As the cryptocurrency market crashed, flash loans on Aave Protocol helped some DeFi traders avoid liquidations worth 2,700 ETH, according to Emilio Frangella, a software engineer at Aave.

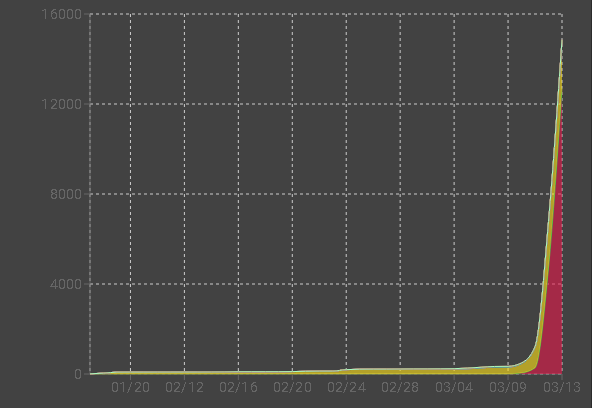

Flash loans on the platform surged from 6,786.02 ETH on Mar. 12 to 14,860.26 ETH at the time of press.

Flash Loans Surge as Markets Tank

Flash loans are smart contracts that allow users to take out uncollateralized crypto loans and then pay them back within the same Ethereum transaction. It offers borrowers access to massive amounts of liquidity.

After bZx was caught off guard by a sophisticated trader who leveraged a flash loan to take advantage of a hole in their mainnet, flash loans were questioned. Some believed it was a new primitive with legitimate use cases, others called it a tool for attackers.

Less than a month later, however, it has become evident that flash loans have utility and the bZx attack was the result of a flaw in the codebase. This is even clearer now that markets have tanked.

Aave has seen DAI flash loans increase from 304 ETH to 2,120 ETH in the last four days. ETH flash loans have surged ahead, with an increase from .08 ETH to 12,699 ETH over the same period.

Source: AaveWatch

While ETH flash loans are perhaps the result of more traders trying to salvage their positions on other platforms, the increase in DAI flash loans is because of DeFi Saver.

DeFi Saver introduced a feature to close a Maker Vault in a single transaction. This functionality is powered by flash loans. This feature lets anyone with an open loan on Maker to take out a flash loan of DAI, pay back their loan, withdraw ETH/BAT collateral, and use it to pay the loan. All of this in a single click.

For those without technical knowledge that cannot operate flash loans, this feature has been a lifesaver, helping many CDP and Vault owners avoid liquidation. Other DeFi protocols have also tapped flash loans for similar reasons.

Kollateral is a flash loan aggregator that pools liquidity from lending protocols that offer flash loans, such as Aave and dYdX. Just over $17 million worth of ETH flash loans is currently accessible through Kollateral.

This has utility for circumstances where a single flash loan pool doesn’t have enough capital to cater to a particular trader. There is the risk of these funds being used for a large attack against a protocol.

However, this is a risk that exists anyway as the trader could manually tap into each of the various avenues where flash loans are offered and simultaneously execute an attack.

Pooling flash loans in one place makes it easier to access the capital, for malicious players and gatekeepers of DeFi alike.

Though initially shunned by the community, flash loans have redeemed themselves by saving several borrowers from paying steep liquidation fees during tanking markets. This is the essence of innovation in DeFi: efficiency.