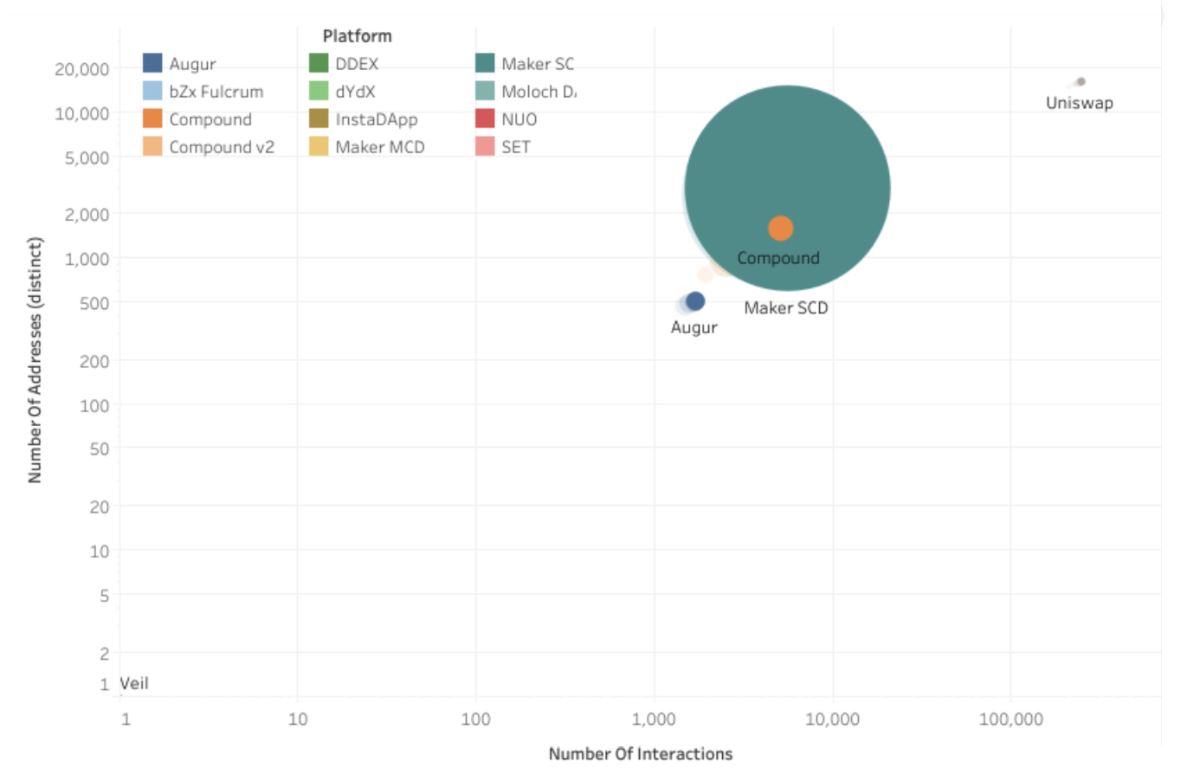

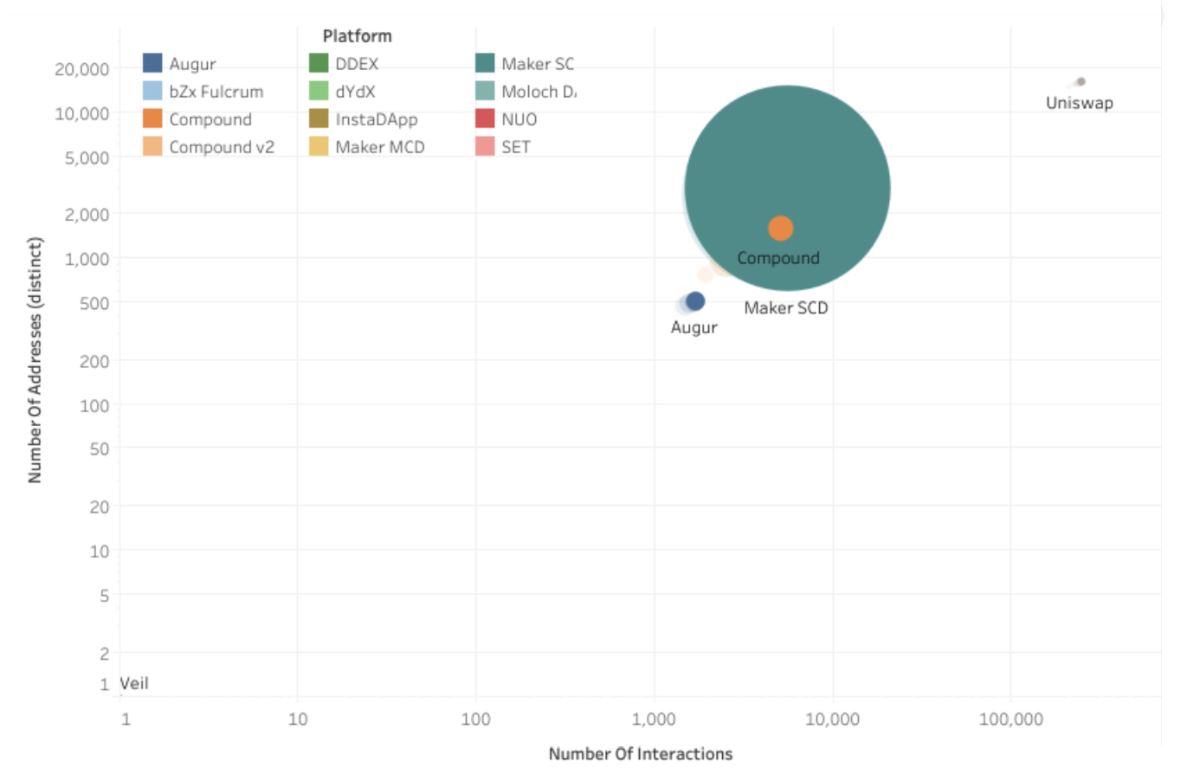

Maker, the Ethereum-based DeFi protocol, remains dominant in decentralized finance, but competitors such as Compound, Uniswap, and Synthetix showed strong growth in 2019.

Maker Remains the King of DeFi

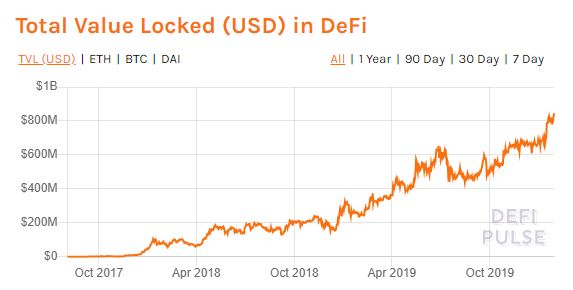

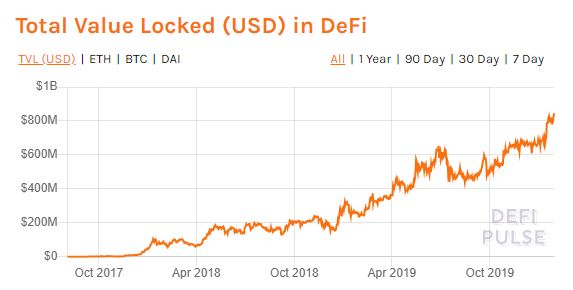

MakerDAO, creator of “the world’s first unbiased currency” DAI, enjoyed first mover advantage in the burgeoning DeFi market. With almost $850 million worth of collateral locked in DeFi smart contracts, Maker dominance sits at 57% with almost half a billion dollars in total locked value. The DeFi market itself grew exponentially in 2019, up from just over $250 million since the beginning of last year.

Maker’s dominance is even more pronounced in lending markets, where it powers 78% of total value locked. In the beginning of 2019, Maker was the only DeFi protocol to have locked in significant collateral.

Competitors Emerge

Over the course of last year, however, competitors emerged to take away some of Maker’s market share. The difference is stark. While MakerDAO began 2019 as the only DeFi player of any significance, by the end of the year, it shared the spotlight with a number of rivals.

Most notably, Compound grew with the wider DeFi market, boasting six times the total value locked in U.S. dollar terms than it had at the start of the year. The Compound protocol currently has almost $150 million worth of assets locked in collateral, spanning eight different markets. Ether and Dai dominate Compound contracts, with around $65 and $24 million worth in its protocol, respectively.

