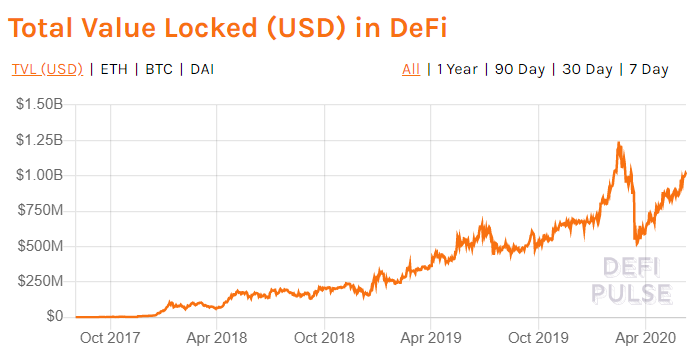

Decentralized financial markets (DeFi) have made a remarkable recovery since the mid-March COVID-19 crash. So much so, that the total locked value has again surpassed $1 billion.

The DeFi ecosystem took a big hit three months ago when the Ethereum price crashed by 50%, wiping out a considerable amount of locked-up crypto collateral. The all-time high for locked-up value in DeFi markets stood at $1.25 billion in mid-February 2020.

However, the amount of collateral in dollar terms plunged by some 58% from over a billion dollars to just above $500 million the following month.

Since then, the emerging market has made a solid recovery, and total value lockup (TVL) has topped the $1 billion milestone again, according to DeFi Pulse.

eToro’s Mati Greenspan was quick to acknowledge the achievement with the following tweet:

“Value in #DeFi smart contracts has returned to $1 billion.”

Ethereum provides the foundation for this new financial landscape, and its price recovery has been instrumental in the resurgence of DeFi.

Since the mid-March collapse, ETH prices have regained 133%. The world’s second-largest blockchain also recently recorded an impressive $500,000+ in single-day network fees, overtaking Bitcoin.

In terms of Ethereum lockup, there is currently 2.7 million ETH locked as collateral in DeFi – representing 2.43% of the entire supply of Ether.

DeFi provides a great way for investors to long ETH, in addition to taking out collateralized crypto loans.

The post DeFi Markets Back at $1 Billion in Total Value Lockup appeared first on BeInCrypto.