Ethereum’s price noted a significant boost in the market following its fall in March. As ETH set out on the path to recovery, the altcoin moved like a wave; however, at the time of writing, it was at a point of forming another trough, being traded at $211.09, while exhibiting falling volatility lately.

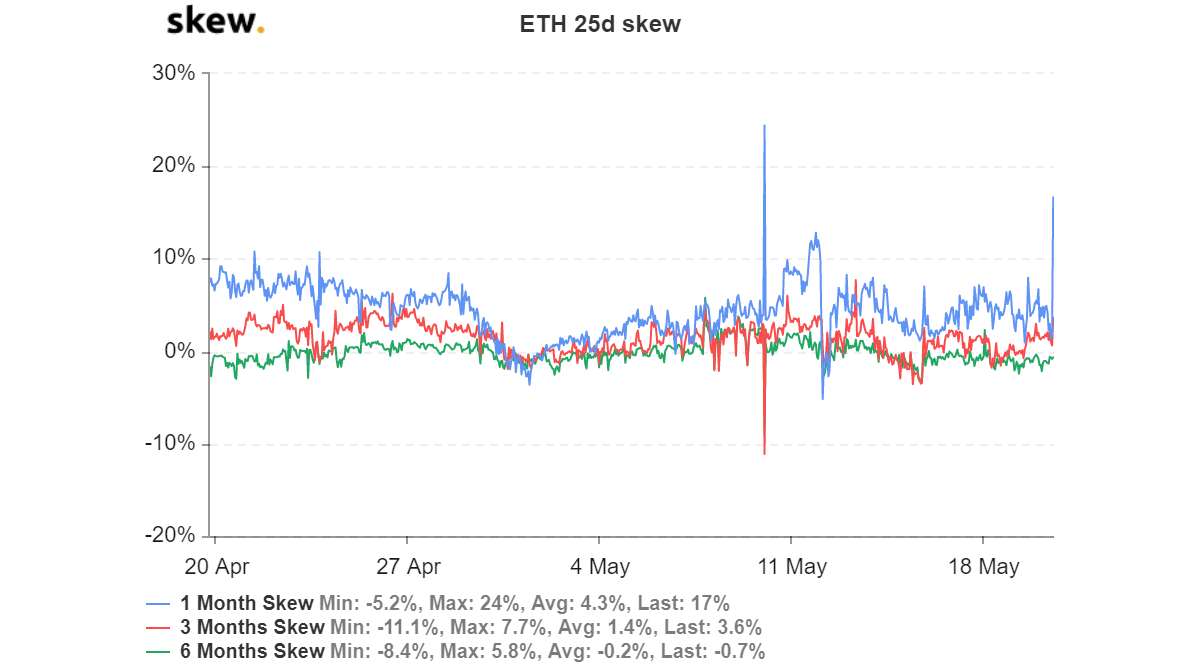

This low volatility gave rise to a positive volatility skew. The metric indicated that the Options contracts for the underlying asset, here Ethereum, with different strike prices, but which had the same expiration, will have different implied volatility. According to data provider Skew, ETH’s 25d skew in the short term [1-month] reported a sudden surge on 20 May, due to which the value which was resting at 1.9%, earlier in the day, went up to 21% within hours.

Such a drastic spike was last seen in March and early-May, both time periods when immense volatility hit the larger crypto-market.