Uniswap, a token exchange protocol and liquidity pooling platform, grew its total locked value from $470 thousand to $50 million in 2019, representing 50X growth over the course of the year.

Synthetix grew from less than $2 million to over $150 million in total locked value in the same period of time, to become the second largest player in the market. On the other hand, Maker’s single collateral and multi-collateral Dai have over two million Ether locked up in contracts, representing 16% growth for the year.

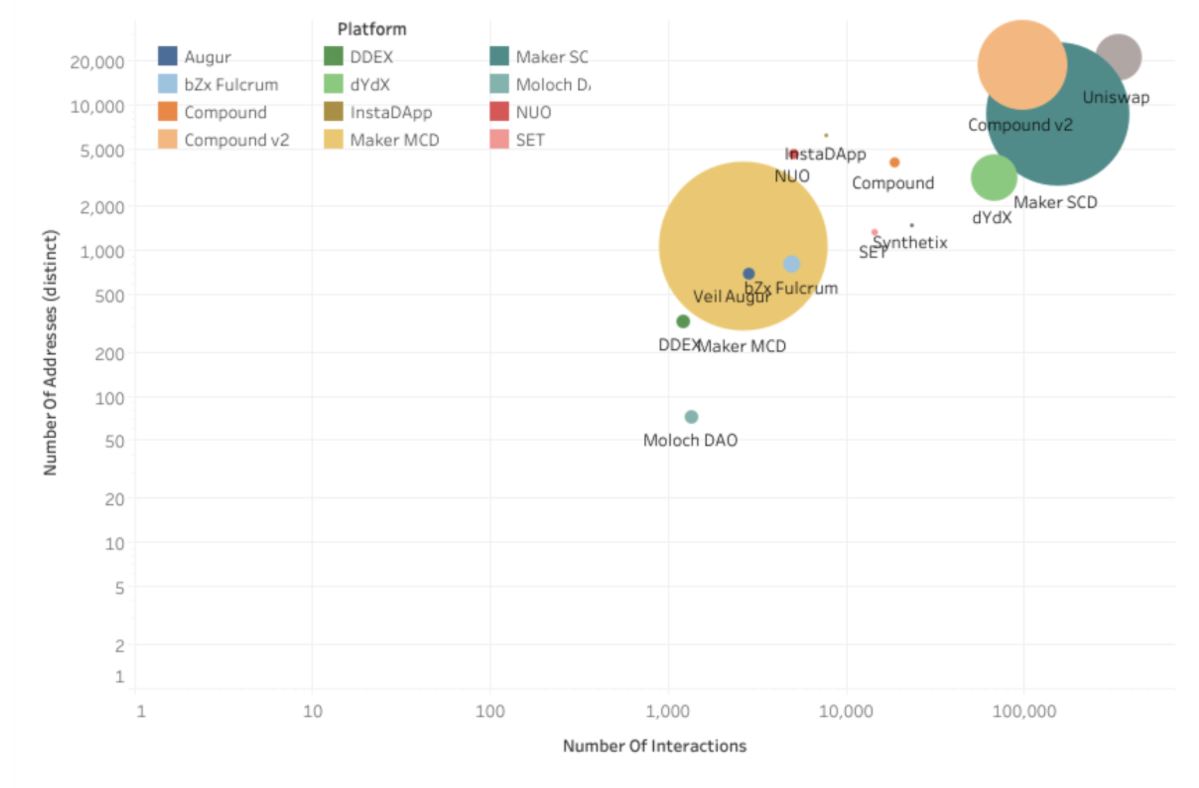

