Key Takeaways

- Aave has skyrocketed nearly 1,100%, but a particular indicator suggests that it could be bound for a steep correction.

- Along the same lines, Ren appears to be forming a double top pattern, which is an extremely bearish sign.

- SwissBorg, however, is trading at new all-time highs with massive support underneath it.

The DeFi news category was brought to you by Ampleforth, our preferred DeFi partner

Share this article

The decentralized finance (DeFi) sector has stolen the crypto spotlight as of late. Tokens from Aave (LEND), Ren (REN), and SwissBorg (CHSB) are just a few that have skyrocketed in price. Still, technical indicators reveal that these DeFi tokens may be out of gas.

Aave Screams Sell After 1,100% Bull Rally

Aave has enjoyed an impressive bull rally since the beginning of the year.

As interest has shifted back towards the DeFi space, the buying pressure behind the decentralized peer-to-peer lending protocol has done nothing but shoot up.

Subsequently, the protocol’s token price has skyrocketed by nearly 1,100%, rising from a low of $0.015 to reach a high of $0.17 recently.

Despite increasing demand for this cryptocurrency, it seems to have reached an exhaustion point based on the TD sequential indicator. This technical index is currently presenting a sell signal on both the 3-day and 1-day chart. The bearish formations developed in the form of a green nine candlestick within both time frames.

An increase in the selling pressure behind LEND may help validate the pessimistic outlook. #

If this were to happen, the TD setup forecasts a one to four candlestick correction before this altcoin continues its uptrend.

