- ETH’s latest liquidations indicate a bullish bias among investors.

- The king alt is back to uncertainty amid a fall in demand and sell press pressure.

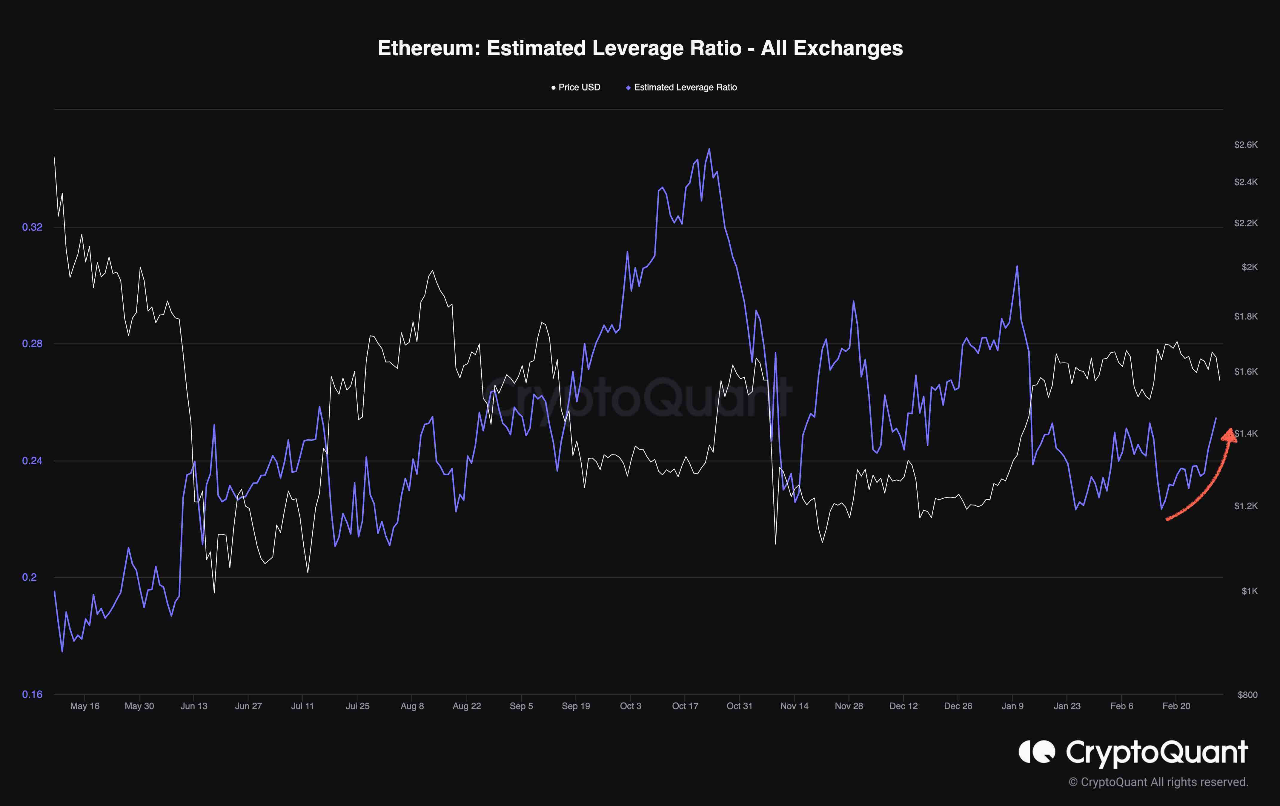

ETH is experiencing a surge in leverage trades following the volatility and demand slowdown since early February. A contrast to its performance in January, but recent observations suggest an increased risk of liquidations which may bring about a surge in volatility.

Is your portfolio green? Check out the Ethereum Profit Calculator

A recent CryptoQuant analysis looked into the potential for the Ethereum futures market being overheated. The analysis was based on the observed surge in the demand for leverage among futures market participants.

The uptick in leveraged trades reflects the lower demand in the market, hence the lower enthusiasm in price action.

A surge in demand for leverage is often associated with a higher risk of longs or shorts liquidations. A volatility surge usually accompanies a large liquidation due to the subsequent short squeeze or long squeeze. But is ETH currently headed for such a scenario?

ETH liquidations quickly shut down bullish expectations

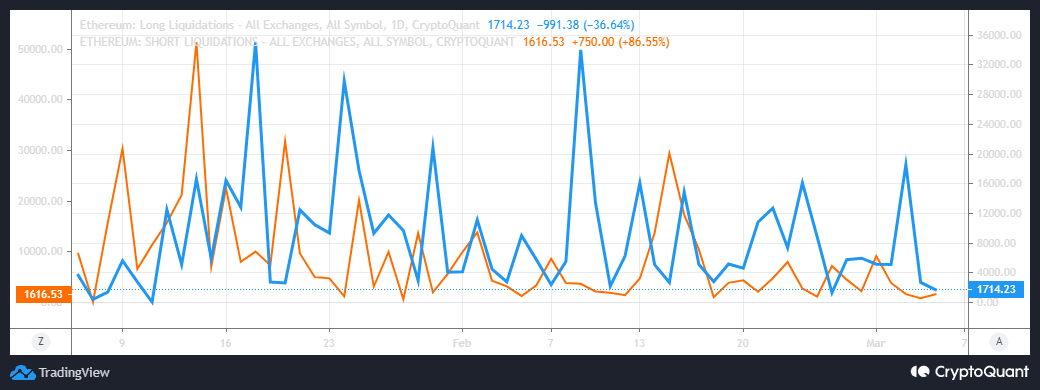

ETH long and short liquidations might reveal some interesting insights about the state of demand.

