- For every loss-making transfer on the network, about 2.3 transfers were found to be profitable.

- All ETH holders were realizing gains over 20% on their investments on average.

Ethereum [ETH] broke through $3,300 as bullish momentum into the world’s second-largest cryptocurrency continued to propel it upwards. At press time, ETH was up 2.61% in the 24-hour period, and more than 12% over the week, according to CoinMarketCap.

Profitability highest since November

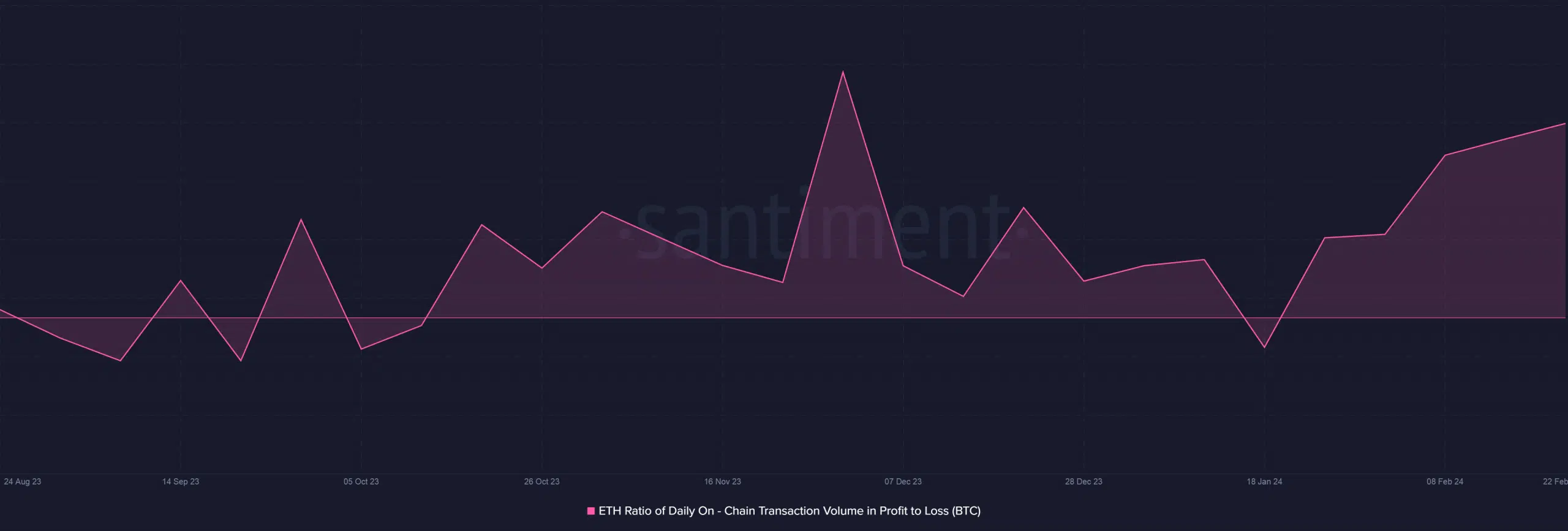

With the price boom, most of the traders were making profits on their transactions. According to blockchain analytics firm Santiment, Ethereum’s on-chain profit/loss ratio in the last week was at a three-month high.

For every loss-making transfer on the network, about 2.3 transfers were found to be profitable.

