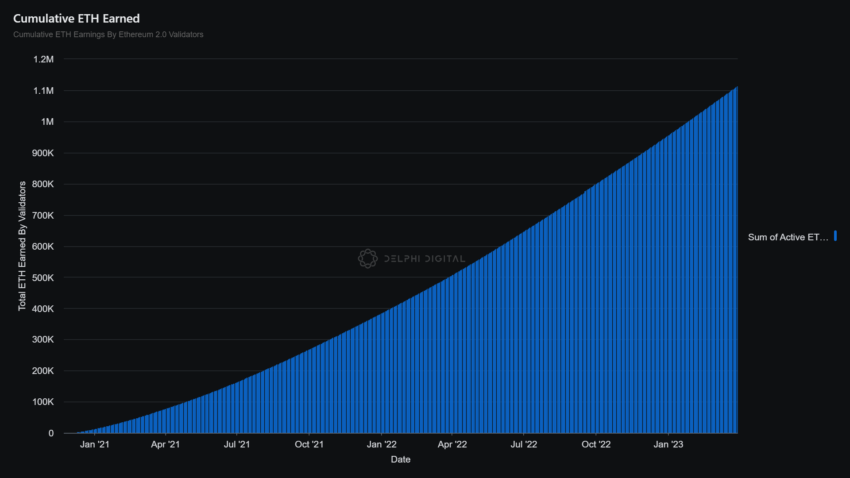

Ethereum validators have earned 1.1 million ETH ($2.007 billion) in staking rewards since January 2021, according to Delphi Digital data.

Ethereum validators started staking in 2021, soon after the launch of the Beacon Chain. Since then, their reward has steadily grown as more validators joined the network.

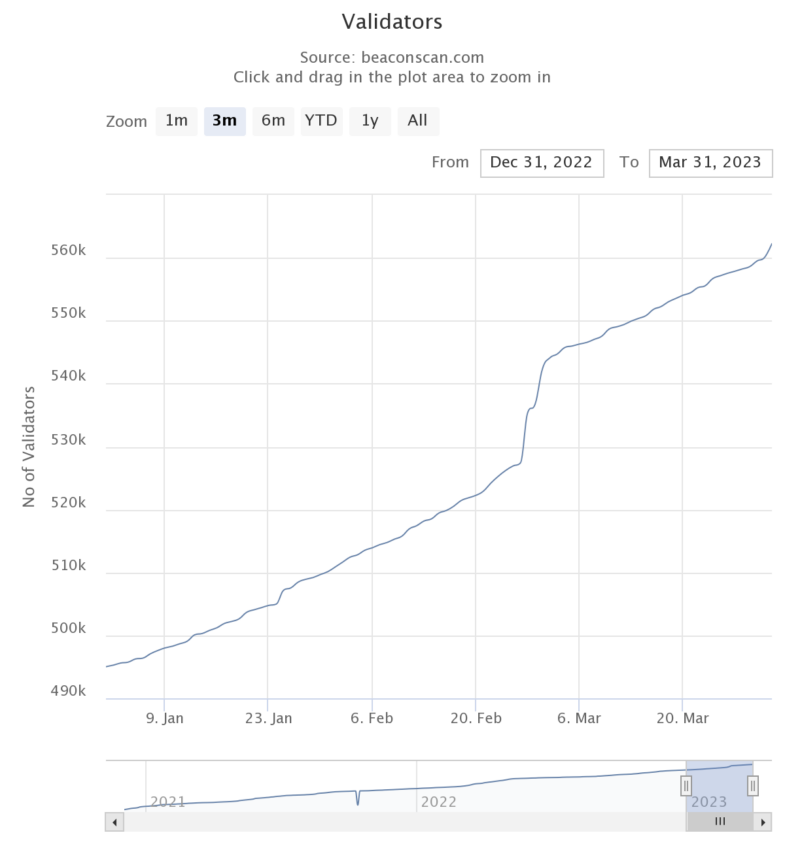

Over 67k Validators Joined Ethereum in 2023

Ethereum validators grew by more than 67,000 new validators in the first 90 days of 2023. At the start of 2023, ETH validators’ count stood at around 495,00 and increased to 562,236 as of the end of March, according to data from beacon scan.

Interestingly, about five entities dominate Ethereum staking. This concentration has been a source of concern over-centralization and the risks of censorship. But any censorship concerns have yet to materialize, as the number of OFAC-compliant blocks on the network has declined since February.

Meanwhile, over 18 million ETH tokens, representing 15% of ETH’s total supply, have been staked. The network has seen increased interest in recent weeks following news that the upcoming Shanghai upgrade would allow validators to withdraw their tokens.

Per DeFillama data, staked ETH on liquid staking platforms is nearly 8 million tokens and is cumulatively worth $14.5 billion.

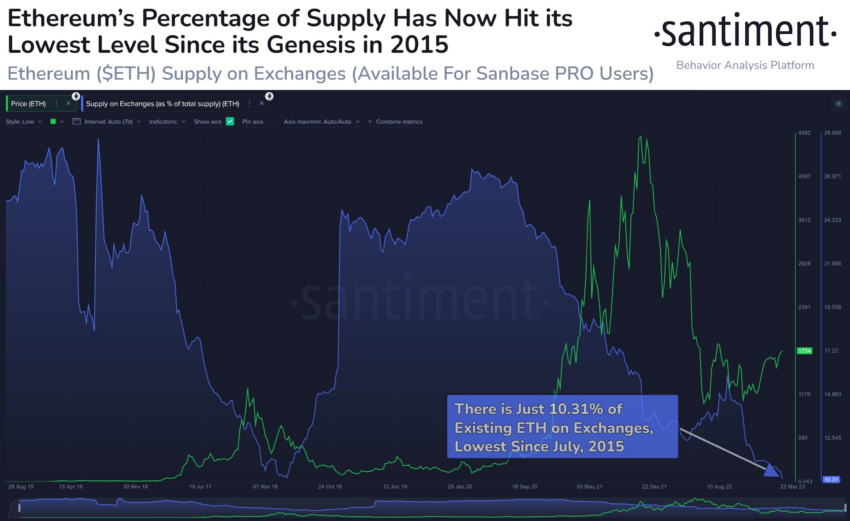

ETH Holders Opt for Self Custody

Meanwhile, ETH’s supply on exchanges has dropped to its lowest volume as more holders opt for self-custody. Blockchain analytical firm Santiment reported that there is just 10.31% of existing ETH on exchanges, which is the lowest amount since July 2015.

Several analysts have interpreted the exchange outflows to mean that investors are showing more confidence in ETH. Usually, a decreasing supply on exchanges means that holders are not looking to sell.

The confidence in ETH is largely justified, given how the asset has turned deflationary since it completed The Merge in September 2022. ETH supply has reduced by around 0.12% to 120.44 million tokens, meaning over 74,000 ETH tokens have been taken off the network.

Besides that, the asset has a largely positive 2023, growing by around 20% in the last 60 days, according to BeInCrypto data.

The post Ethereum Validators Have Earned Over $2 Billion in ETH Staking Rewards Since 2021 appeared first on BeInCrypto.