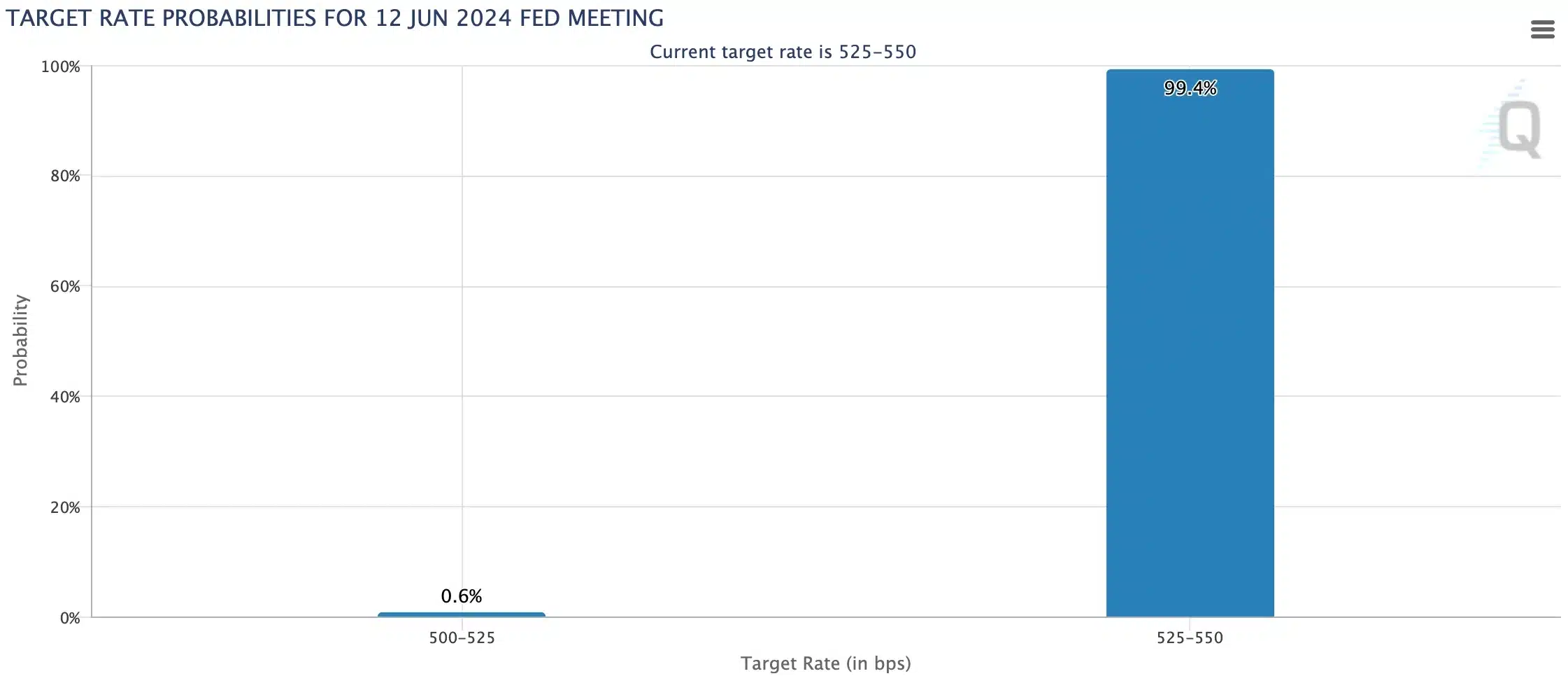

- The CME FedWatch Tool has indicated a low probability of a cut.

- Senator Warren’s letter hinted at Bitcoin’s bullish situation.

With the Federal Open Market Committee (FOMC) meeting scheduled for the 12th of June, the crypto community is abuzz with speculation about its effect on market dynamics.

Current indications suggest that interest rates will likely remain unchanged. In fact, the CME FedWatch Tool indicated at a mere 0.6% probability of a quarter-point rate cut at the meeting.