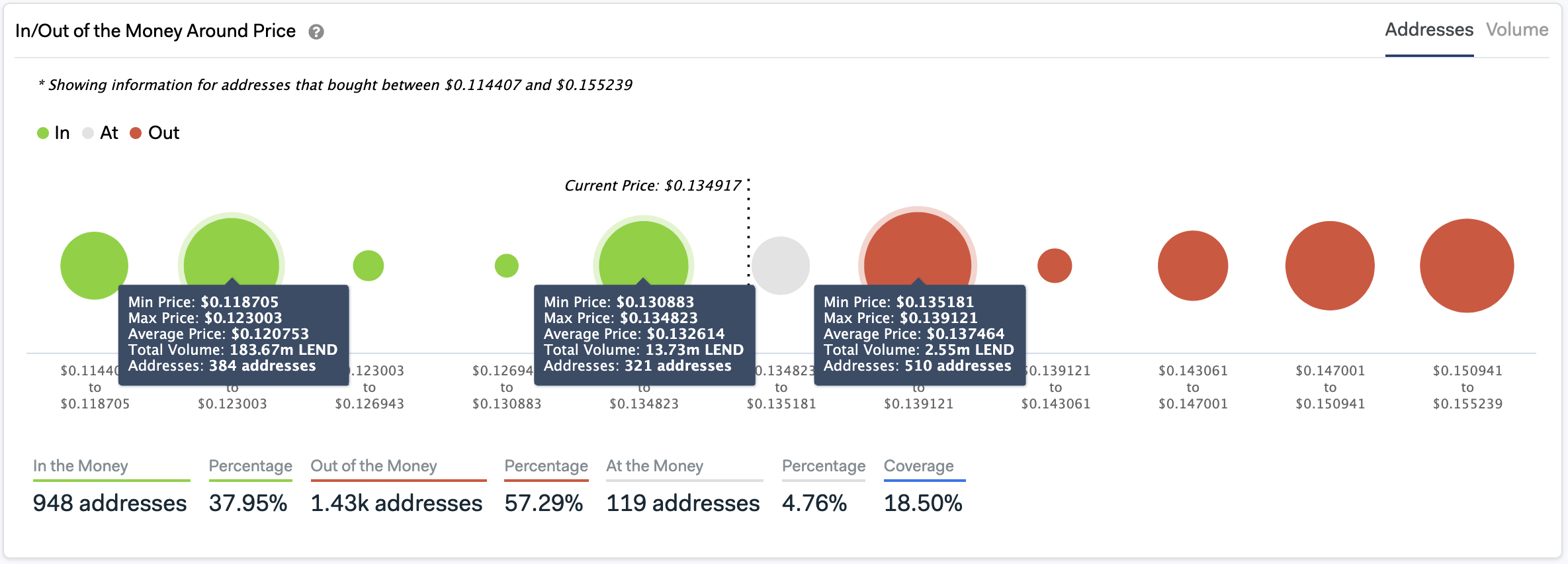

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model supports this bearish view as it indicates a significant supply barrier ahead of Aave. Indeed, roughly 42,000 addresses had previously purchased 37.6 million LEND between $0.135 and $0.16.

This is a critical resistance level as several of these addresses will likely attempt to break-even on their positions, absorbing any upside pressure.

On the flip side, the IOMAP cohorts show that the most significant support level sits around $0.12.

Here, approximately 400 addresses had previously bought a total of 183.7 million LEND. This supply hurdle may have the ability to act as strong support.

Holders within this price range may try to remain profitable in their long positions. They may even buy more Lof this DeFi token to avoid prices from falling below this level.

120 Million Idle REN Are on the move

Following March’s market meltdown, Ren entered an uptrend that has seen its price rise over 500%.

The bullish momentum allowed it to nearly retest highs of $0.155 that it reached in August 2009. Now, it seems like this DeFi token is forming a double top pattern on its 1-week chart.

This technical formation is considered an extremely bearish reversal pattern, according to Investopedia.

While the second rounded top appears to be currently forming slightly below the first top, it suggests that the trend is getting exhausted, and there is a high probability of a sharp retracement.

Moreover, Santiment’s Token Age Consumed index recorded a substantial spike in idle REN tokens exchanging hands in the last few hours. This on-chain metric measures how many coins have recently moved between addresses, multiplied by the number of days since they last moved.

“Spikes in ‘Token Age Consumed’ can signal changes in the behavior of some long-term holders, and tend to precede increased volatility for the coin’s price action,” affirmed Santiment.

The last time a large number of old REN tokens changed hands was on June 19.

During that time, approximately 12 million idle REN moved between different addresses. Subsequently, the price of this cryptocurrency dropped by 13%.

Now that around 120 million idled REN tokens are on the move, history could repeat itself, suggesting a downward impulse on the horizon of this DeFi token.

Based on the Fibonacci retracement indicator, an increase in sell orders behind REN may see it fall towards the 23.6% or 38.2% Fib level.

These support zones for this DeFi token sit at $0.124 and $0.105, respectively.

Breaking above the recent high of $0.154, however, will jeopardize the bearish outlook. If this were to happen, REN’s price would likely explode and reach new all-time highs.

SwissBorg Hits New All-Time Highs

SwissBorg is currently trading at new all-time highs following the 1,760% price increase it has experienced since the beginning of 2020.

This is a clear sign of the excitement among market participants around DeFi projects. But, as a wise man once said, “everything that goes up must come down.”

Indeed, the TD sequential indicator has presented two sell signals over the past few days on CHSB’s 3-day chart. The bearish patterns developed in the form of a sequential 13 candlestick and green nine candlestick.

When combined, these bearish formations can be extremely effective at predicting market tops.

If they were to be validated by a spike in the selling pressure behind this DeFi token, it is reasonable to expect a one to four candlestick correction or the beginning of a new downward countdown.

Everything will depend on whether or not the bulls see the recent price action as a sign to take profits.

