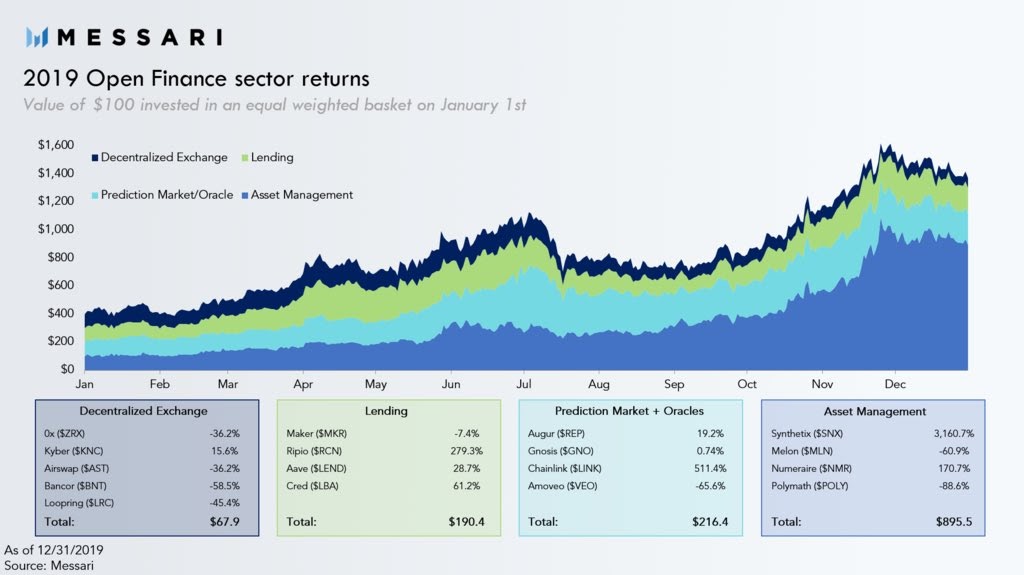

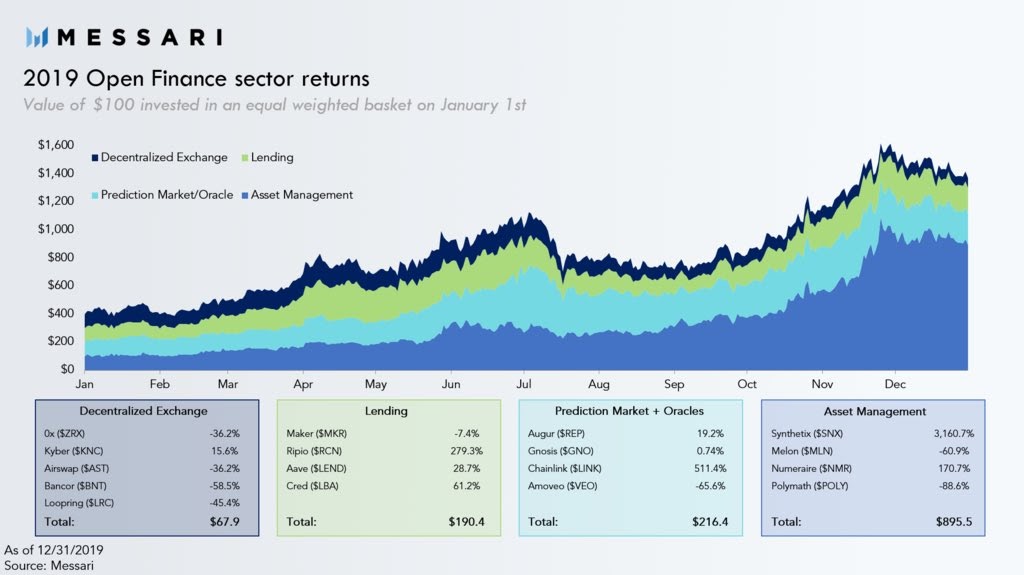

A research experiment by Messari highlights how certain sub-niches of DeFi outperformed the rest by linking price appreciation to utility and usage.