Source: CME FedWatch Tool

In other news, Senator Elizabeth Warren wrote a letter to Federal Reserve Chair Jerome Powell on the 10th of June, urging for interest rate cuts. The letter urged,

Source: Warren.senate.gov

Impact on the crypto market

According to CoinMarketCap, the global crypto market was down by 0.45% over the last day at the time of writing, reflecting FUD (Fear, Uncertainty, and Doubt).

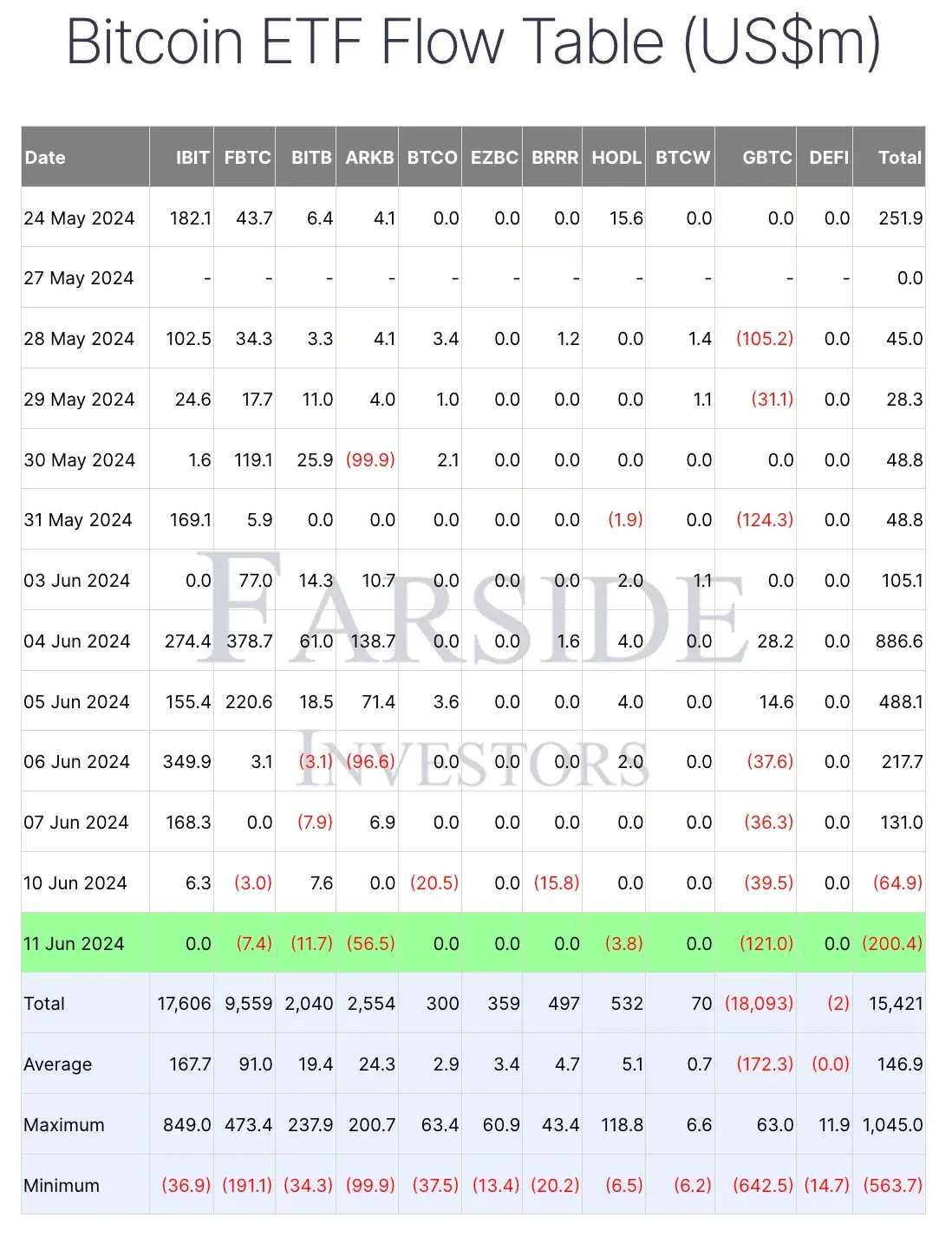

Moreover, on the 11th of June, Bitcoin [BTC] spot exchange-traded funds (ETFs) experienced significant outflows of $200.4 million, with Grayscale Bitcoin Trust ETF (GBTC) leading the pack as per Farside Investors.

