Bitcoin has managed to consolidate higher in the charts after a few consistent surges; other major assets have followed BTC’s path in improving their respective valuations.

Despite rising market caps, the address profitability for certain major cryptos has not mirrored their current market performance.

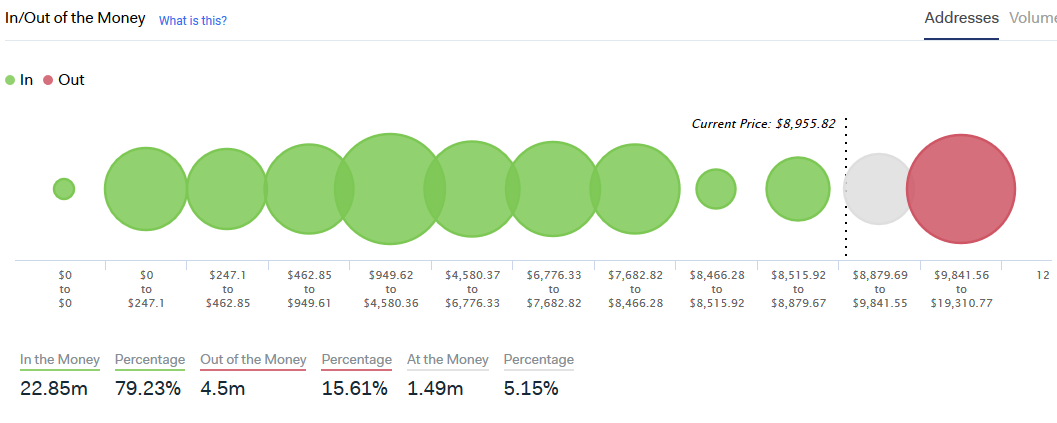

Data from intotheblock.com indicated that a majority of the addresses holding BTC had a higher percentage of money coming in on their holdings rather than outflow.

Source: intotheblock

The chart exhibited that 79.23 percent of the addresses entered the market before the current BTC valuation of $8955, whereas around 15.61 percent of the addresses bought their BTC above it.

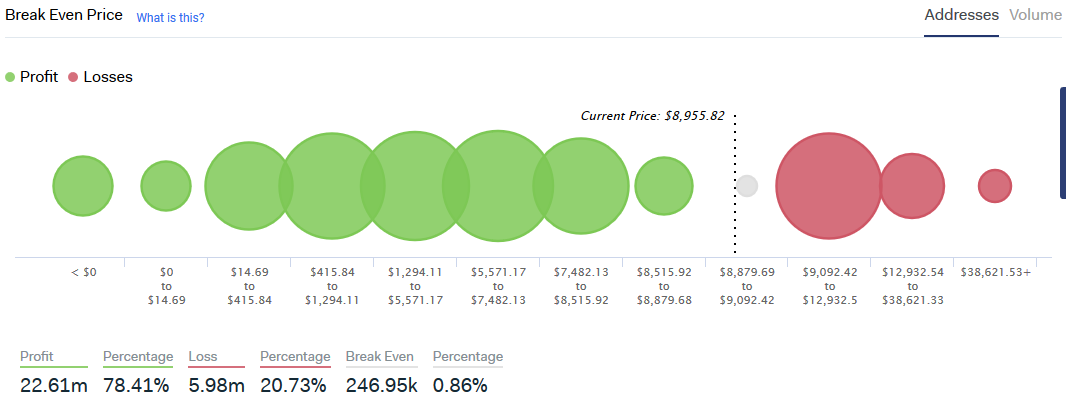

Source: intotheblock

The site also calculated an address’s profit or loss by adding all sells and subtracting all buys made by an address in its entire history. On observing the address profitability chart, Bitcoin holders stood tall with heavy bags. 22.61 million addresses incurring a profit in the current market; 20.73 percent of the addresses incurred a loss, while 0.86 percent remained at a break-even stage.

