- Stablecoins are set to be “mainstream,” per Bitwise exec.

- Exec suggests Ethereum, Solana as starting points for stablecoins investments.

Asset manager Bitwise sees the booming $159.5 billion stablecoin market as another crypto frontier worth investors’ attention.

In Q1 2024 alone, Tether [USDT], the leading stablecoin issuer by market cap, netted a record $4.5 billion in profits. How can others benefit from the subsector if they are not stablecoin issuers?

Per Bitwise, looking at the concentration of stablecoins is the key. In a memo to investment professionals, Bitwise CIO Matt Hougan noted that,

“You can’t expect appreciation from holding stablecoins directly—after all, they are designed to hold a stable value. But you can invest in the “picks and shovels.” In this case, that means Layer 1 blockchains like Ethereum and Solana, which host both stablecoins and the DeFi apps that interact with stablecoins.”

Ethereum, Solana for stablecoin ventures?

For starters, Bitwise’s inclination was informed by the high chances of the US passing stablecoin legislation in late 2024 or early 2025.

This could lead to the “mainstreaming of stablecoins,” per Hougan.

To back his arguments, Hougan claimed that stablecoins are good for the US since they’re pegged to the US dollar and are one of the biggest US Treasuries buyers. Hougan emphasized,

“Second, stablecoins are big buyers of U.S. Treasuries. In fact, stablecoins are already the 16th largest “sovereign holder” of Treasuries in the world, and that’s before we see the impact of this mainstream push.”

But Bitwise’s primer for picking Ethereum [ETH], Solana [SOL], and their respective DeFi ecosystems is based on stablecoin dominance and usage.

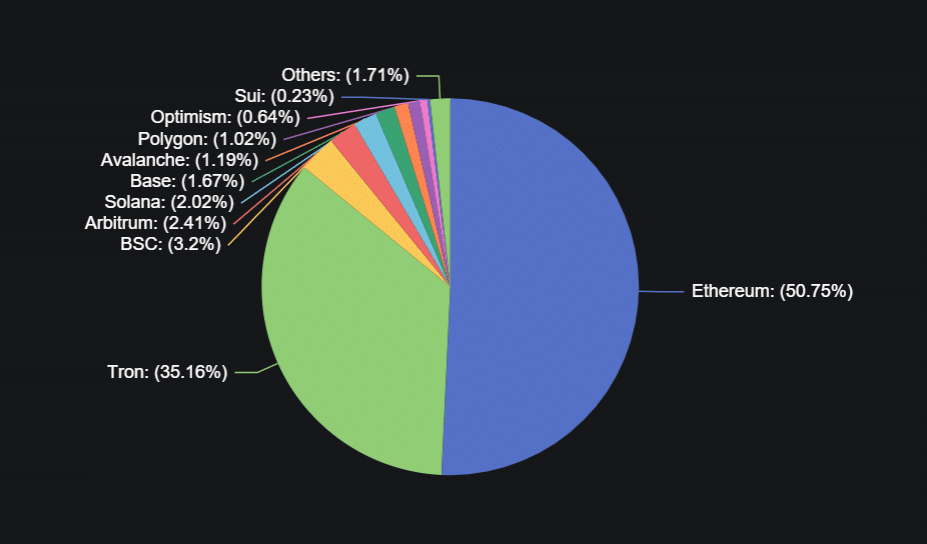

DeFiLlama data showed that the Ethereum chain commanded the highest stablecoin dominance and controlled 50.75% of the market share.

It was followed by Tron [TRX], BSC, Arbitrum [ARB], Solana, and the rest in that order.

The executive didn’t divulge much about how to approach the dominant stablecoin chains and DeFi platforms.

One could assume that the exec meant accumulating native tokens of the dominant L1 chains and platforms.

But, as with everything in crypto, Bitwise’s alpha shouldn’t be taken as financial advice unless you’ve done your thorough due diligence.