Ethreum spot price was slashed by 7.53% due to a market-wide correction on 21 April. Due to intense selling pressure, ETH’s valuation fell from $180 to $167.

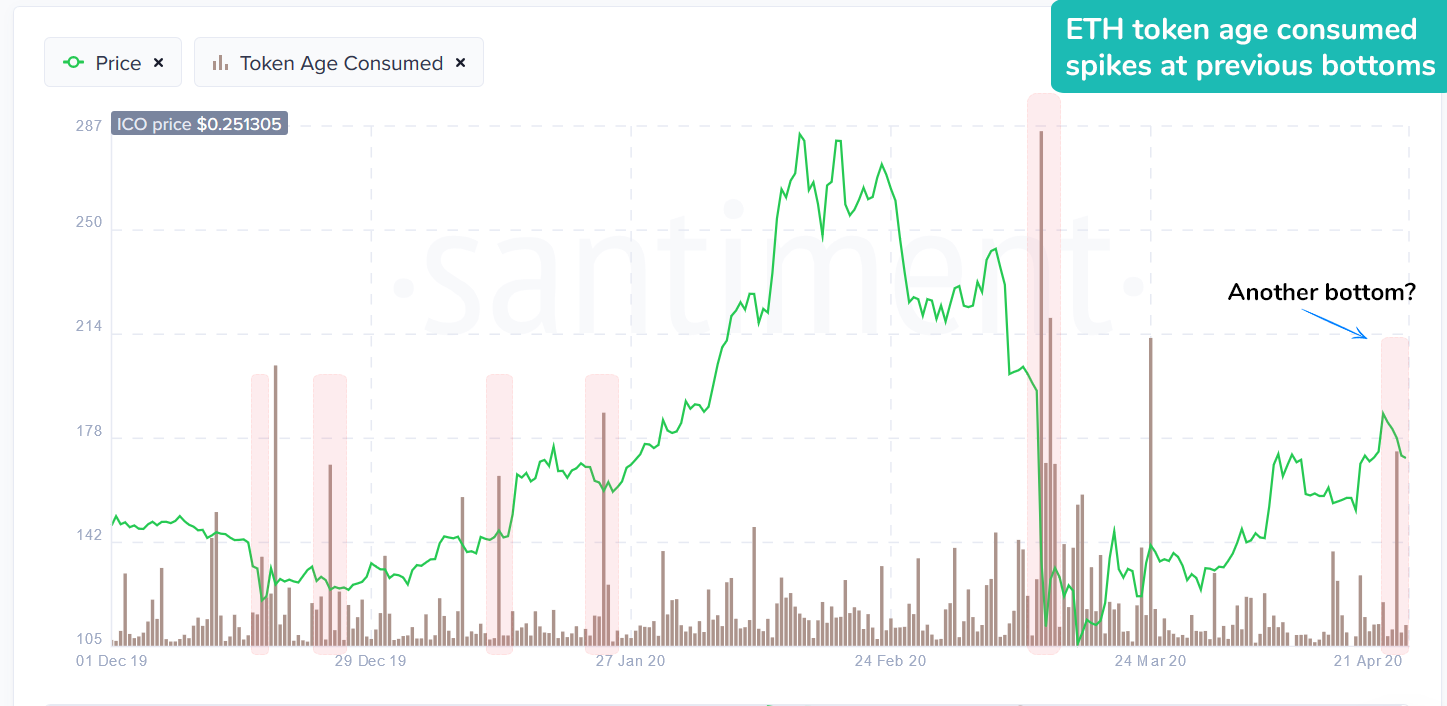

According to the insight provided by Santiment, the fall called attention to a great spike formed in ETH’s Token Age Consumed. The metric, Token Age Consume, indicates the number of tokens/coins changing addresses on a particular date, multiplied by the days since it last moved. In other words, it provides data on movement of dormant coins. For Ethereum, the great spike meant that a significant amount of previously dormant tokens/coins were moved either between exchanges or wallets.

Source: Santiment

According to the previous trends, such spikes have been preceded by a local bottom. Thus, ETH’s local bottom was formed before there was a movement of the dormant coins, which has been looked at as a positive sign which might have already resulted in some gains for the coin.

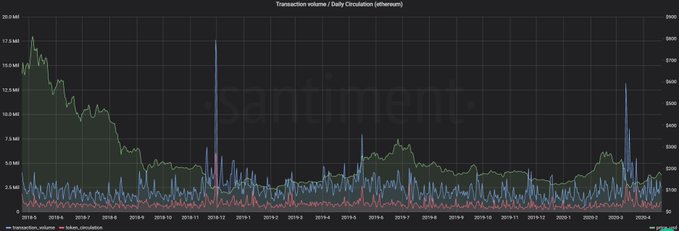

Source: Twitter

The spike often pointed at the short-term behavioral shifts among the market stakeholders. This short-term shift can be visible as the selling pressure converted into buying pressure in the market, at press time. ETH was surging by 2.77% and its value was restored to $175.81, at press time.

Ethereum’s price may notice a rising pressure from Buyers’ end, as the Ethereum 2.0 testnet has also been gaining support.

A similar trend was noted in the Bitcoin market earlier in April, when Santiment had pointed at the large Token Age Consumed spike. On 2 April, the spike preceded the surge in the BTC value from $6,200 to $6,700.