Key Takeaways

- Nansen’s analysts have observed continued inflows into DeFi pools backed by robust development even after the market crashed in May.

- 1.2 million smart contracts were deployed on Ethereum in June following the recent crash, the highest in Ethereum’s history.

- Despite the threat of competitors and MEV, Nansen say that Ethereum is well poised to succeed.

Share this article

Crypto Briefing sits down with Ethereum analytics firm Nansen’s researchers to discuss the state of DeFi since the market-wide crash in May.

DeFi Yields Are Falling

Crypto is currently experiencing a positive rally, aiming for all-time highs reached during Q1 and early Q2 of this year. The explosion of the DeFi and NFT niches highlights the market’s eagerness to participate in the Ethereum ecosystem. One of the biggest driving forces behind DeFi’s growth has been yield farming, which exploded last year in what’s now referred to as “DeFi summer.” While DeFi has grown since then, Nansen analyst Young says that yield farming is “unique to DeFi and severely underrated by DeFi users.”

The recent bear trend in the market has differed from previous ones as crypto holders now have a way to put their assets to work. The negative price action in volatile assets has driven many more risk-averse farmers to stablecoin pools. Nansen researcher Yuffie says that data has pointed to “massive inflows into stablecoin pools on DEXs since May.” Curve Finance, one of Ethereum’s top decentralized exchanges that primarily focuses on dollar-pegged assets, has seen a $2 billion in total value locked since May. She adds:

“A flight to safety during a bear market, where we have seen heavy rotation into stablecoins as a safe haven asset (so-called “Pool 1” farms), combined with an overall drop in leverage (as evidenced by the decline in open interest) has led to downward pressure on DeFi yields.”

While the annual percentage returns on DeFi pools have subsided over the past few months, they typically remain higher than the savings rate offered by traditional banks, which are less than 1% worldwide. In comparison, the annual percentage returns for stablecoins on Yearn.Finance’s vaults range between 1% and 5%.

On the other hand, the market-wide correction has also motivated some DeFi users to take riskier bets on newer launches. There are abundant opportunities in the space for earning tokens in exchange for bootstrapping decentralized platforms. The popular Layer 2 derivatives platform dYdX, for example, recently announced its token launch six months after its mainnet launch. Yuffie says that other than yield farming, savvy DeFi users are “on the hunt for retrospective airdrops, especially for popular projects that are yet to issue a token.”

Despite the attractive rewards yield farming offers, there are risks that users need to be aware of. Lucrative annual returns incentivize users, but soon after the initial rewards drop, the token can plummet in value. Moreover, rug pulls—when project founders remove liquidity from a pool, leading to a token price crash—are common, particularly among pseudonymous founders.

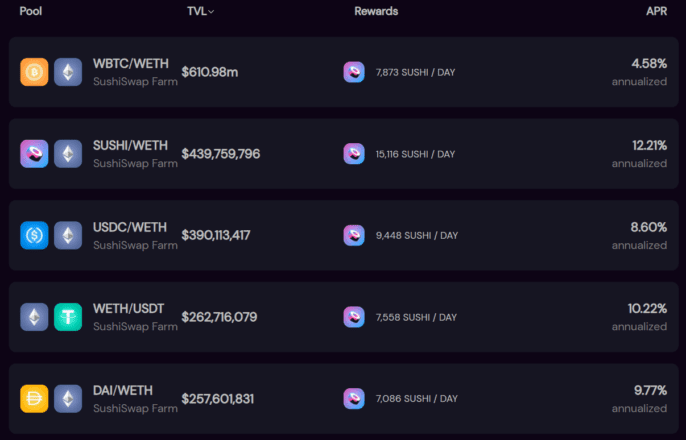

In recent months, the yields offered by so-called DeFi “blue chips” have reduced due to the saturation of liquidity pools and a drop in governance token prices. The top five farms by total value locked (TVL) on Sushi are currently earning 4% to 12% returns.

The yields were higher during the DeFi summer, and the higher token prices gave users sizeable rewards during the peak of the bull season. Moreover, the increased usage of top DeFi pools negatively impacted the returns. Young says that there are now “more inbound channels for capital outside of DeFi to flow into the ecosystem,” and that the decline in rewards is “an eventuality” of mass adoption. When a major exchange like Coinbase offers yield on tokens like USDC via Compound, for example, the rates are bound to fall further.

Development in the Ethereum Ecosystem

The negative trend in prices has barely affected Ethereum’s ecosystem growth. Young notes that around 1.2 million contracts were deployed in June, which is the highest level in Ethereum’s history. “If you take a look at our Ethereum and Polygon dashboard, you’d find that there are 20 to 50 token deployments on Ethereum a day,” he says.