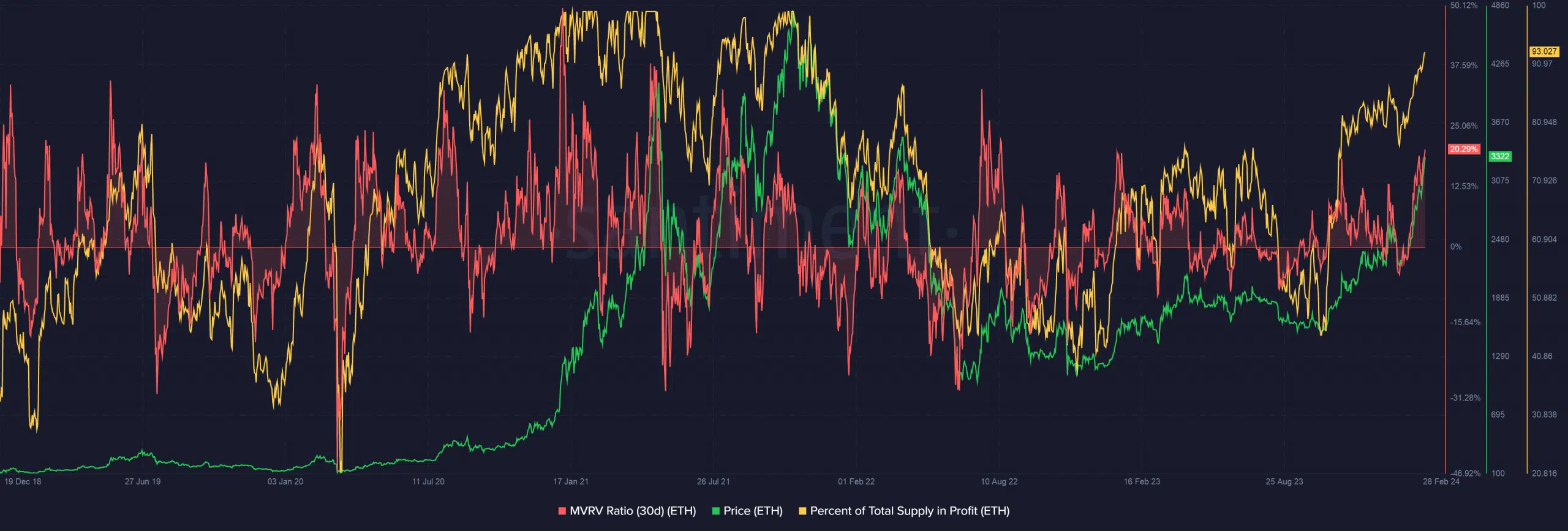

The percentage of total supply in profit exceeded 93% as of this writing. On a rising curve, this level was last seen during August 2021, three months before ETH hit all-time highs (ATH).

Moreover, on an average, all ETH holders were realizing gains over 20% on their investments, as evidenced by the 30-day MVRV Ratio. Typically, the more the ratio increases, the more likely traders have historically demonstrated their willingness to sell.

