Lido (LDO) is presenting as a key beneficiary of Ethereum’s continued growth into a strategic financial infrastructure layer.

Lido is the dominant ETH staking protocol. It features a decentralized autonomous organization (DAO) that enables users to stake Ether and receive daily rewards while keeping full control of their staked tokens.

Lido Positioned as the Profit Engine Behind Ethereum’s Rise

Crypto market participants are warming up to the idea that staking infrastructure goes beyond technical plumbing and becomes a profit engine.

With a surge of institutional and ecosystem interest in ETH, some analysts now argue that Lido’s native token, LDO, could be significantly undervalued.

Kyle Reidhead, co-owner of Milk Road, recently highlighted a cluster of bullish catalysts forming around Ethereum. The crypto executive pointed to Ethereum’s successful Layer-2 (L2) roadmap, adoption by major companies like Robinhood and OKX, and the growing trend of ETH used in corporate treasuries.

“ETH is setting up to do really well here IMO…I’m getting very bullish on ETH,” he said.

Reidhead cited the involvement of the Ethereum Foundation (EF) and the upcoming arrival of ETH staking ETFs as further accelerants.

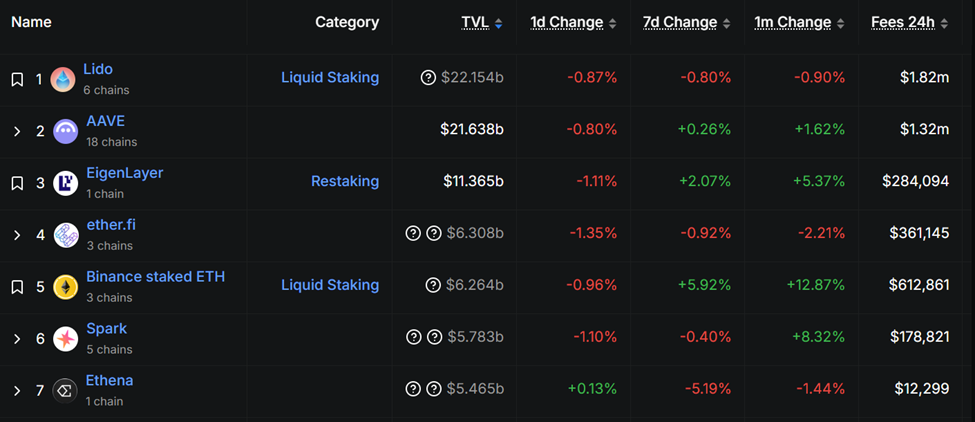

This trend could translate directly into bottom-line profits for Lido, which controls roughly 60% of all staked ETH.

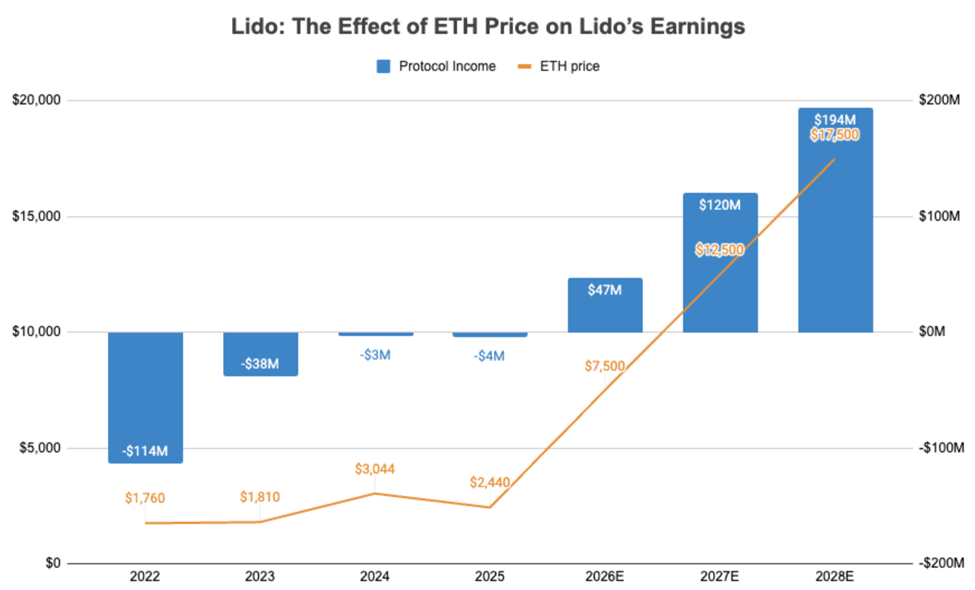

m0xt, an analyst at Milk Road, explained that Lido’s revenue model scales with ETH itself.