Today, Ethereum is no longer dominated by wasteful gas guzzlers like the early NFT project CryptoKitties or scams like Forsage. Among the biggest gas spenders are centralized exchanges, decentralized exchanges, NFT marketplaces, and other DeFi applications (since EIP-1559 launched last week, OpenSea has burned the most gas, according to data from ultrasound.money).

The high demand for block space on Ethereum mainnet can make it expensive to use the network. Yuffie notes that almost all of Ethereum’s top 20 gas spenders are decentralized exchanges, stablecoins, and NFT games, and are “arguably participating in non-frivolous activities.”

According to Yuffie, the rise in popularity of EVM-compatible chains like Polygon and Binance Smart Chain suggests that “the masses were primarily concerned with the scalability aspect of things” rather than the applications. She adds that inflows to Polygon have remained high with on-chain activity rising despite the severe drawdown in the market in May.

The Future of Ethereum and its Competitors

Ethereum’s gas fees are lower today than in the first half of the year, down from an average above 150 gwei to around 50 gwei. Flashbots has been a major contributor to the drop, while Layer 2 solutions should further help reduce the cost of interacting with the network.

Binance Smart Chain and Polygon both have close to $50 billion in total value locked in their ecosystem today. The growth of Layer 2, meanwhile, has been slow. “Optimism has a working Uniswap V3 product and does less than 10,000 transactions a day,” Young says. Optimism is a Layer 2 scaling solution leveraging Optimistic Rollups. It’s due to launch in full this summer; many of Ethereum’s leading DeFi applications are expected to deploy their contracts on the network when it goes live.

“Bear in mind that solutions take time to scale their user base,” Young notes. “Polygon seems like a new, “out-of-the-blue” development, but its mainnet was in fact launched in May to June last year.”

When scaling solutions host token launches and liquidity pools offering attractive yield farming rewards, liquidity can start to flow to the networks, which explains why Polygon has succeeded this year.

Besides scalability, Ethereum faces another challenge in Maximal Extractable Value (MEV) attacks, where miners can reorder blocks on the chain to profit.

Miners and sandwich attackers often search for high-volume transactions in the Ethereum mempool before transactions are confirmed. They can front-run traders by paying higher fees or collude to accept transactions to a block ahead of the trader. Nansen research engineer Daniel Krupiza estimates that “around 85 sandwich attackers successfully prey on 2,000 DEX traders per day.”

He believes that adjusted trading patterns and the development of trading systems hardened against MEV, such as Balancer and Gnosis’ automated market maker CowSwap, are the only long-term solutions to these types of attacks.

Overall, though, Ethereum is in a strong position. Last week, Ethereum successfully launched its London hardfork, which included the crucial EIP-1559 proposal. The update introduces a gas fee burn with every Ethereum transaction and has acted as a positive market catalyst for ETH. The network will also merge to Proof-of-Stake sometime in the coming months.

Young believes that even the growth of so-called Ethereum killers like Solana and Avalanche is unlikely to have a significant impact on the ecosystem. Rather, he says, the leading smart contract blockchains “will most likely coexist.”

While Ethereum is still best known as the home of DeFi, NFTs are also acting as a bridge for onboarding new users and fresh liquidity. Yuffie predicts that many of these new users will eventually embrace DeFi. “In terms of how the masses will be boarded onto DeFi, if I were to make an educated guess, it would be via play-to-earn NFT games like Axie Infinity,” she says.

Share this article

Aave is Exploring Solana, Avalanche, Layer 2 Expansion

Aave founder Stani Kulechov revealed that the protocol was looking into expanding its markets beyond Ethereum and Polygon. Aave to Enable Cross-Chain Collateral Decentralized lending protocol Aave is working on…

Efficient Market Hypothesis: Does Crypto Follow?

The Efficient Market Hypothesis (EMH) is a concept in financial economics which states that security prices reflect all the available information about a financial instrument. EMH is one of the…

SushiSwap Says Optimism Showed Favoritism to Uniswap During Layer 2 La…

SushiSwap CTO Joseph Delong has accused Optimism, a Layer 2 scaling project, of giving preferential treatment to Uniswap. SushiSwap CTO Speaks Out Against Optimism Sushiswap and Uniswap are two of…

EIP-1559 and the Future of Ethereum with Justin Drake

Justin Drake talks ahead of Ethereum’s EIP-1559 update, shipping as part of the London hardfork. A Landmark Year for Ethereum Ethereum is going through big changes. The price of ETH…