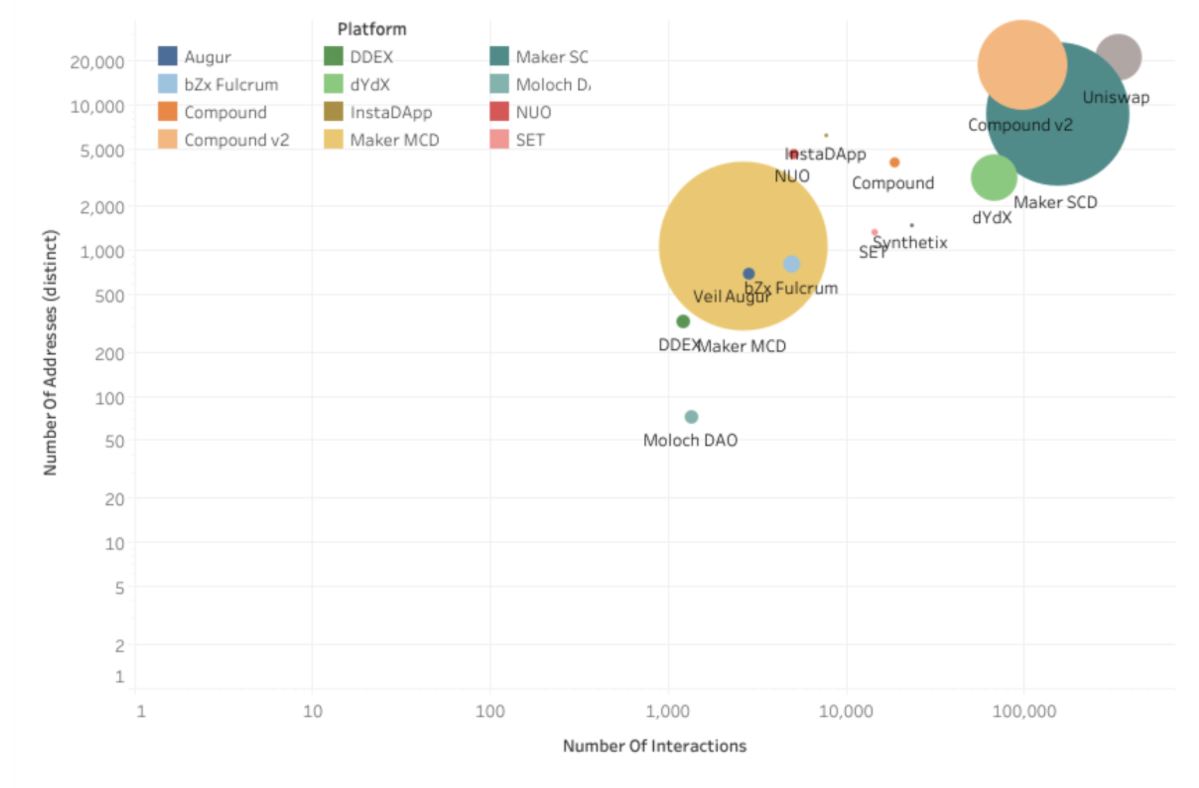

With eight major lending protocols, a few of the more recent entrants saw staggering growth rates. According to DeFi Rate, Nuo Network grew by 66,000%, with bZx and InstaDApp both soaring by almost 30,000% in terms of value locked.

Why Has the Landscape Changed so Dramatically?

Maker continues to be the dominant force in DeFi, but it is no longer the only player. As the DeFi market exploded, room was created for competitors. DeFi in 2019 in many ways mirrors the explosion of growth of blockchain projects in 2017.