Dollar Returns From Top Tokens

The rise of DeFi was unmistakably a central theme in the cryptocurrency landscape of 2019. Assets locked in open finance protocols surged from $200 million to nearly $680 million over the course of a year.

Investing in DeFi can be broken down into two broad categories: putting money into a protocol, such as contributing USDC to Compound’s money markets, and investing in a protocol’s native token. The principal focus was placed on the former, while the latter was largely ignored by the market.

Few tokens offered returns that trumped Bitcoin’s. A new notable examples, however, include Synthetix (SNX), Numerai (NMR), and ChainLink (LINK), offering 3,160%, 171%, and 511% respectively.

The bulk of DeFi applications can be crammed into four distinct groups: lending protocols, decentralized exchanges (DEXes), oracles and prediction markets, and asset management.

On the whole, asset management offered superior returns relative to other groups and DEX tokens were the biggest losers, with the exception of Kyber Network’s Crystal token (KNC).

Investing $100 in the four assets outlined by Messari yielded a return of 796% and the same amount invested in DEX tokens amounted to a 32% loss. These results can be understood by examining how each platform captures value as well as their differing token economics.

Token Economics Snowball Effect

Projects like Compound and Set Protocol have performed amicably without launching a native token. For the ones that went ahead with an ICO, value capture mechanisms across protocols vastly differ based on the core use cases for the native token.

Maker’s (MKR) token economics haven’t been positively priced in by the market despite the protocol growing larger than any other financial dApp. Throughout 2019, Maker added 28.4% to the total amount (USD) of value locked in the protocol, while the price of the token dropped 7.4% over the same period.

ChainLink requires projects relying on their oracle services to pay node operators in LINK. This is a fairly straightforward token model that created legitimate demand for LINK. Partnerships with the likes of Google and Intel also played a role in LINK’s price appreciation

Synthetix attributed its price action to a 105x uptick in usage. The fundamental difference between Maker and Synthetix boils down to how token holders benefitted from their investment.

The burn mechanism that Maker integrated vows to use a portion of stability fees earned from the opening of Collateralized Debt Positions (CDPs) and vaults to purchase MKR from the open market and burn it, thus reducing overall supply.

Other than a negligible effect on token free float, this has no meaningful impact on token economics. Token burns are akin to share buybacks. Since Maker holders don’t have a claim on earnings, reducing outstanding supply does not imply a higher value token.

Conversely, investors in SNX have a claim on token flows. Network inflation and fees from trading on the Synthetix exchange are both diverted to SNX stakers.

As a result, holding SNX and staking it on the network allows one to earn more tokens. This has a cascading effect in terms of value capture. Annual network inflation as of March 2019 is 75% and will reduce until it reaches a terminal rate of 2.5%. This incentivizes early adoption as more SNX accrues for each token staked.

The project invested a chunk of their ICO money into their own protocol, effectively bootstrapping liquidity in the initial stages. As Synthetix gained more usage, stakers were rewarded with more fees along with the inflation, price appreciation snowballed, leading to the explosive price action witnessed in 2019.

Exceptions to the Case

Just like Maker captured value but MKR lost value, Augur’s protocol lost 81.4% of capital locked over 2019, but ended the year on a surprisingly strong note, recording a 19.2% return.

Ripio (RCN), which raised $37 million in an ICO, was up 280% on Dec. 31, 2019. It is a relatively unknown project with traction in Latin America and no data regarding protocol usage. In a report from 2018, Coindesk stated that the protocol has 3,000 lenders and issues loans up to $730.

Markets tend to behave irrationally and treat different cases asymmetrically. MKR’s burn mechanism didn’t result in price appreciation, yet Binance Chain (BNB) returned 125% despite price falling off a cliff in June 2019. Understanding these nuances will be critical for those looking to profit from the rise of decentralized finance in 2020.