Here, it’s important to note that rate cuts often lead to bullish momentum for risk-on assets like Bitcoin and cryptocurrency. So, Senator Warren’s appeal could end up helping Bitcoin and the crypto market in general.

Inflation remains sticky

Needless to say, the inflation rate in the US has been a matter of concern for quite some time.

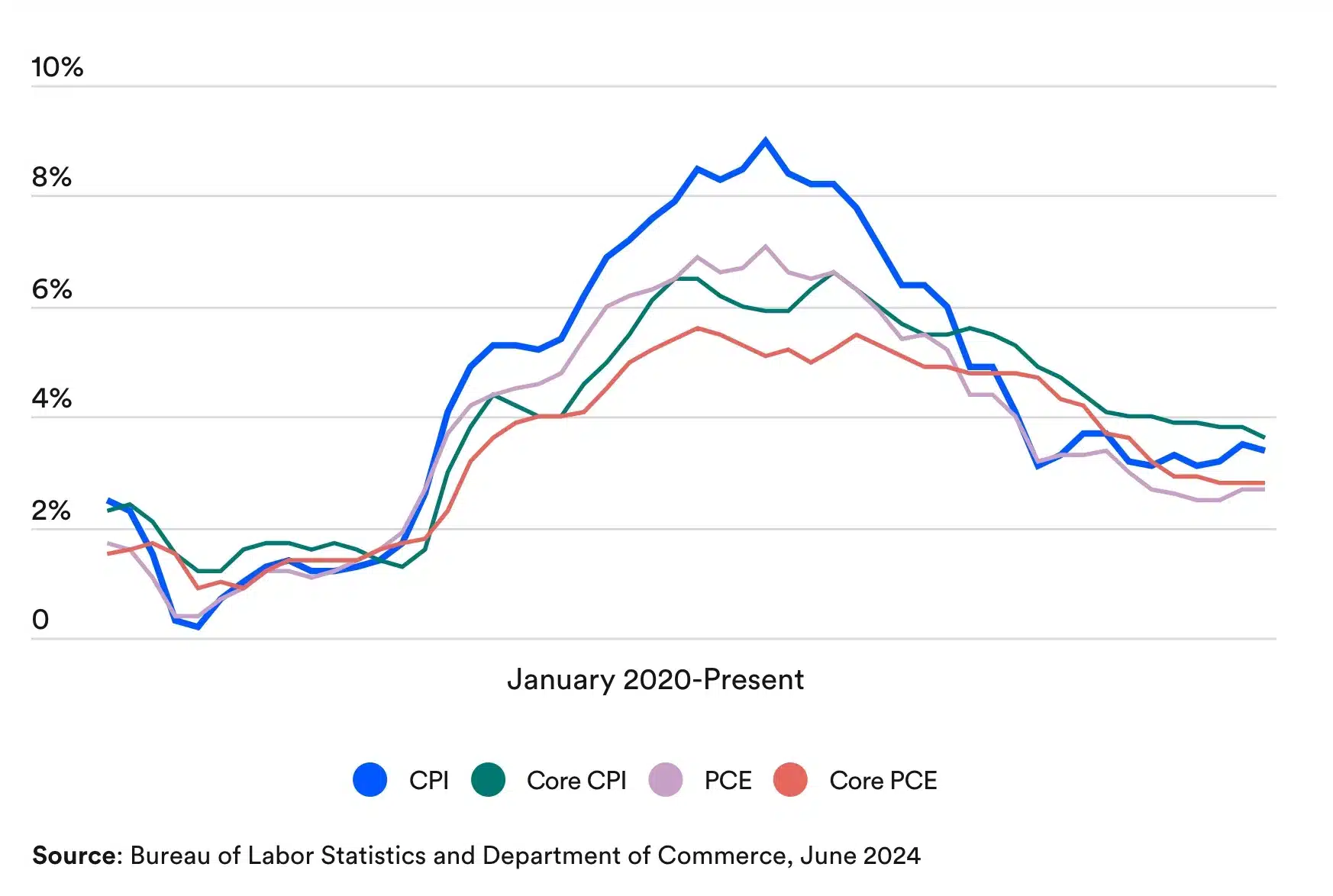

According to the Bureau of Labor Statistics and the Department of Commerce, the Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE) index, has shown faster improvement compared to the Consumer Price Index (CPI).

