Several DeFi projects have fallen to some exploit since the beginning of 2020. But instead of casting the entire sector aside as broken, some investors say that despite these failures, DeFi survived.

And in a world full of shortsighted scammers and experiments, that’s very bullish.

Did DeFi Survive?

Headlines surrounding the crypto market crash have dominated the news cycle.

Analysts are working to identify where prices are headed next. Others, like MakerDAO, are still picking up the pieces. Amidst the chaos, the broader DeFi space faced its first real test.

Almost the entirety of the decentralized finance movement rests on the shoulders of the Ethereum network, warts and all.

The advantage of this blockchain has been its malleability. Developers of all stripes can pick up Solidity, the network’s programming language, to build smart contracts and reprogram large portions of traditional finance.

Unfortunately, when Ether’s price drops in any meaningful way, it can put projects leveraging the network’s infrastructure at risk. This was the case with MakerDAO.

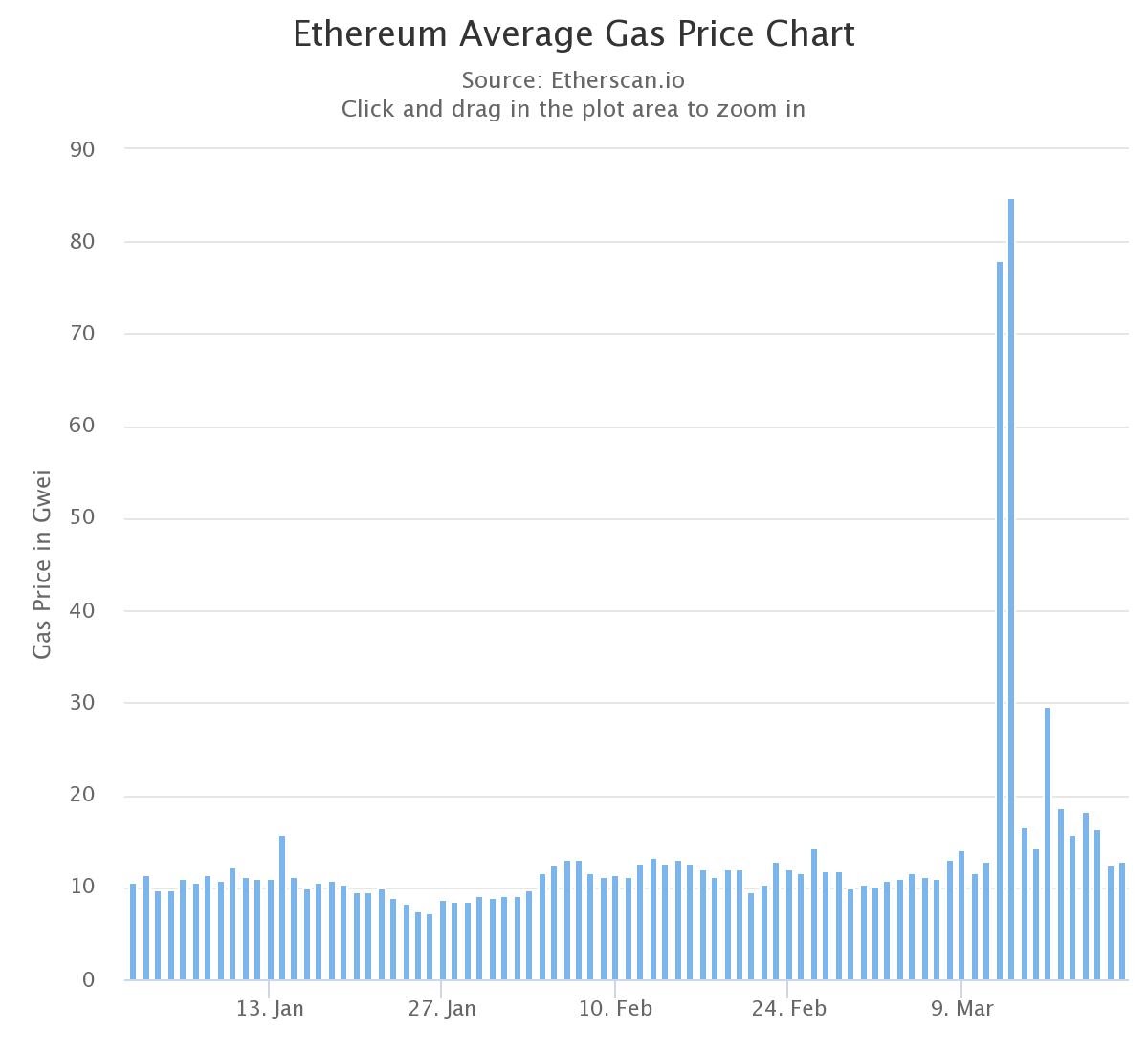

When the price of ETH crashed, holders simultaneously rushed for the exit. This spiked gas prices for transactions throughout the network. The high gas prices also exacerbated the speed at which transactions could be executed. This placed a lag on price oracles, including industry leaders Chainlink, as well as Maker’s oracle called the “Medianizer.”

Once these oracles updated, the reported price dropped by over 20% and liquidated many Maker vaults. The ETH released following these liquidations was then placed on auction, according to the Maker protocol. But, again, high gas prices prevented several auctioneers from buying up the ETH on offer.

One astute buyer raised their gas fee to an exorbitant sum, cut to the head of the auction queue, and effectively bought all $8 million worth of Ether for free.

The event is still playing out as Maker scrambles to salvage the protocol by all means necessary. Advocates have assembled a backstop syndicate to help replace Maker’s deficit, and the protocol has integrated USDC to improve liquidity.

Still, Maker is facing dire straits, which may spell the end for crypto’s only decentralized stablecoin, DAI. It’s not over yet, of course, and one say the protocol has survived.

But even before what commentators are now calling “Black Thursday,” DeFi faced a series of unforeseen risks.

For some investors, however, trying to assess these risks is all the fun.

Assessing Risk in Financial Experiments

Framework Ventures is emerging as the first DeFi-exclusive venture firm.

Outside of the few large VCs that bought up millions in Maker governance tokens (MKR), Framework appears to be taking a much more nuanced, and perhaps more risky approach.

“It’s sort of like a risk-related ‘whack-a-mole,’” co-founder Michael Anderson said in an interview with Crypto Briefing.

