Key Takeaways

- Compound surged over 10% after integrating Curv, a crypto custodian focused on institutional investors. Compound will leverage the technology to help institutional clients earn rewards on their idled tokens.

- A crucial technical index estimates that COMP is poised to advance higher, despite the gains already posted.

- If demand continues to climb, the DeFi token could rise towards $175.

Share this article

DeFi protocol Compound looks to be preparing for a bullish breakout as its utility expands throughout the cryptocurrency industry.

Enterprises Use Compound to Earn Rewards

The autonomous interest rate protocol Compound continues demonstrating its utility by rewarding investors attractive returns for their crypto holdings.

Due to the of the protocol’s enduring success custody startup, the Compound team will integrate Curv, a crypto custodian focused on institutions. The move is set to provide institutional organizations with the ability to earn cash on their idled digital assets.

Curv’s list of clients includes exchanges, custodians, asset managers, and other organizations. This demographic will now be able to redeem assets securely through Curv’s wallet interface and API powered by the Compound protocol.

“[Curv’s] integration is an exciting advancement in expanding enterprise-grade access to and ownership of the Compound protocol,” said Robert Leshner, Founder and CEO of Compound.

The announcement seems to have brought back interest among market participants for COMP. The DeFi token has been in a downtrend since Jul. 5, which saw its price depreciate by more than 25%. But after the partnership news broke out, Compound jumped over 10%.

Now a popular technical indicator among crypto enthusiasts estimates that this altcoin is poised to advance further.