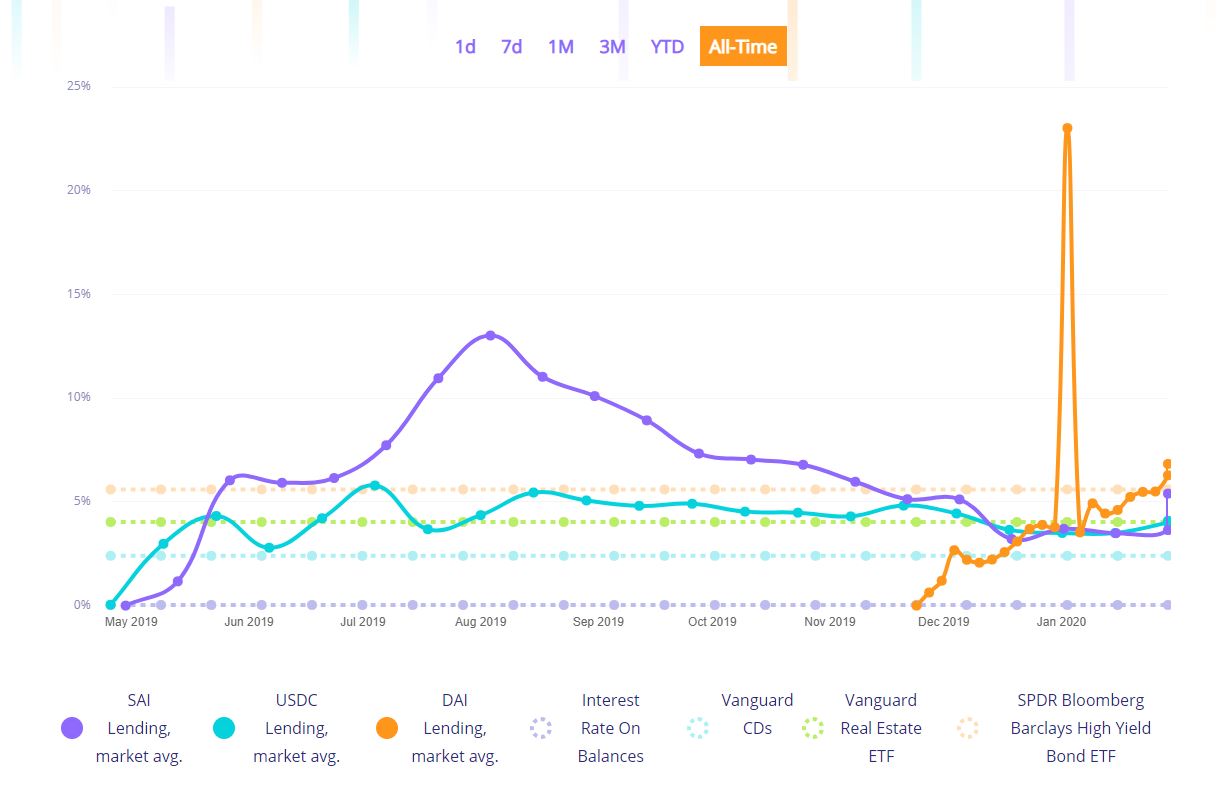

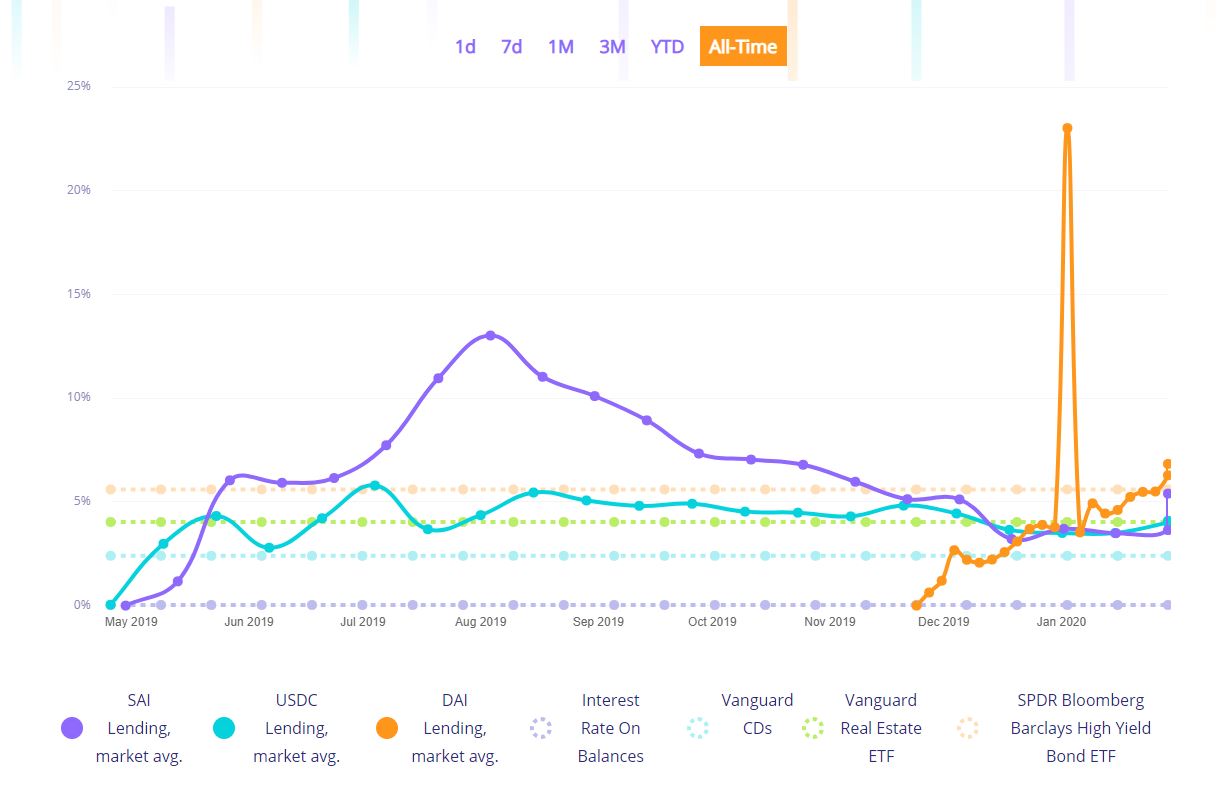

One of the reasons for the surge in interest in decentralized finance are the high yields. Compared to more traditional assets, DAI and SAI have both seen yields expand to double digits. Those stability fees have been rare, but stablecoin yields in the DeFi market are ordinarily above five percent. Compared to low yielding traditional assets, DeFi contracts provide attractive returns for investors.

The 2019 explosion of growth is probably the most significant reason for the rapid expansion of MakerDAO competitors. According to DeFi Rate, the entire market grew by almost 140% over the year, with the increase in locked DAI growing almost 1,000%.

Derivatives surged by close to 5,000%, the fastest growing segment of the market. The growth in DeFi derivative products explains the success of Synthetix, a “crypto-backed synthetic asset platform that provides on-chain exposure to real-world currencies, commodities, stocks, and indices.”

A year ago, one in every 56 Ether was locked in a DeFi protocol. That figure is now around 37. That hasn’t led to an increase in the price of Ether, which was down slightly for the year. The Ethereum network continues to grow in terms of activity, but its token price has not enjoyed a resultant uptick.

