Like a crashing wave, Bitcoin’s spot price has been on a downward motion over the past few days. While sellers are closing their positions, the low price of the crypto-asset has been quite inviting for many. On 26 February, Bitcoin was recuperating from the fall on 25 February, but as the buyers tried to stabilize the market, the sudden selling pressure contributed to a loss of almost 7% within three hours. This misstep by the king coin caused it to slump under $9k, a level that was once a strong psychological level. With the coin’s price recorded to be $8,823, at press time, it might have to cross this barrier once again.

Source: BTC/USD on TradingView

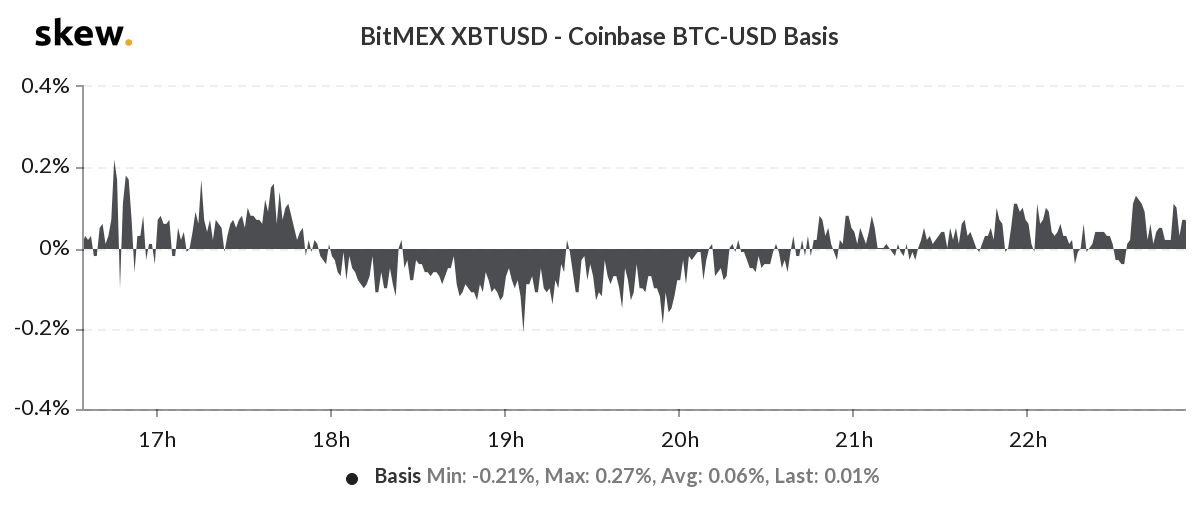

The sudden drop in Bitcoin’s price caused some variation in spot market trade as the selling pressure rose within three hours. According to data provided by analytics firm, Skew, the BitMEX XBTUSD – Coinbase BTC-USD Basis reflected continuous positive spikes, indicative of the extreme buying pressure in the market. However, the dump that followed later in the day was also reflected in the negative spike. As buyers stabilized the price of the coin, the sellers sold the asset, contributing to a negative spike and the escalated devaluation of Bitcoin.

Source: Skew

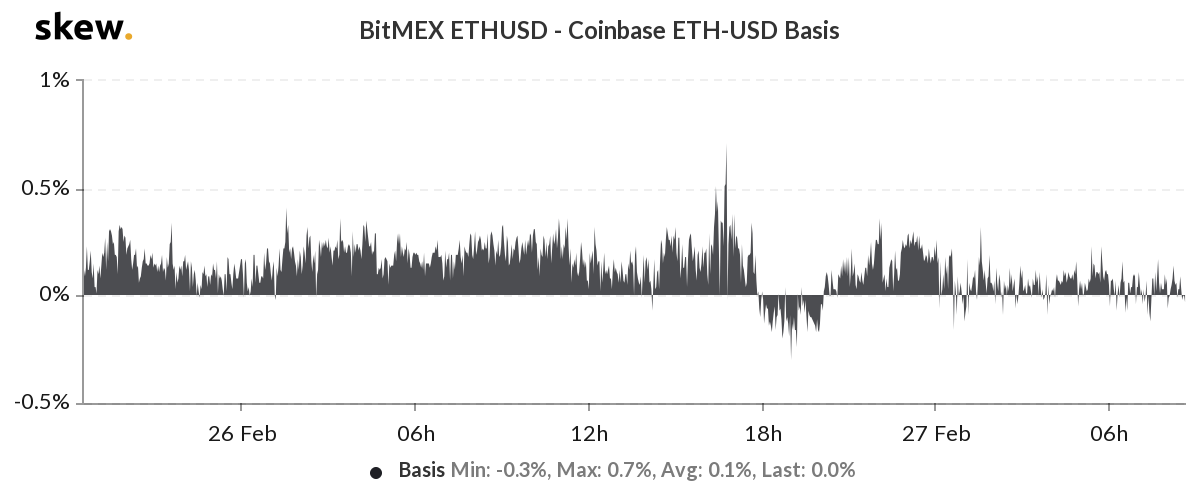

A similar trend was visible in the ETH market as the price of the coin followed Bitcoin’s lead and slumped. The price of Ethereum reflected a positive spike of 0.7% on 26 February at 16:45 PM UTC, with enormous buying pressure. However, the fall caused the price to slip and sellers to shed Ether. In what may be a sign of ETH returning to 2020’s bullish ways, at press time, the price of Ethereum was noted to climb by 5.66% and it was valued at $230.61.

In fact, even Bitcoin’s price has been seeing some positive movement over the past few hours. At press time, Bitcoin had climbed to $8,850.34, recording a growth rate of 1.73%.