Ethereum [ETH], like many other alts, has been under a lot of downward pressure in the market. However, unlike the world’s largest cryptocurrency, Bitcoin [BTC], the coin has been reporting 76.31% Year-to-Date return. Ethereum’s value at the beginning of the year was $133.24, but at press time, was being traded at $230.21. In fact, in the month of February, ETH has recorded a growth of 27.35%, despite a falling market lately.

Source: ETH/USD on Trading View

Traders generally try to diversify their portfolio in order to assess the risk and manage their investments. Apart from the general stock market, investments in certain crypto-assets have been beneficial for traders and one such asset has been Ethereum. According to its one-year Return on Investment [ROI], users who bought the coin a year ago would have been able to realize an RoI of approximately 2x.

ROI is the ratio or percentage value that indicates the profitability or efficiency of a certain investment or trade.

Source: Into The Cryptoverse

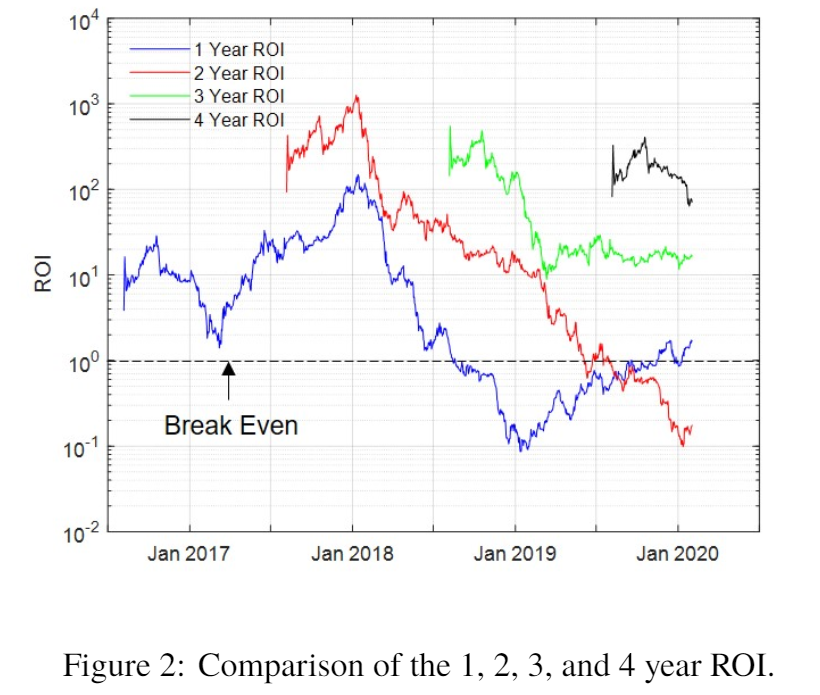

The peak of the 1-year ROI was 100x in January 2018, while the bottom was around 0.1, representing an annual loss of 90%. The chart only highlighted the ROI from buying and selling a specific time later and did not optimize on the exact timing. Similarly, when the 2-year ROI was considered, it was 1,000x on investment.

This meant that if the user had invested a sum of $1,000 in ETH 2 years ago, it would have translated into $1,000,000. The report elaborated,

“In fact, had you bought at the bottom and sold at the peak (instead of just selling exactly 2 years later), you could have made substantially more than this, which is truly impressive for an asset that did not even exist in 2014.”

Meanwhile, the 3-year ROI found lower support at 10 and has been hovering over this mark for the last year. Further, the 4-year ROI suggested a return of at least 50x, if the user had purchased ETH 4 years ago and hodled.

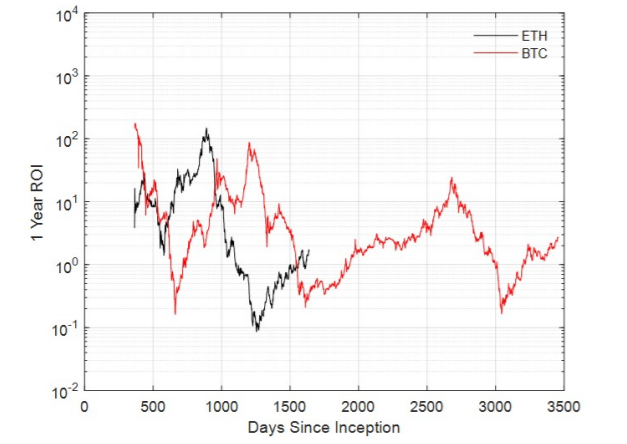

The top two crypto-assets, Bitcoin and Ethereum, reported almost similar ROIs over the past 1 year, despite there being differences in the date of their inception. The 1-year ROI for both peaked to nearly 100x and reported peak losses at around 80% for BTC, and 90% for ETH.

Source: Into The Cryptoverse

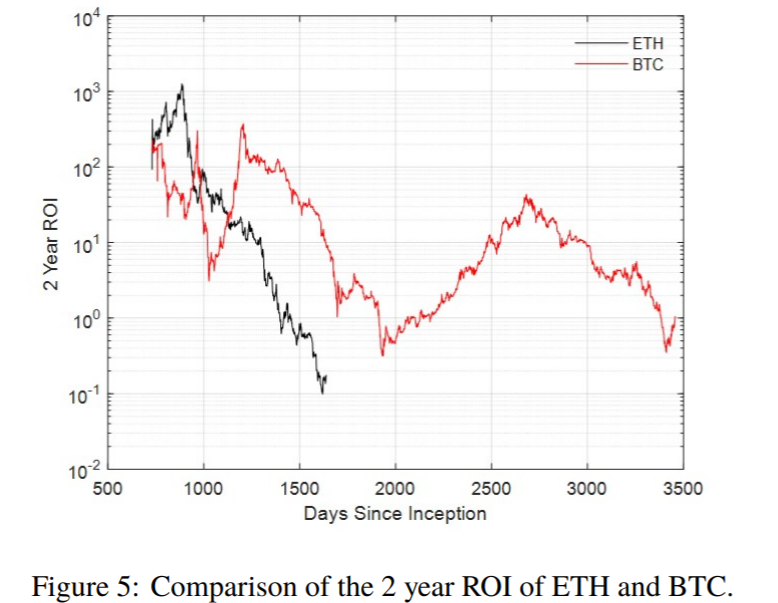

When the 2 year ROI for ETH was compared to that of BTC, the bottom for ETH was lower than BTC, with ETH reporting a 90% loss over a period of 2 years. The 2-year ROI peaked at around 1,000x for ETH, when compared to just about 400x for BTC.

Source: Into The Cryptoverse

The 2-year ROI for the second-largest asset bounced off of the 90% line and resumed its climb up, but has to reach the 100 to get back to par.