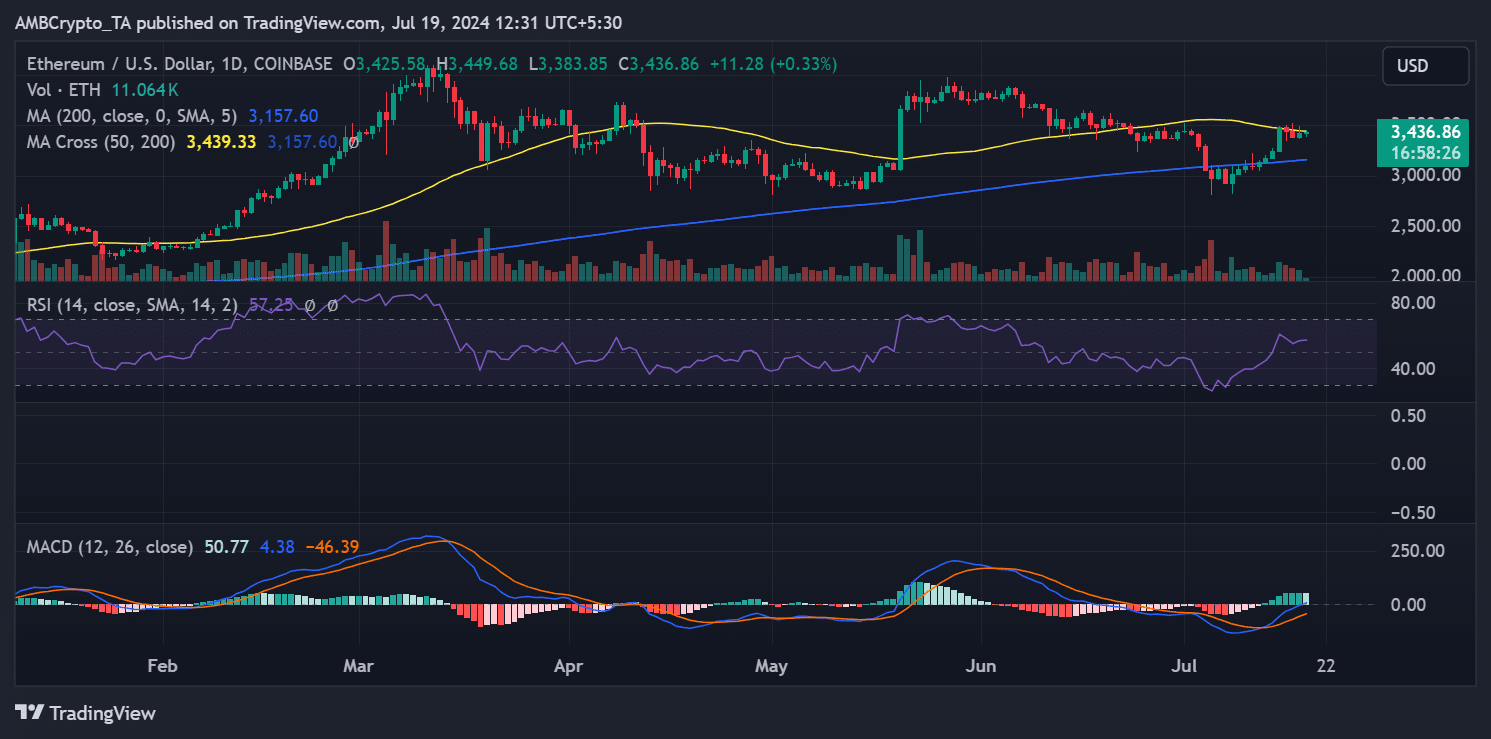

- ETH is still stuck below its short-moving average.

- The price trend, however, showed that bulls were active in the market.

In recent days, Ethereum [ETH] has been experiencing a series of uptrends, with any declines noted being too mild to impact its overall upward trajectory significantly.

As ETH’s price continues to climb, traders are becoming increasingly bullish, showing greater aggression in their market positions.