However, both indicators indicate persistent inflation.

Optimism persists

Despite concerns, Michaël van de Poppe took to X (formerly Twitter) and noted,

“It’s important to note that price action can be trappy. If the rate decision is unchanged, the markets might have an initial response downwards, but usually, the real move happens at a later point.”

Further elaborating on his point of view, he said,

“Bitcoin rallied by more than ten percent after previous FOMC events. Ethereum rallied by more than twenty percent after previous FOMC events. Both of them corrected by the same amount before the event, so a repricing back upwards seems reasonable to expect.”

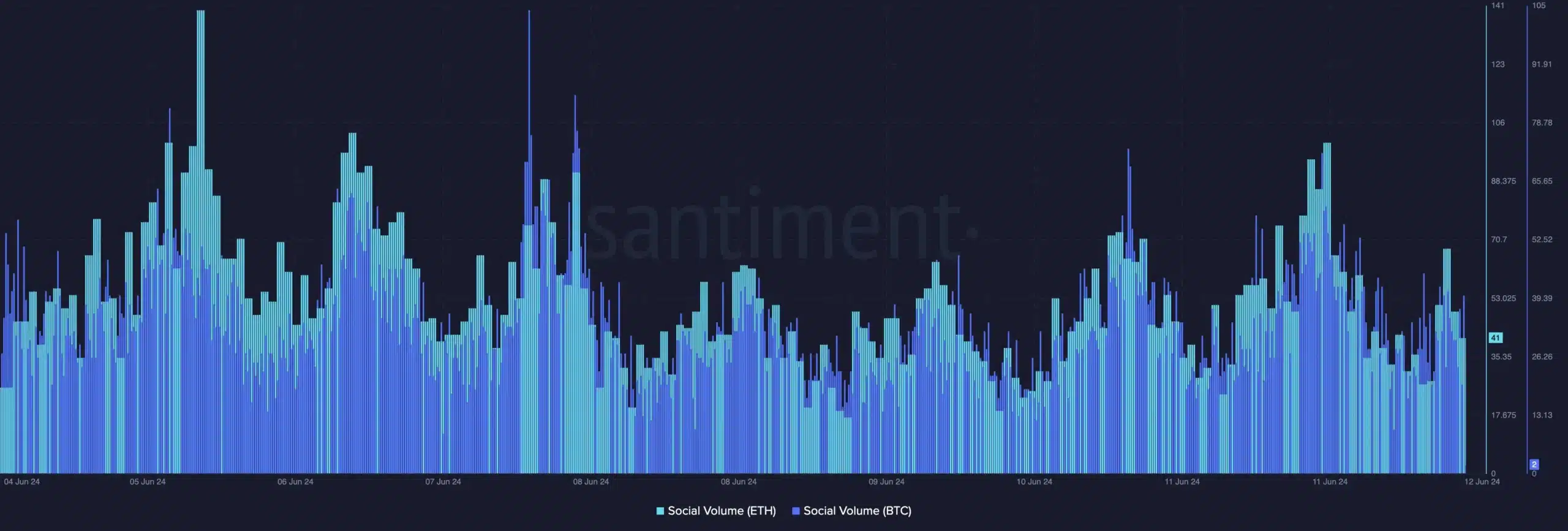

AMBCrypto’s analysis of Santiment data further confirmed this, revealing a significant spike in social volume for Bitcoin and Ethereum [ETH].

Hence, as everyone waits for the Fed’s decision on interest rates, it would be interesting to see if history would repeat itself or if the market will suffer the impact of the FOMC meeting.