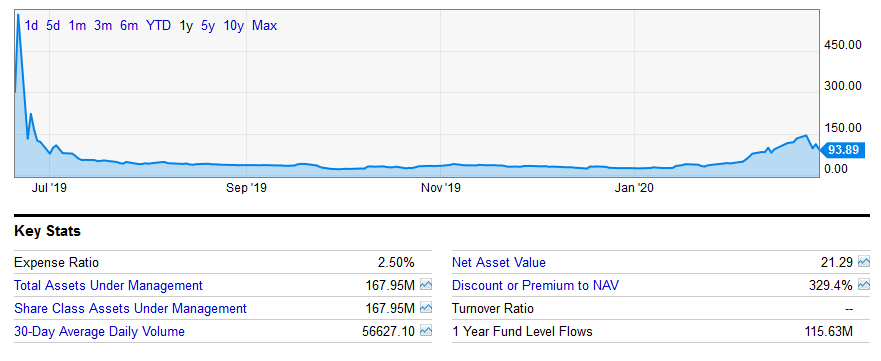

Grayscale’s Ethereum Trust [ETHE] made headlines on 27 February after its premium rates hit a high of 465 percent for the ETHE holdings worth only around $21.29 per share, at that time. As previously reported, many have speculated that a surge in premium could have been due to increasing institutional demand, in spite of the growing bearish trend. However, at press time, a more neutral reason can be identified as the reason for this spike.

As highlighted by Arcane Research, Grayscale‘s products including ETHE have a defined lock-up period structured in its working operations. A lock-up period is a window of time during which investors are not allowed to redeem or sell shares of a particular investment.

For hedge funds, the lock-up period is put in place to give investors time to exit investments that could be illiquid or which may shake the balance of their portfolios.

Hence, the spike in ETHE premium could have been due to the fact that due to structural limits, investors were not able to put out when ETH dipped by 14 percent on 26 February.

Arcane’s report suggested,

“This doesn’t mean that markets aren’t efficient in this situation, butcould mean that markets aren’t clearing (removing the premium) for specific reasons.”

The aforementioned argument can be validated by the fact that the premium dropped down to $93.89 at press time, within 24-hours of it registering a $112.19 premium. From 465 percent, the rate has slipped to 326 percent and many believe that the premium might falter even more after the locked-up period gets cleared up for other large portions of investments.

Source: ycharts.com

A rise in premium over the past week does indicate constructive participation from the institutional side, but the 465 percent premium spike may have been due to a lock-up period functionality.

Over the past day, total assets under management for ETHE have also dropped down to $167.96 million after registering a total AUM of $171.4 million on 27 February.

At press time, Ethereum had a total market cap of $25.06 billion, with a mere 0.86 percent positive return over the 24-hour period.

Source: Coinstats