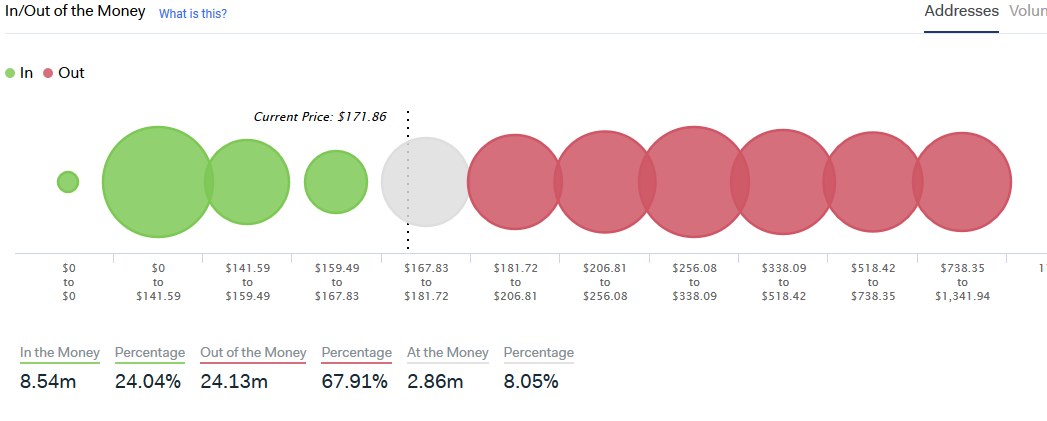

Source: intotheblock

In comparison to Bitcoin, Ethereum addresses showed a rather average performance. 67.91 percent of the ETH holders had money going out from their addresses despite ETH’s current rise to $171.86. A mere 24.04 percent of addresses accounted for money coming in from the current market scenario.

Source: intotheblock

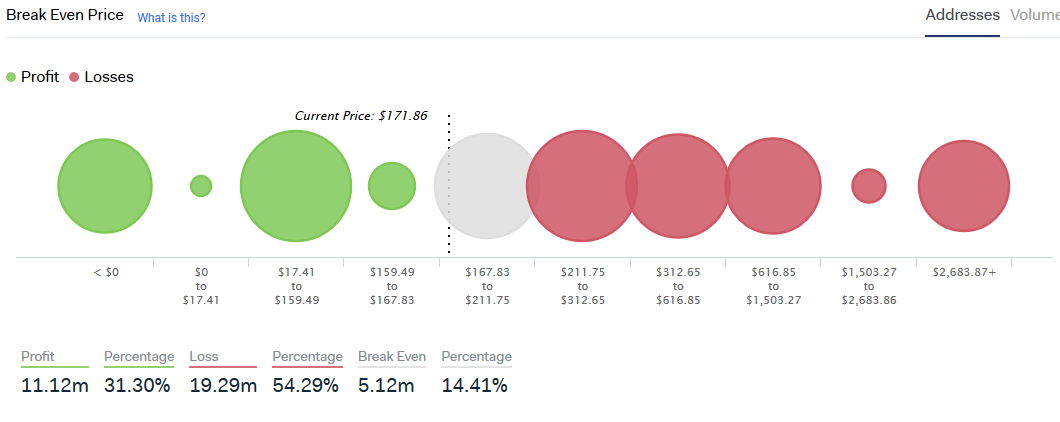

In terms of address profitability, a majority of ETH holders registered a loss with 54.29 percent of the addresses in the bracket above the current price. 14.41 percent were currently in the break-even range and 31.30 percent of the addresses registered a profit.

Source: intotheblock

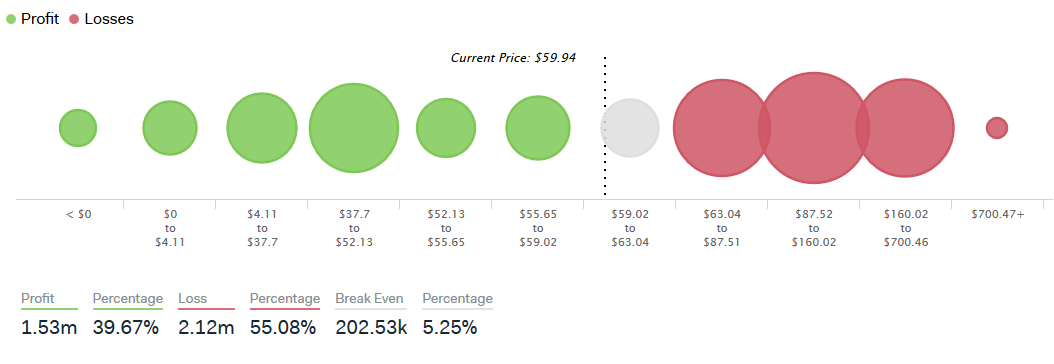

Litecoin exhibited similar signs as 55.08 percent of the holders endured a loss in the market. A majority of people had entered LTC‘s market between the range of $87 and $160, which suggested Bitcoin’s silver counterpart required another 33 percent hike to register greater address profitability.