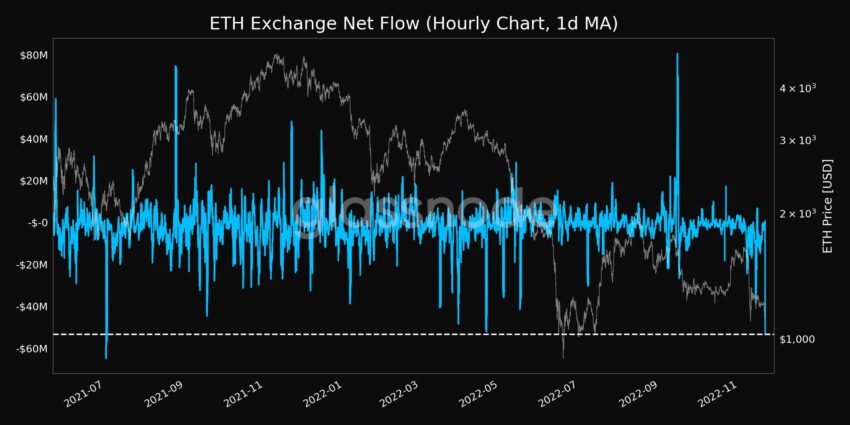

Despite the larger market’s bearish pressure, Ethereum exchange outflows dominated the market. ETH Exchange Net Flow (1d MA) reached a 16-month low of -$53.31 million on Nov. 21.

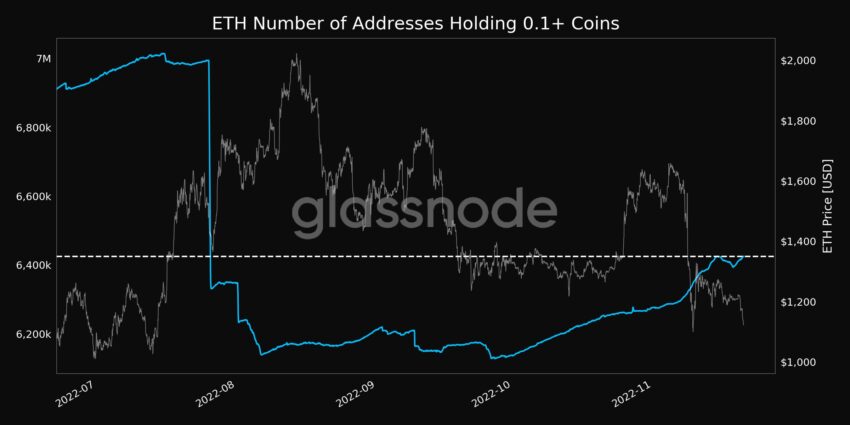

One positive trend was that smaller ETH fish continued to accumulate as Number of Addresses Holding 0.1+ Coins reached a three-month high of 6.42 million.

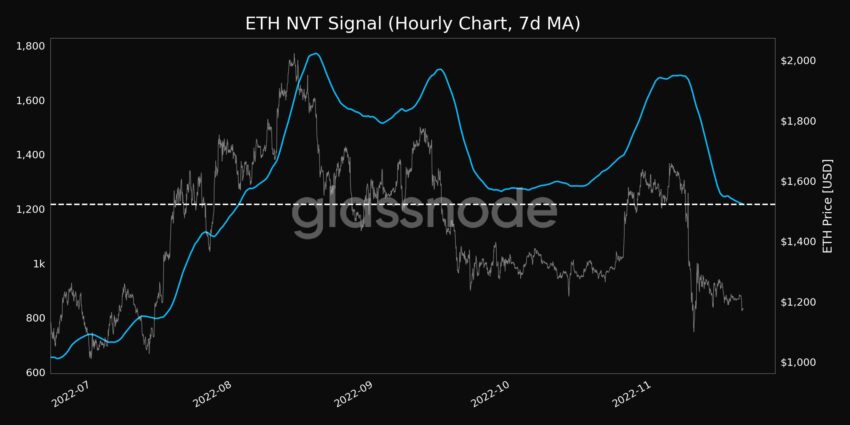

While ETH moved away from exchanges, a low NVT Signal indicated that investors were pricing Ether at a discount as on-chain Transfer Volume outpaced Market Cap growth. Ethereum NVT Signal (7d MA) reached a three-month low of 1,216.

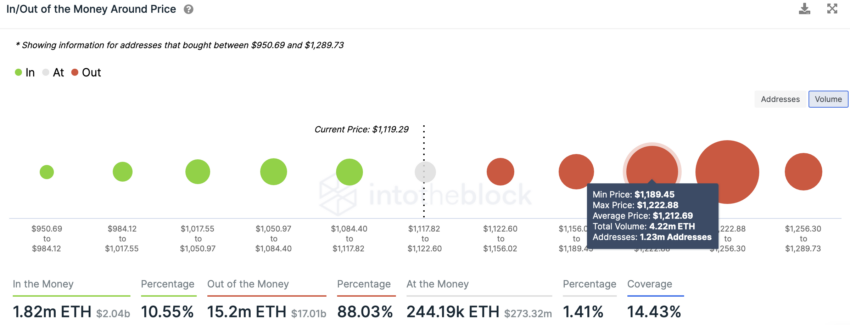

With investors placing ETH at a discount, the market could be looking towards more price losses, especially with the FTX hacker dumping ETH. A look at the In/Out of Money around Price Indicator suggested that the Ethereum price had no considerable support as of now.

Thus, a fall below $1,000 wouldn’t come as a surprise. However, if the bearish thesis invalidates and ETH bulls push price action in the positive direction, reclaiming the $1,212 mark where 1.23 million addresses hold 4.22 million ETH could lead to a key reversal in trend. Until then, more losses could deter market participants from investing.

Disclaimer: BeinCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

The post Ethereum Price to Dip Below $1,000 as FTX Hacker Continues Dumping ETH appeared first on BeInCrypto.