He’s referring specifically to investing in the untested waters that make up events like Maker’s. For those who have been following the space carefully, other similar events have popped up throughout 2020.

These have included large scale hacks on the bZx platform, liquidity manipulation on Synthetix, and the more complex iEarn attack. Critically, each of these events blurred the lines between coding failures and pure financial experimentation.

Many a developer responded in their post-mortems that they had not predicted such an outcome. Folks from traditional finance couldn’t believe such operations were possible in the first place.

When you can swing around millions of dollars (in a flash loan), the threat model changes.

It’s not normal to be able to move funds in a literal instant across lending, leverage, and exchange platforms (all in 1 transaction). https://t.co/9KsQswDfYp

— Simon de la Rouviere (@simondlr) February 15, 2020

It is at this frontier of experimentation, risk, and crypto that Framework Ventures is working.

Before Framework, Anderson worked in investment banking at Barclays Capital and has had his fair share of risk management experience. Alongside him is Vance Spencer, who helped Netflix with corporate development in Japan.

The two developed Hashletes, a successful blockchain-based NFT project that tokenized trading cards of American football players.

Since selling Hashletes, the two have made roughly 14 different crypto-related investments via Framework. The most notable, at least for the DeFi space, have been in Synthetix, Chainlink, and Edgeware.

Anderson explained that the synthetic asset model is particularly interesting insofar as it may soothe low-liquidity issues.

“Low liquidity is easy to manipulate,” said Anderson. “But it’s not necessarily a problem with the protocol. Just a feature.”

Still, finding projects that work around this “feature” is a high priority.

It’s in part why Framework is interested in initiatives like Loopring Exchange, a zkRollup-based decentralized exchange (DEX), and also Ren Protocol’s dark pools. For the uninitiated, dark pools are a common feature in finance, and they allow large orders to be placed without moving spot market prices.

Each of these offers some form of decentralized order-based trading that would effectively open up the DeFi space, according to Framework.

When it comes to making investments, Anderson said that the firm helps pre- and post-launch as well as growth once a project gets off the ground. This could be in the way of tokens or equity. Through their sister company, Framework Labs, they offer staking services, OTC liquidity and help defend pegs, among other activities.

All in all, the firm is bullish when other, more traditional firms are still skittish about the potential for DeFi. And with so few peers working at the forefront of crypto experimentation, one can be sure the payouts will match the risk—assuming that the sector doesn’t blow up first.