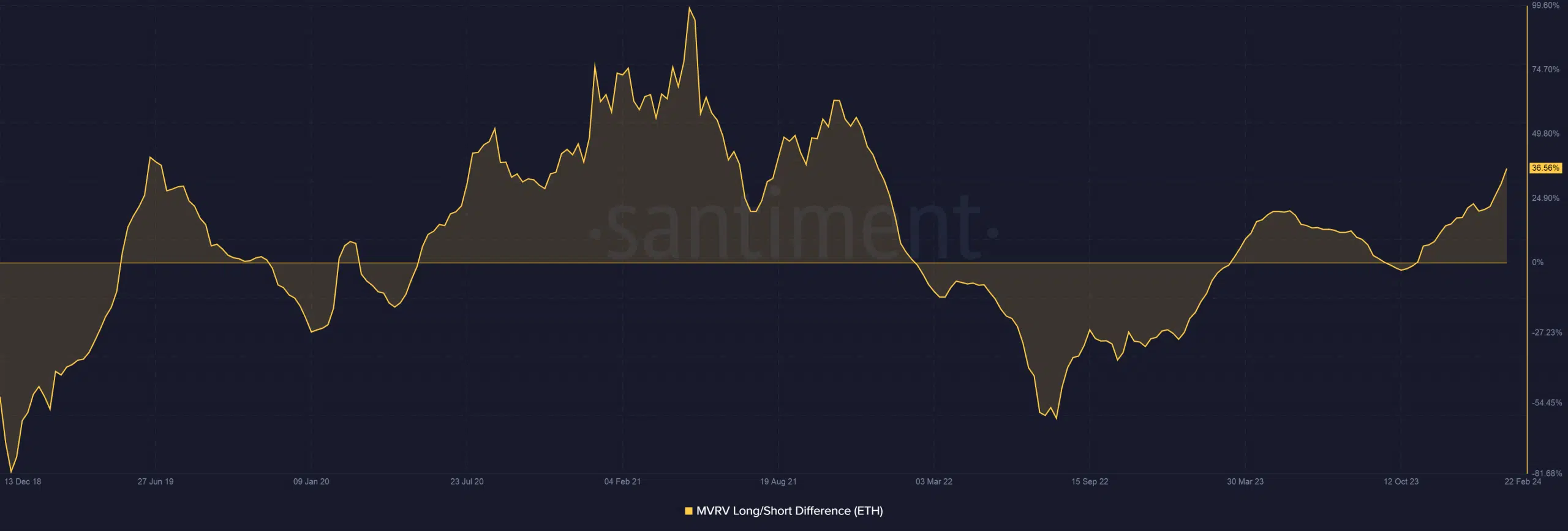

However, AMBCrypto’s investigation of MVRV Long/Short Difference indicator showed that long-term holders were realizing higher profits than short-term holders.

Hence, it was highly likely that these diamond hands would wait for prices to ride to ATH and beyond before distribution.

Be mindful of pullbacks

ETH’s bullish impetus should not make you lose sight of potential corrections on the way.

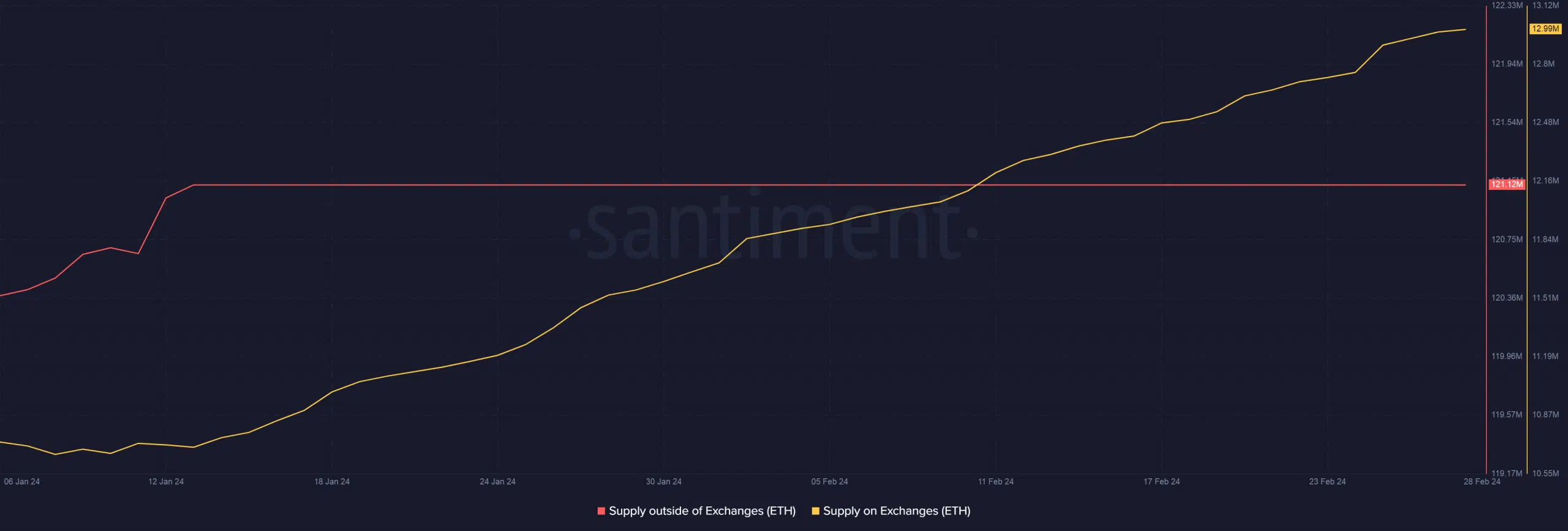

The total amount of ETH on exchanges has increased steadily since the start of 2024, while the supply outside has plateaued. This is generally interpreted as rise in short-term sell pressure. Such corrections might be a good time to buy the dip.

Is your portfolio green? Check out the ETH Profit Calculator

All ready for Dencun

That being said, with strong bullish catalysts to follow, ETH supporters were confident of an extended bull market.

One among these was the hugely-anticipated Dencun Upgrade, intended to reduced transaction fees on layer-2 (L2) chains. According to a recent blog post by Ethereum Foundation, the upgrade was activated on all testnets, and was set for mainnet launch on 13th March .