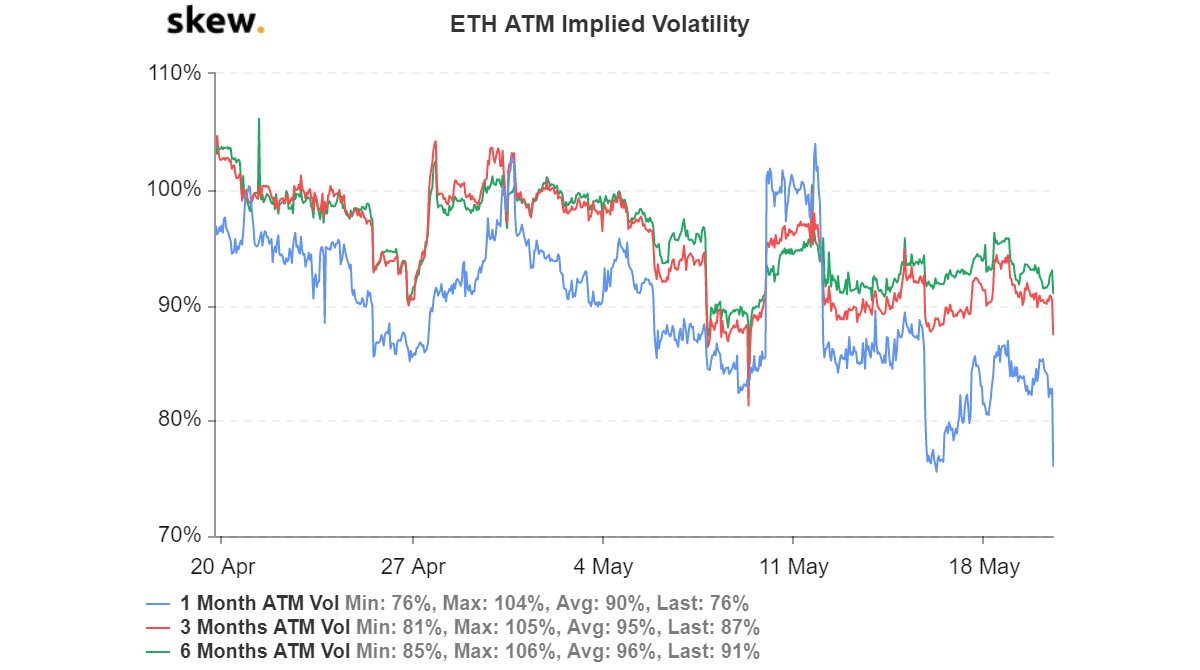

The ETH ATM Implied Volatility metric also noted a sharp decline. As the Skew spiked, the 1-month implied volatility at 82% dipped to as low as 73%.

Source: Skew

As the IV sank, traders were not expecting a high price swing in the ETH market. This sentiment, along with a rising skew, highlighted the growing interest of traders in Ethereum Options. Further, the realized volatility for the short-term [1 month] also fell from 84% to 77%.

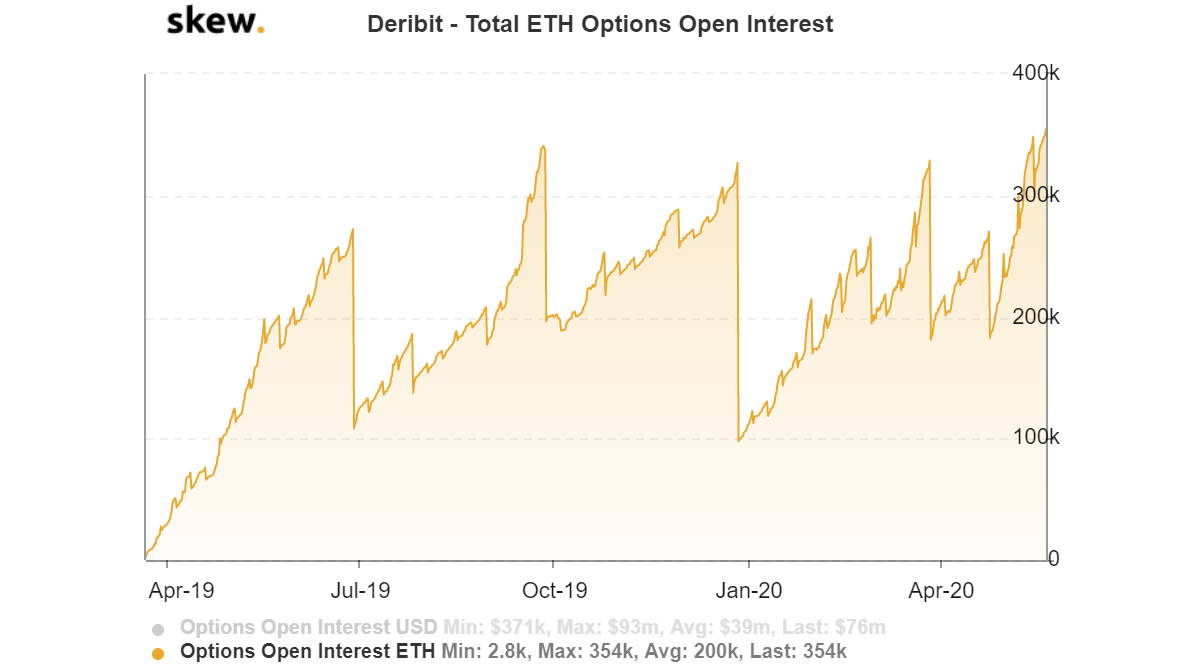

The aforementioned growing interest became evident on Deribit. One of the largest Ethereum Options exchanges, Deribit marked its all-time highs consecutively. On 20 May, the number of open positions on the exchange jumped from 346k to 371k.

Source: Skew

The options market has been noting a great influx from traders on Deribit as the exchange also saw its OI climbing to its all-time high of $1 billion in Bitcoin options.