Ethereum sends strong signals

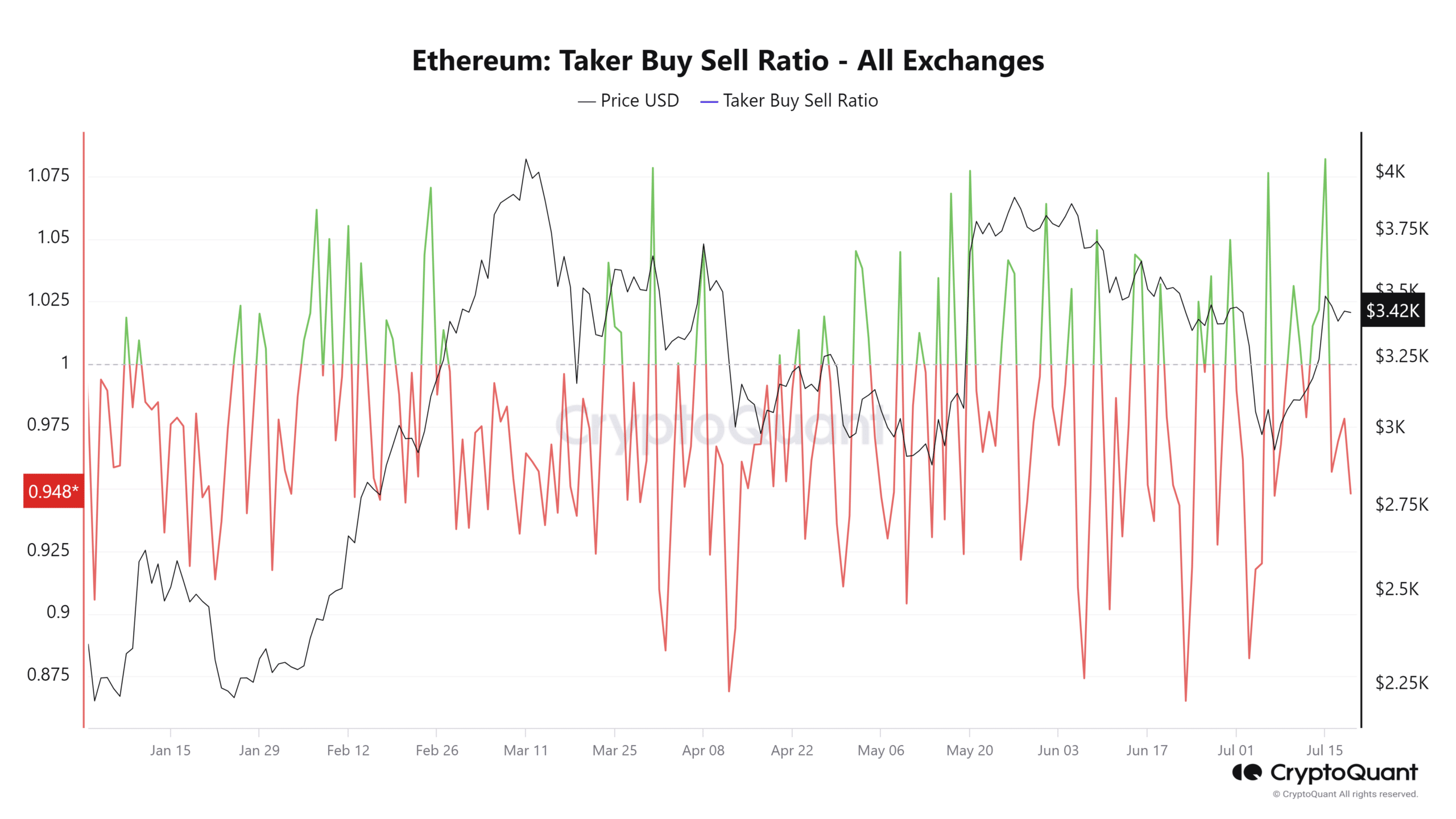

A recent analysis of the Taker Buy Sell Ratio for Ethereum on CryptoQuant revealed significant activity. This ratio has experienced notable spikes above the value of 1 in recent weeks, indicating shifts in market dynamics.

A Taker Buy Sell Ratio above 1 is a strong indicator of aggressive purchasing by bulls. It suggests that buyers are taking the initiative in executing market orders, which tends to drive prices upward.

The recent spikes in this ratio corresponded with the periods when the ETH price began to rise, showing increased buying pressure.

As of this writing, the Taker Buy Sell Ratio has slightly dipped below 1. This reduction may imply a temporary easing of buying pressure or an increase in selling activity.

However, should the upward trend in the Taker Buy Sell Ratio resume, CryptoQuant suggests it could confirm a potential mid-term bullish trend for Ethereum.

This would likely lead to further price increases as bullish sentiment sustains and intensifies in the market.

Ethereum’s Open Interest shaping up

AMBCrypto’s analysis of Ethereum’s Open Interest on Coinglass indicated a significant uptick in the last few days. Starting around the 9th of July, the Open Interest increased from approximately $12 billion to over $14.2 billion.

Additionally, there has been a sharp rise in Ethereum’s Funding Rate.

A rise in the Funding Rate typically indicates that long positions are paying premiums to short positions, suggesting bullish sentiment among traders holding long positions.

These developments — the rise in Open Interest and the higher Funding Rate — suggest increased market activity and cash inflow from buyers.

This aligned with other bullish indicators like the Taker Buy Sell Ratio, painting a picture of a strong bullish trend for Ethereum.

ETH’s growing bull trend

As of press time, Ethereum was trading at approximately $3,436, marking a less than 1% increase.

This subtle rise followed a more significant increase of over 1% in the previous trading session, which pushed its price to around $3,425.

Read Ethereum’s [ETH] Price Prediction 2024-25

AMBCrypto’s look at Ethereum’s Moving Average Convergence Divergence (MACD) provided further insight into its market behavior. As of this writing, the ETH MACD was trending above zero, which typically signals a bullish trend.

However, the indicator lines are positioned slightly below zero, suggesting that while there is indeed a bullish trend, it has not yet gained strong momentum.