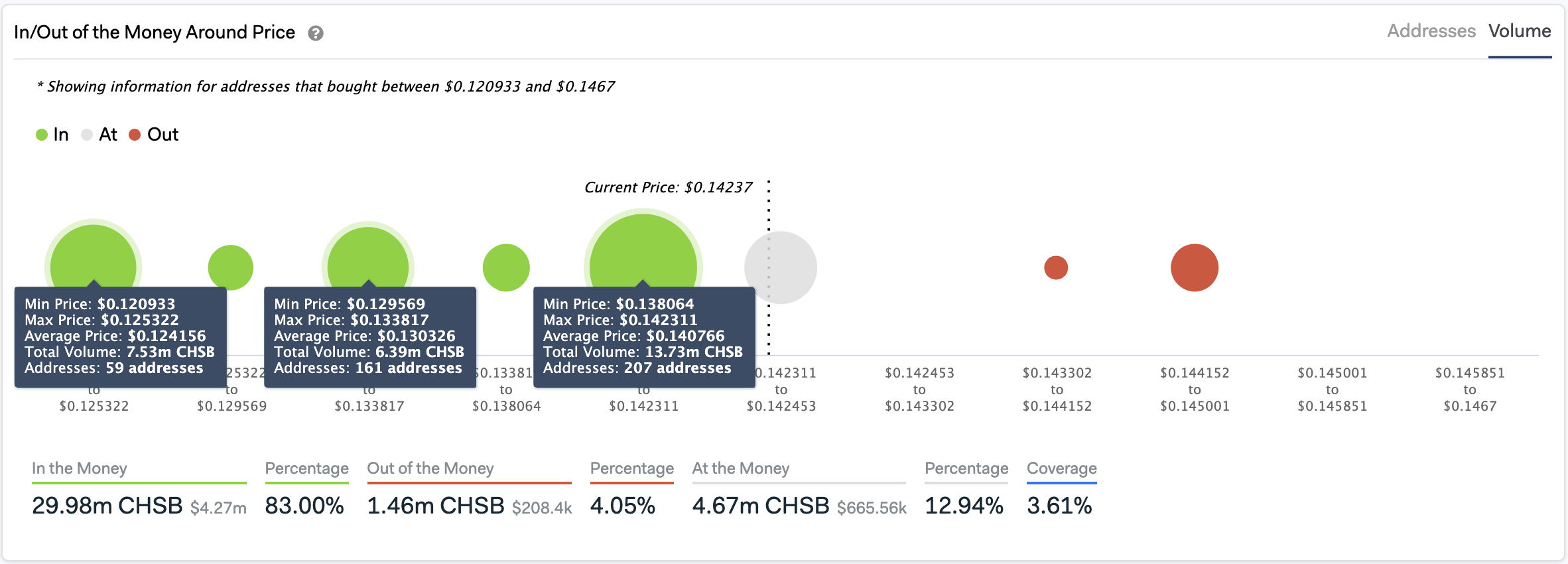

In the event of a correction, IntoTheBlock’s IOMAP model reveals that three critical support walls may prevent SwissBorg from a steeper decline.

The first and most significant support sits between $0.138 and $0.142. Between these price points, 207 addresses bought 13.73 million CHSB. Breaking below this supply barrier could see SwissBorg fall towards the next support level at $0.13.

Here, 161 addresses purchased a total of 6.4 million CHSB.

If these support barriers fail to hold, then the next level to watch sits between $0.12 and $0.125, where 59 addresses had previously bought 7.5 million CHSB.

It is worth noting that SwissBorg does not face any resistance ahead as its trading around new all-time highs. Therefore, if the buying pressure continues to accelerate, and this altcoin can move past the recent high of $0.174, it is reasonable to assume that it will advance further.

DeFi Runs on Ethereum

With all the hype going around DeFi, Skew believes that Ethereum will benefit the most in the long-term.

The crypto derivatives analytics firm maintains that the stablecoins and DeFi tokens running on top of Ethereum seem to have a “more sustainable” product and market fit than the ICOs of 2017.

Along the same lines, John Todaro, head of research at TradeBlock, said that Ethereum would eventually “hit escape velocity” as the popularity of DeFi platforms continues to increase.

“There’s a lot of excitement around new DeFi tokens. Reminder that most of that collateral locked up across those platforms is in Ethereum. As that outstanding Ether supply comes down and demand from DeFi platforms hits escape velocity, ETH will rally hard,” stated Todaro.

Although the uptrend of the different projects previously analyzed seem to approach an exhaustion point, a correction would likely allow sidelined investors to get back into the market.

An eventual influx of new capital into these DeFi projects will not only help them advance further but also increase the utility of Ethereum.