In brief:

- Bitcoin’s correlation with the S&P 500 is still very much intact as witnessed in yesterday’s dip.

- Ethereum is also highly correlated to BTC.

- Therefore, logic dictates that Ethereum is also highly correlated to the S&P 500.

- If ETH is a measure of the alt-market, then the entire alt-coin market is also correlated to the traditional stock market.

Bitcoin’s correlation with the traditional stock market has been the focus of many analysts with a majority picking the S&P 500 to demonstrate this fact. Yesterday’s dip by BTC once again reminded us that the future of the King of Crypto is firmly in the hands of institutional investors and the traditional stock market. The selling in the traditional markets was caused by an alarming increment of new cases of COVID19 and fears that a global second wave of the Coronavirus is very much a reality. These fears were organically transferred to the crypto markets as witnessed in the dip by Bitcoin (BTC) and Ethereum (ETH).

Ethereum is Correlated to Bitcoin and thus the S&P 500

As earlier mentioned, the majority of the correlation research between the crypto and the traditional markets is carried out by comparing Bitcoin to the S&P 500. This often leaves Ethereum investors with no other option than to opt to use this correlation indirectly since BTC pretty much dictates the direction of the crypto markets.

It is with this correlation between Ethereum and Bitcoin, that it can be concluded that ETH is also highly correlated to the S&P 500.

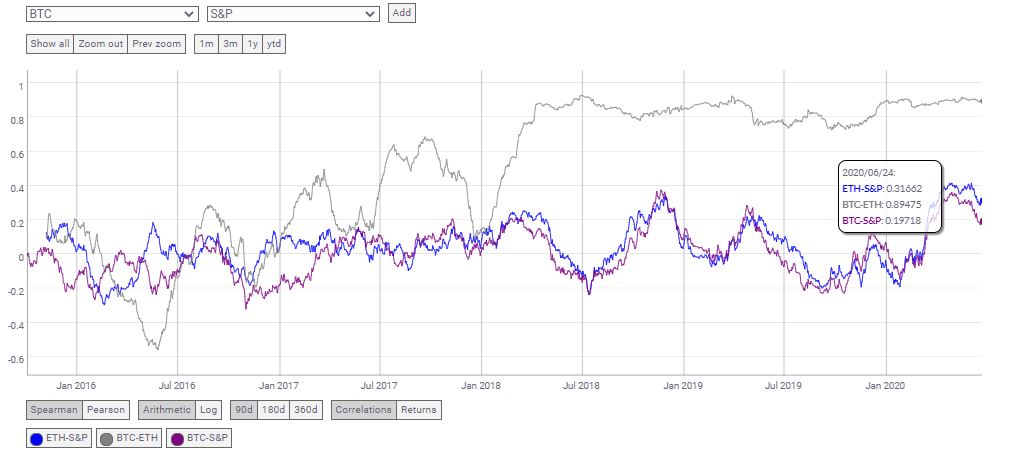

Exploring these correlations on Coinmetrics between the three pairs of Ethereum and Bitcoin, Bitcoin and the S&P 500, and Ethereum and S&P 500, results in the chart below.

Further dissecting the chart, the following observations can be made.

- Ethereum’s correlation with Bitcoin is high at approximately 0.89.

- Ethereum’s correlation to the S&P 500 mimics Bitcoin’s correlation with the S&P 500.

- The correlation between Ethereum and the S&P 500 (0.31) is higher than between Bitcoin and the S&P 500 (0.197).

Conclusion

Since the Coronavirus crash of mid-March, Bitcoin has been highly correlated to the S&P 500 and has been the focus of many analysts thus far. This is done under the assumption that BTC dictates the crypto markets. However, Ethereum’s correlation with the S&P 500 is also very much evident and could be a better measure of the overall health of the alt-coin markets rather than using BTC. The latter’s dominance in the crypto markets often fluctuates and Ethereum is a better measure of the overall health of the alt-coin market.

Only time will tell if Ethereum’s correlation with the traditional markets will become the focus of analysts and even result in ETH’s very own stock-to-flow model.