It’s all systems go for Ethereum as technical analysis shows a possible breakout is on the horizon.The end of January saw a rejection at $185. But since then, Ethereum has tentatively broken through. Today it’s up just under 1%, sitting at around $188. Ethereum daily showing 50-day & 100-day MA. (Source: tradingview.com)Ethereum Is Showing Bullish SignsTechnical analysis shows that the 50-day moving average is poised to cross the 100-day moving average on the Ethereum daily chart – a strong indicator of positive price momentum.The last time this happened (mid-February 2019), Ethereum surged a massive 180%. From the cross to the peak, it hit $363 some three and a half months after the event.However, this was followed by a strong reversal, setting off a downward channel ever since.Should Ethereum manage to crack the $200 level, then it may be time for celebration. Having said that, caution needs to be exercised.The Fundamentals Are As Strong As EverAll the same, the fundamentals surrounding the number two cryptocurrency are as strong as they’ve ever been. And many analysts believe Ethereum stands to gain significantly when the bulls finally manage to kick the bears into touch.Ethereum will lead the bull market, exactly as it did in 2017.— CryptoWolf (@IamCryptoWolf) February 3, 2020

Ethereum daily showing 50-day & 100-day MA. (Source: tradingview.com)Ethereum Is Showing Bullish SignsTechnical analysis shows that the 50-day moving average is poised to cross the 100-day moving average on the Ethereum daily chart – a strong indicator of positive price momentum.The last time this happened (mid-February 2019), Ethereum surged a massive 180%. From the cross to the peak, it hit $363 some three and a half months after the event.However, this was followed by a strong reversal, setting off a downward channel ever since.Should Ethereum manage to crack the $200 level, then it may be time for celebration. Having said that, caution needs to be exercised.The Fundamentals Are As Strong As EverAll the same, the fundamentals surrounding the number two cryptocurrency are as strong as they’ve ever been. And many analysts believe Ethereum stands to gain significantly when the bulls finally manage to kick the bears into touch.Ethereum will lead the bull market, exactly as it did in 2017.— CryptoWolf (@IamCryptoWolf) February 3, 2020

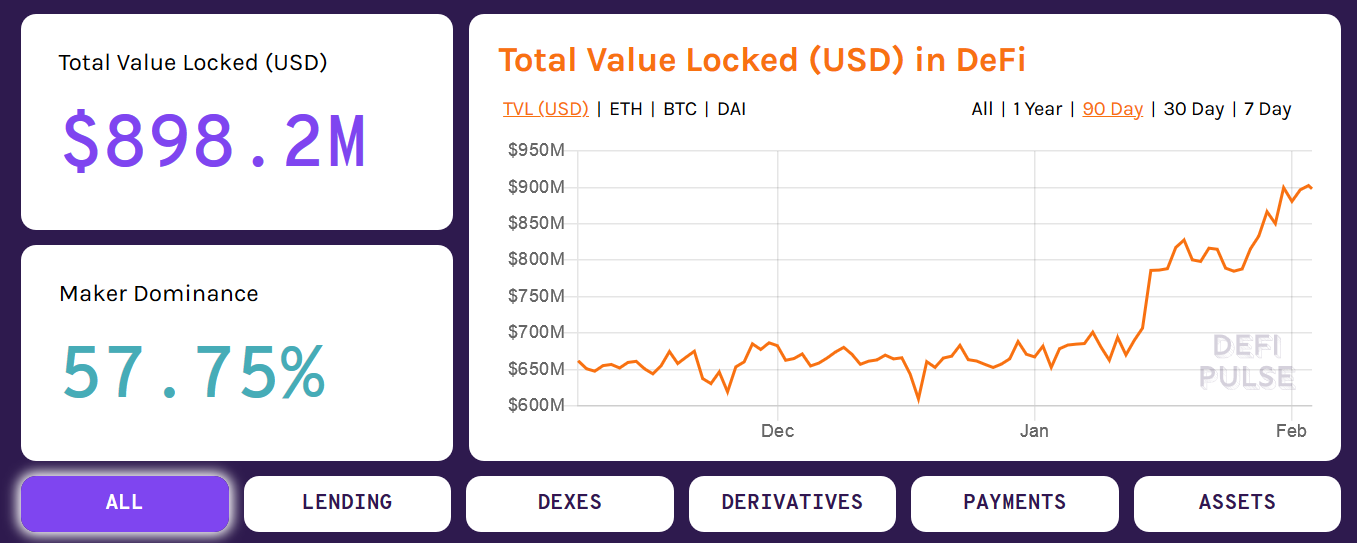

For example, the dollar amount locked up in DeFi reached an all-time high at the turn of the month. Currently, it’s hovering at just below $900 million. And $1 billion in the coming months seems highly feasible. Dollars locked in DeFi. (Source: defipulse.com)DeFi refers to the term decentralized finance, which is an open financial ecosystem to build financial tools and services in a decentralized manner.

Dollars locked in DeFi. (Source: defipulse.com)DeFi refers to the term decentralized finance, which is an open financial ecosystem to build financial tools and services in a decentralized manner.