On the other hand, ETH shorts liquidations dropped since the start of March while longs liquidations experienced a surge. The outcome confirms that long liquidations were piling up due to the bullish expectations.

ETH traders rapidly exited their leveraged long positions as the price dropped since 2 March. A bearish bias may lead to an increase in short positions but the likely outcome, in this case, is a drop in demand for leverage.

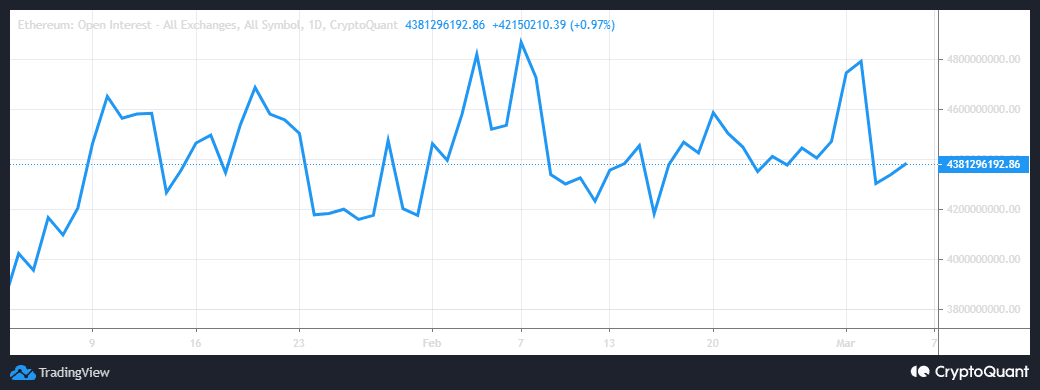

A consequence of the uncertainty at the current range after the surge in long liquidations. The recent drop in ETH’s open interest metric confirms this, courtesy of its drop in the first few days of March.

The open interest metric recently pivoted as bearish momentum slowed down. However, this outcome was not backed by a strong surge in bullish demand.

A possible reason for this was the increase in uncertainty about the next market direction. This may explain the lack of stronger demand for leverage as the market looked for footing.

How many are 1,10,100 ETHs worth today?

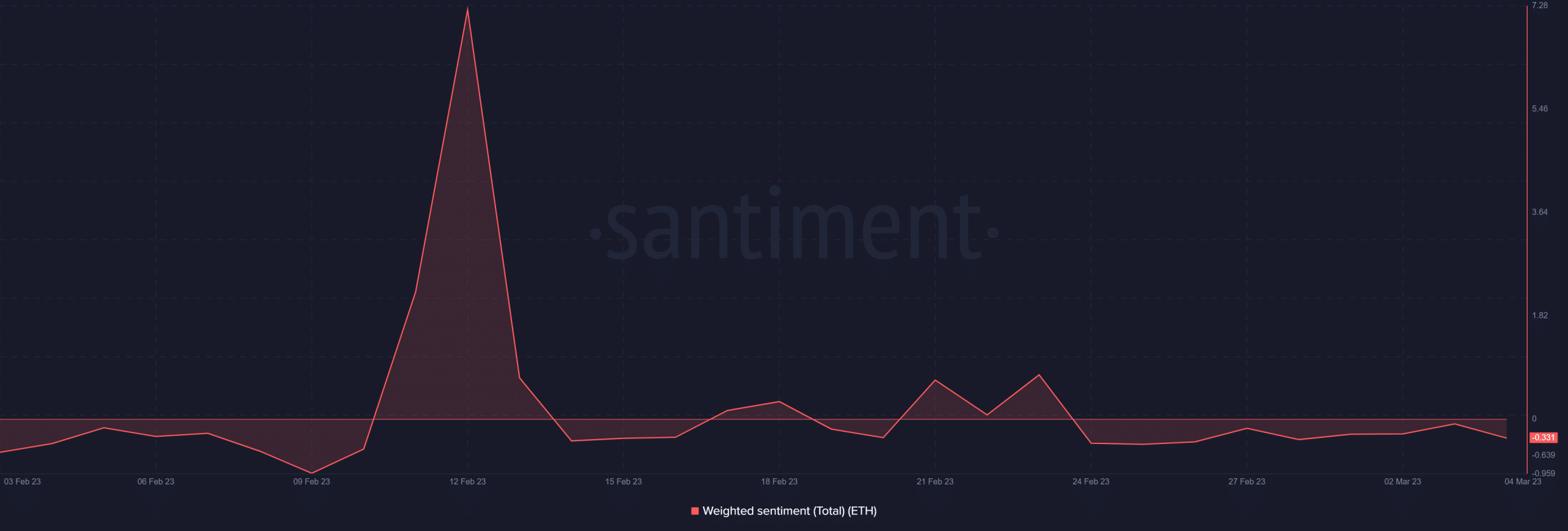

Furthermore, ETH’s weighted sentiment demonstrated a lack of enthusiasm, especially about the prospects of another rally.

Well, the weighted sentiment metric sums up the current low-demand situation for cryptocurrency and the market in general.

Things are likely to remain the same until mid-week or the end of the week as key economic data comes out, potentially impacting prices.

These uncertainties may also explain why most investors are shying away from taking on leverage.