Key Takeaways

- DeFi tokens have performed extremely well in 2020, with LEND, BNT, LINK, and KNC leading the way.

- Balancer’s liquidity mining initiative proves that tokens are vital in creating incentives.

- Governance tokens will grow along with protocols, as they effectively control the direction the protocol takes.

- There are risks to using governance tokens to incentivize usage, as it could get concentrated in a few hands.

The DeFi news category was brought to you by Ampleforth, our preferred DeFi partner

Share this article

DeFi is booming as the niche’s top tokens outperform the crypto market. But as the sector’s total value grows, governance tokens, issued by the likes of Balancer and Compound, could become the latest trend in capturing DeFi’s expanding value.

Taking Aim at Bitcoin

The last few weeks have been immense for DeFi. After hitting $1 billion of locked value once again, top DeFi tokens gained tremendous value as buyers overran the markets.

Bitcoin may be stuck in a range, but DeFi traders had a glorious week.

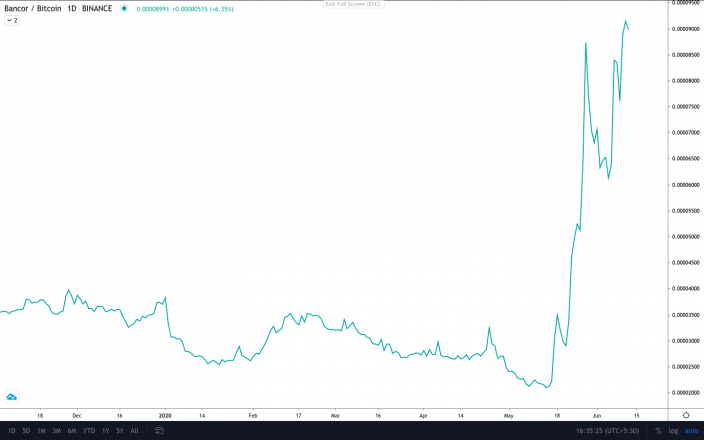

It began when Bancor announced a new upgrade to its protocol. In less than a month, BNT has outperformed BTC by 340%.

Then came the news that Kyber Network hadn’t just hit $1 billion of total volume since mainnet, but had almost doubled it’s 2019 volume of $388 million in the first five months of 2020. KNC outperformed BTC by 75% in June alone.

Aave hit $100 million of total liquidity and is quickly catching up on Compound. LEND, Aave’s native token, is up 80% against BTC in June and 780% in 2020 so far.

While these tokens stand out, most DeFi projects have witnessed resilient growth since Black Thursday, and their tokens have followed suit.

But there’s a new trend in DeFi, and astute investors are already taking notice.

DeFi’s Governance Token Model

Maker was the first DeFi protocol to launch a governance token. MKR was one of the first governance tokens in crypto.

MKR holders can vote on executive proposals on the MakerDAO. These proposals decide what the stability fee, DAI savings rate, and other financial levers in the Maker system should look like. Simply put, holding MKR gives one control over the direction the protocol takes.

For a deeper dive into Maker’s native token, readers are invited to read our free SIMETRI report on MKR.

Governance tokens are making a comeback with the likes of Compound, Balancer, and Curve Finance, all headed in the same direction.

Uniswap proved that a successful DeFi protocol doesn’t necessarily need a token. But Balancer’s announcement of allocating its native BAL token to liquidity providers – dubbed “liquidity mining” – was met with soaring demand.

A token may not be a necessity, but it helps the protocol in many ways.

Issuing tokens to active participants can work as an incentive to bootstrap liquidity early on. Synthetix made use of this incentive, as are Balancer and Compound.

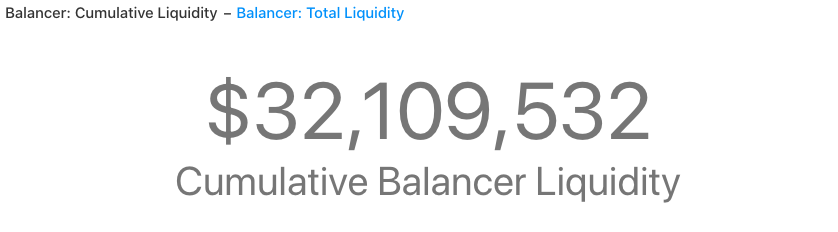

Ever since the announcement of liquidity mining hit the public, Balancer has been on a roll. Currently, it has more liquidity locked in it than Uniswap v2, albeit this liquidity is concentrated in a few assets rather than spread out like Uniswap’s.

Compound is taking a similar route, allocating COMP tokens based on one’s lending/borrowing activity on the protocol. Curve Finance doesn’t have a token yet but has confirmed it will soon launch a governance token to be allocated across its various liquidity providers.

This model serves a dual purpose: it helps build liquidity through incentives, and it distributes the token that controls the direction of the protocol.

Since governance tokens control the protocol, it makes sense for their value to rise in lockstep. These tokens could become a new way of betting on DeFi’s success, as they will appreciate alongside total value locked.

There are downsides to this model, however.

As seen with Balancer, the liquidity mining announcement brought whales into the mix. $15 million of Balancer’s $32 million of liquidity is just RPL – Rocketpool‘s token.

If a handful of whales provide 90% of a protocol’s liquidity, it will lead to the same situation as MKR, where over 90% of tokens are held by less than 1% of all MKR investors. And while this concentration of tokens isn’t a big deal for utility tokens, it can threaten the decentralization of a protocol with a governance token.