On the Vicinity of a Bullish Impulse

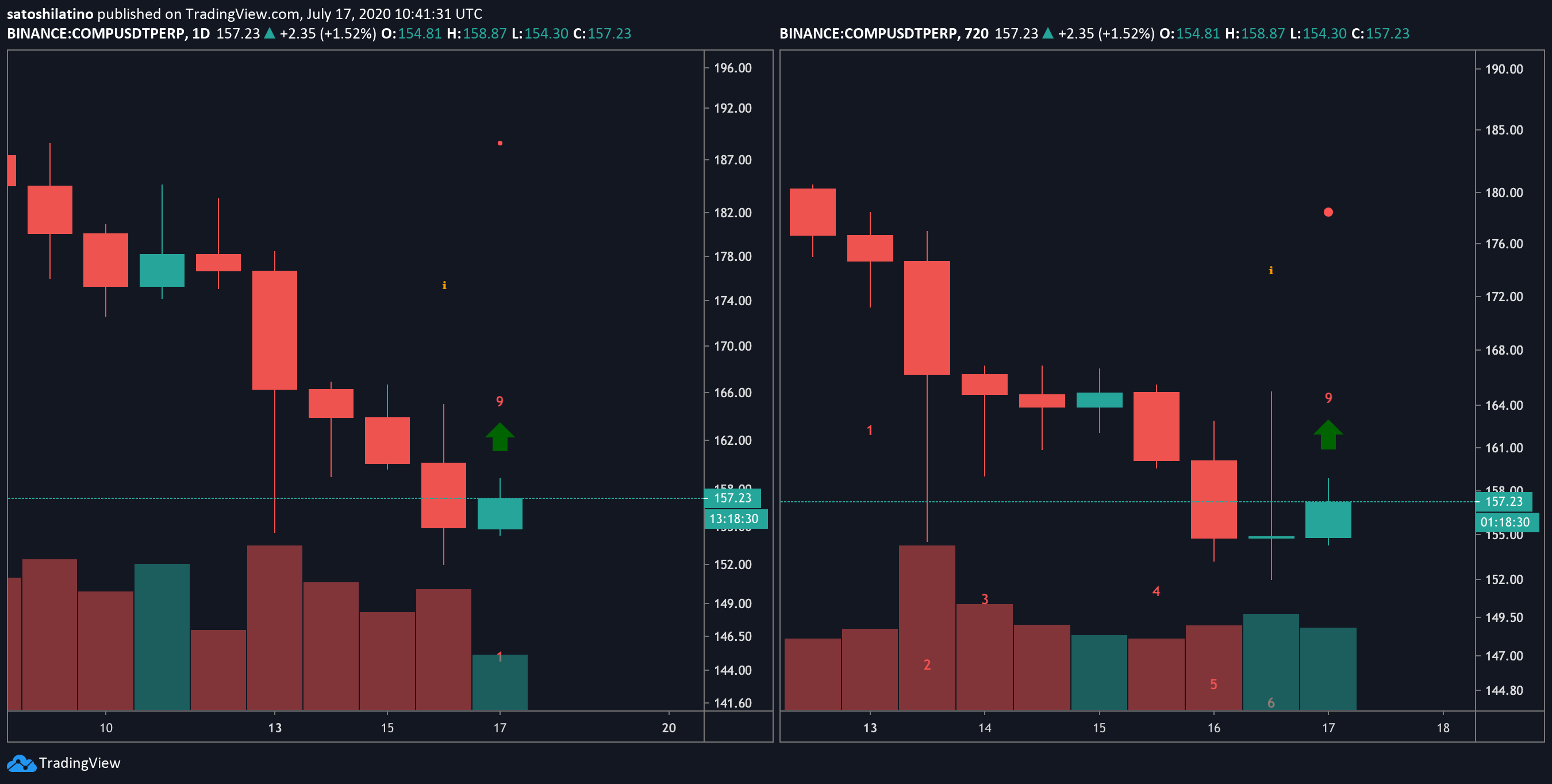

The Tom Demark (TD) Sequential indicator has proven to be essential in determining COMP’s price action.

A glimpse at the 10-minutes chart reveals that this technical index has been able to accurately anticipate when the DeFi altcoin is about to reach local tops and bottoms.

Currently, the TD index is presenting a buy signal on COMP’s 1-day and 12-hour charts. The bullish formations developed in the form of red nine candlesticks anticipating that this cryptocurrency is bound for an upswing.

Indeed, this technical index forecasts a one to four candlesticks upswing or the beginning of a new upward countdown.

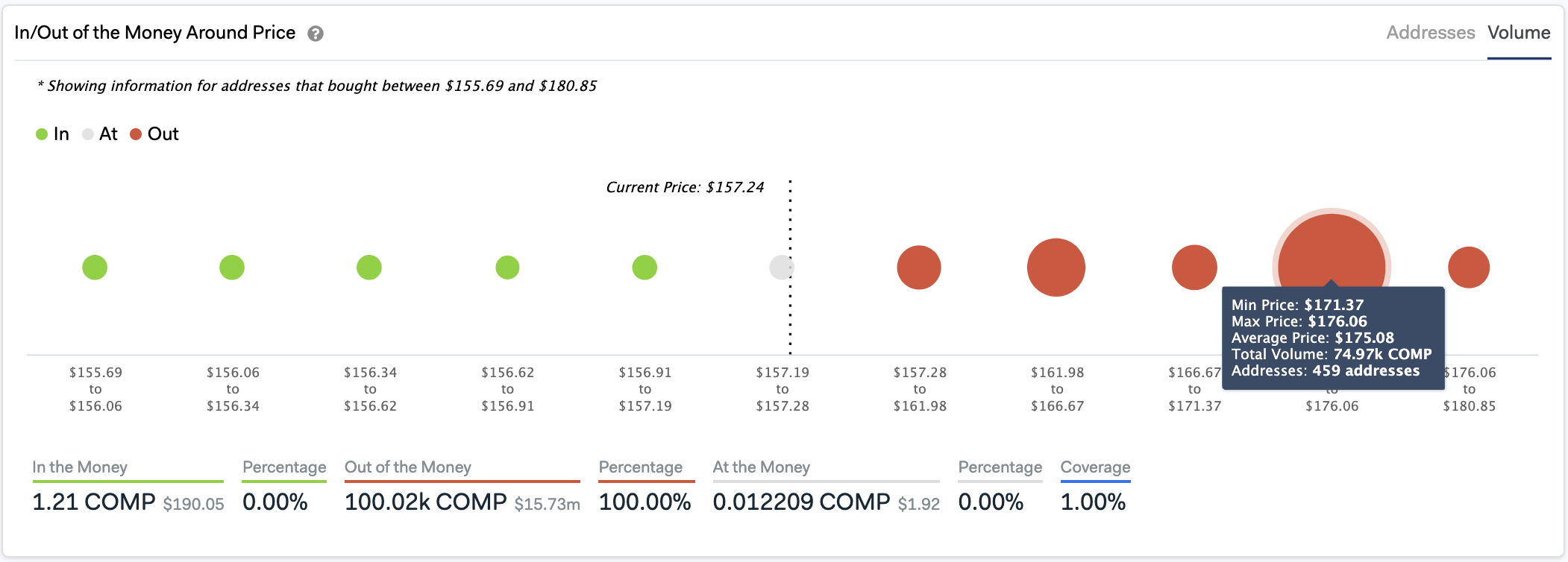

As Compound appears to be sitting in oversold territory, a spike in the buying pressure behind it may have the strength to validate the optimistic outlook. If this were to happen, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals there are no significant supply barriers that would prevent the DeFi token from rising towards $175.

Around this price level, however, Compound may find a strong supply wall. The IOMAP cohorts show that 459 addresses had previously purchased nearly 75,000 COMP tokens between $171.37 and $176.06.

It is worth noting that Compound sits on top of a fragile support barrier, and whales hold roughly 82.5% of all tokens. For this reason, investors must implement a robust risk management strategy when trading this cryptocurrency to avoid getting dumped on by large holders.