Key Takeaways

- Coinbase Pro revealed its preparing to list Compound on its retail platform on June 22.

- The announcement saw a significant number of investors buy COMP in anticipation of the listing.

- In the last few hours, this cryptocurrency surged over 200% and it may have more room to go up.

The DeFi news category was brought to you by Ampleforth, our preferred DeFi partner

Share this article

Algorithmic interest rate protocol Compound stole the spotlight in the cryptocurrency markets after Coinbase revealed it would list the token on its retail platform, with COMP prices doubling.

Coinbase Announces Support for Compound

Compound is a decentralized protocol that establishes money markets with algorithmically set interest rates based on supply and demand, according to its whitepaper. This feature allows users to exchange the time-value of their Ethereum assets frictionlessly.

The Compound protocol currently has nearly $400 million worth of digital assets earning interest across nine different markets. The vote of confidence that market participants have given this blockchain startup was significant enough for Coinbase to announce that it would add support for it.

In a recent blog post, the San Francisco-based cryptocurrency exchange revealed that starting on June 22, users will be able to transfer COMP to their respective Coinbase Pro accounts. Trading will begin the following day only if the “liquidity conditions are met.”

After the announcement was made, the price of Compound rose by over 200%. It went from trading at a low of $64 to reach a high of $134, based on data from Santiment.

Compound is the latest beneficiary of the well-known “Coinbase Effect.” This is a phenomenon where a token’s price skyrockets after being listed on the American exchange. Although Coinbase is not the biggest exchange in the market, its reputation and popularity play a vital role in the massive price jumps that cryptos go through when added to this platform.

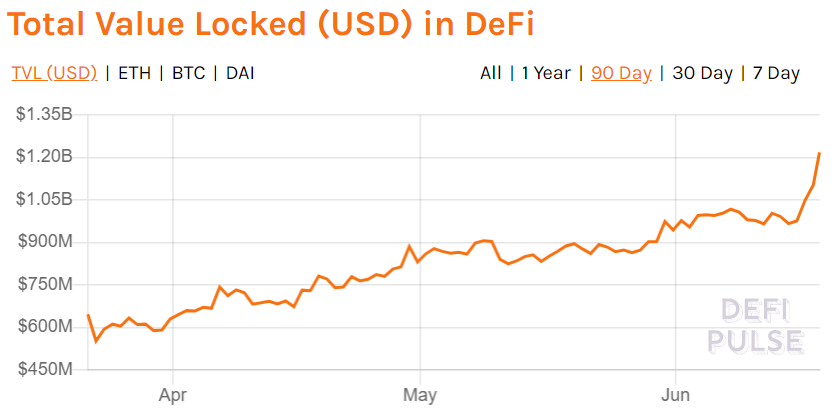

Beyond the apparent price impact, the DeFi market has seen a surge in interest as people rush to earn interest on the protocol.

Maker was another altcoin that was recently added to Coinbase. After the announcement was made, investors rushed to get a piece of MKR as its price doubled in a matter of weeks. But recently, the DeFi leader took a 40% nosedive as the hype around the listing faded.

With this in mind, market participants must implement a robust risk management strategy when trading COMP. Though the coin may have more room to go up, insiders who bought in earlier are likely to dump their holdings on the new surge of retail investors.