The Future of DeFi

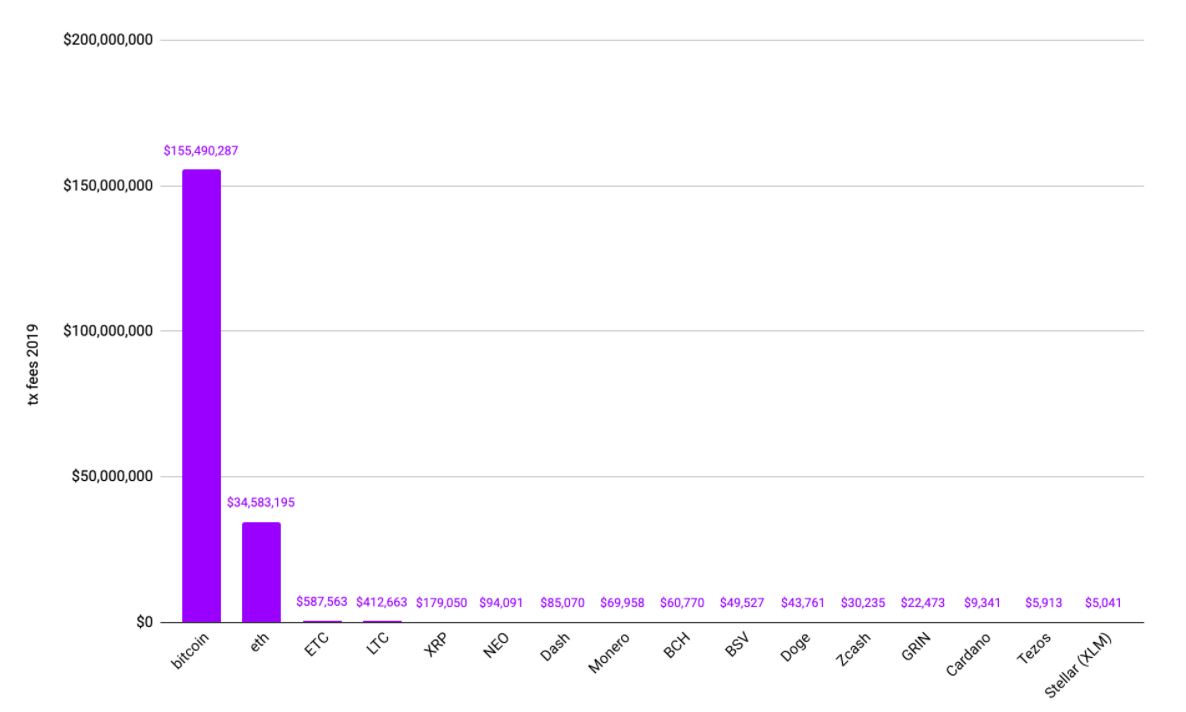

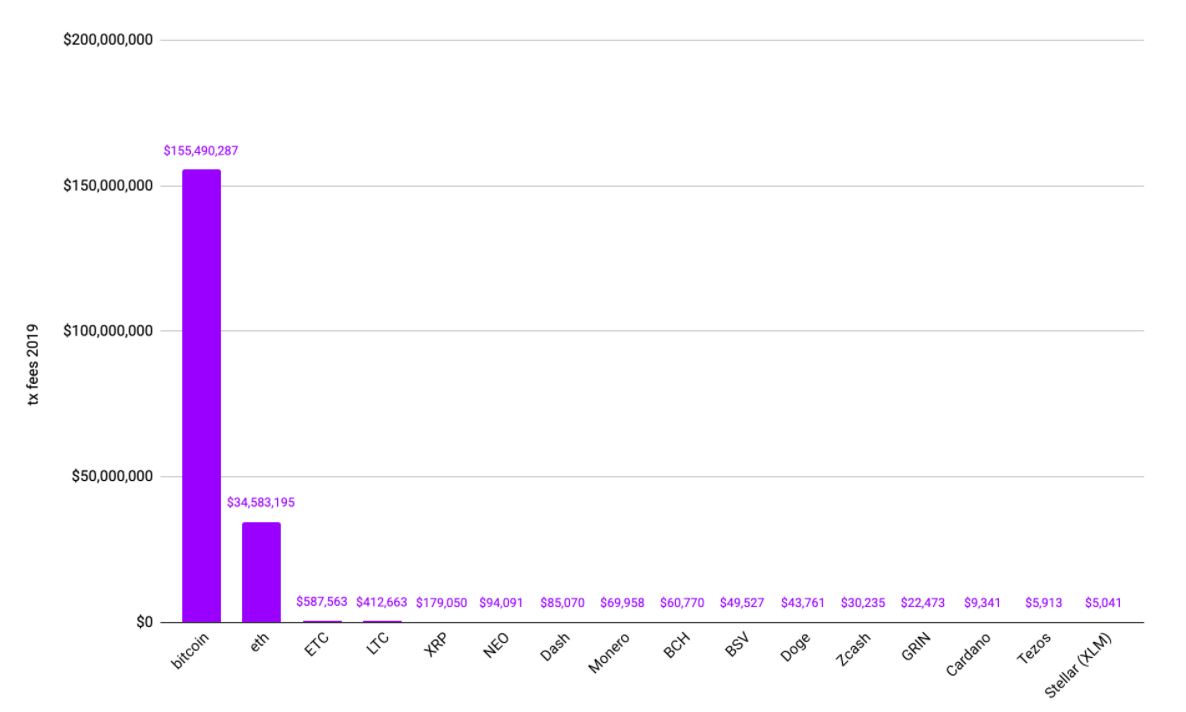

With Bitcoin and Ethereum towering over the remaining 14 most active blockchains, Ethereum’s ecosystem appears healthy and vibrant. It hosts the fastest growing segment of the blockchain landscape in DeFi, but its price decoupled from the level of decentralized finance activity last year despite almost 3% of it being locked up in DeFi contracts.

As the decentralized finance industry matures, it is unlikely to witness such significant rates of growth in the future. But given the emergence of a number of new players in the space in 2019, the makeup of the sector is likely to shift. Maker remains the most significant entity, but as in all areas of crypto, that could change rapidly.

Keeping ahead of the curve and remaining innovative is important. The arrival of decentralized insurance protocol Nexus Mutual last year demonstrated that there is a lot of innovation to play out in the space. But user experience is beginning to be acknowledged as vital to a project’s success. If DeFi is to truly go mainstream, society stands to benefit immensely.