“Bullish on ETH? Then you should be bullish on LDO too,” he wrote.

This stance is based on Lido earning staking rewards in ETH and only distributing around 50% of that income to validators. Based on this, a rising ETH price boosts Lido’s profit margin without a corresponding increase in operational costs.

“But here’s the kicker, not all costs rise with ETH,” m0xt continued.

Over the past three years, Lido’s liquidity costs have averaged $13.5 million annually. Meanwhile, operating expenses have hovered around $40 million.

Assuming those stay flat, or even conservatively bump to $50 million, Lido could generate tens of millions in profit purely from Ethereum’s price appreciation.

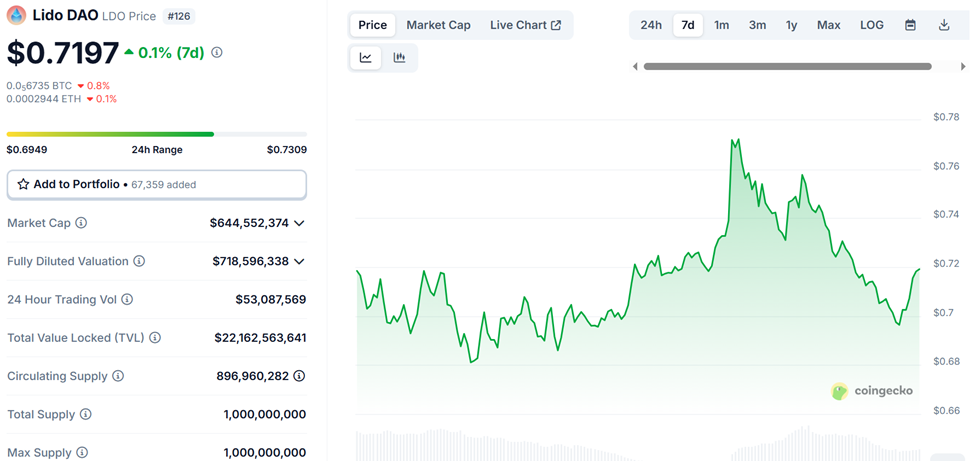

With 90% of LDO’s token supply already in circulation and a current market cap of $644 million, LDO may be mispriced relative to its cash flow potential.

Growing Investor Interest in LDO as ETH Demand Accelerates

Investor sentiment is starting to shift in line with this thesis. Crypto trader kcryptoyt emphasized Lido’s dominant market share in the ETH staking ecosystem.

The trader acknowledged some skepticism around the long-rumored “fee switch,” which could redirect protocol fees to LDO holders. He also admits that the LDO looks like an attractive buy.

“I haven’t pulled the buy trigger because well…it’s ETH we’re talking about but I can’t lie it, LDO is starting to look very appealing,” wrote the trader.

Meanwhile, the broader market backdrop only strengthens the case. As Ethereum begins to resemble a “reserve asset” for the crypto economy, mirroring Bitcoin’s role in institutional portfolios, Lido stands to benefit as the largest gateway to ETH staking.

Ethereum’s increasing integration into corporate treasuries, DeFi infrastructure, and ETF products is reinforcing demand for yield-bearing ETH exposure, much of which flows through Lido.

While risks remain around protocol governance, regulatory scrutiny, or competitive staking models, analysts suggest Lido’s position is uniquely entrenched.

As Ethereum inches closer to reserve asset status, LDO could emerge as one of the most leveraged ways to gain exposure to that shift.

According to data on CoinGecko, LDO was trading for $0.7197, up by a modest 0.1% in the last week.

The post How Lido Is Gaining Traction as Ethereum Becomes a Strategic Reserve Asset appeared first on BeInCrypto.