An independent research paper explores the in-depth economics behind Ethereum 2.0. The study hails from Tanner Hoban and Thomas Borgers, both members of the corporate development team at ConsenSys.

During the 100 pages of the report, the authors dissect the incentive model for the future Ethereum network. They also point out some potential security risks as the network makes the big switch from mining to staking. What are the potential risks of this transition? And how will it affect the cryptocurrency space?

The Long Hard Road To Serenity

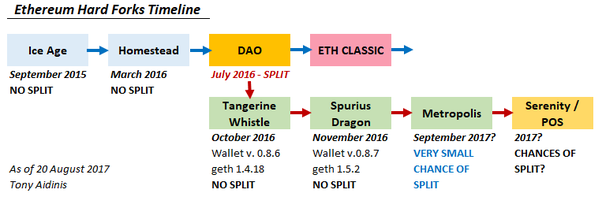

After years in the making, Ethereum 2.0 is still not here. The loudly-announced ‘Serenity’ transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) is taking some time to come to life.

Originally planned to start implementation as early as 2017, developers keep delaying the launch.

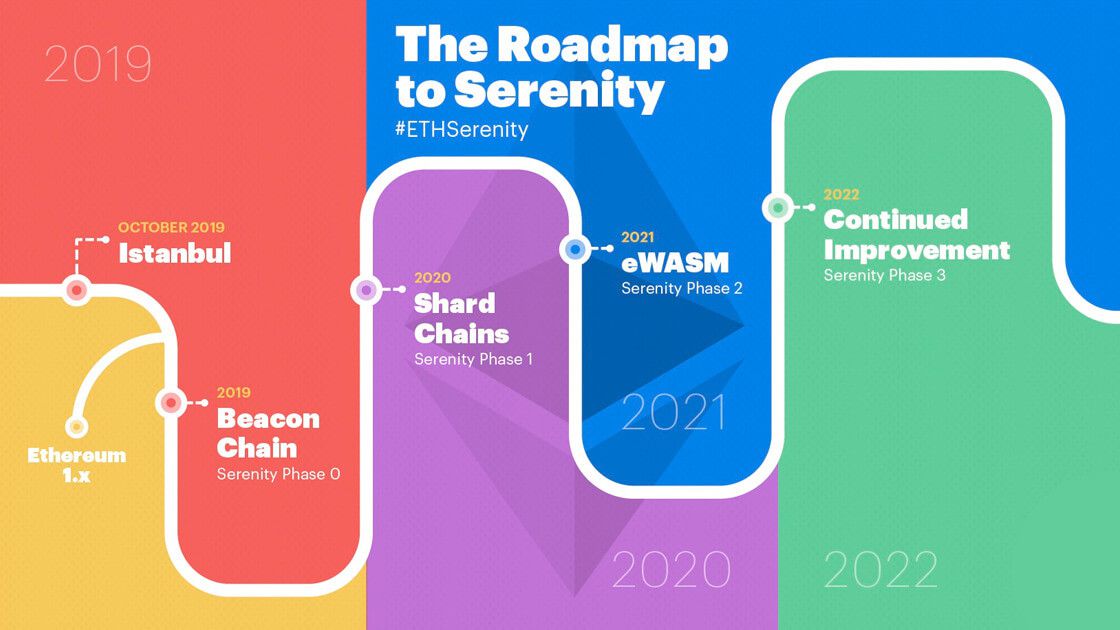

Developers likely underestimated the scope of the project back then. Serenity has been split into phases, and they are scheduled to occur during the next few years.

It’s not simply a matter of changing a few lines of code.

Serenity is a complete rebuilding of Ethereum, from the transaction validating system to the incentives for network validators. It will introduce the beacon and shard chains, enabling the processing of transactions in parallel.

It will also change the current Ethereum Virtual Machine (EVM) to the more advanced Ethereum Web Assembly Machine (eWASM). The current EVM can only process transactions in a sequential manner, whereas eWASM will be able to do so in parallel.

At the time of writing, Serenity is nowhere in sight, although there’s constant development in progress. According to the cited study, Phase 0 is scheduled for the second half of 2020.

Not surprisingly, some in the crypto community have been particularly critical of the constant delays due to high expectations.

The Economic Model Review

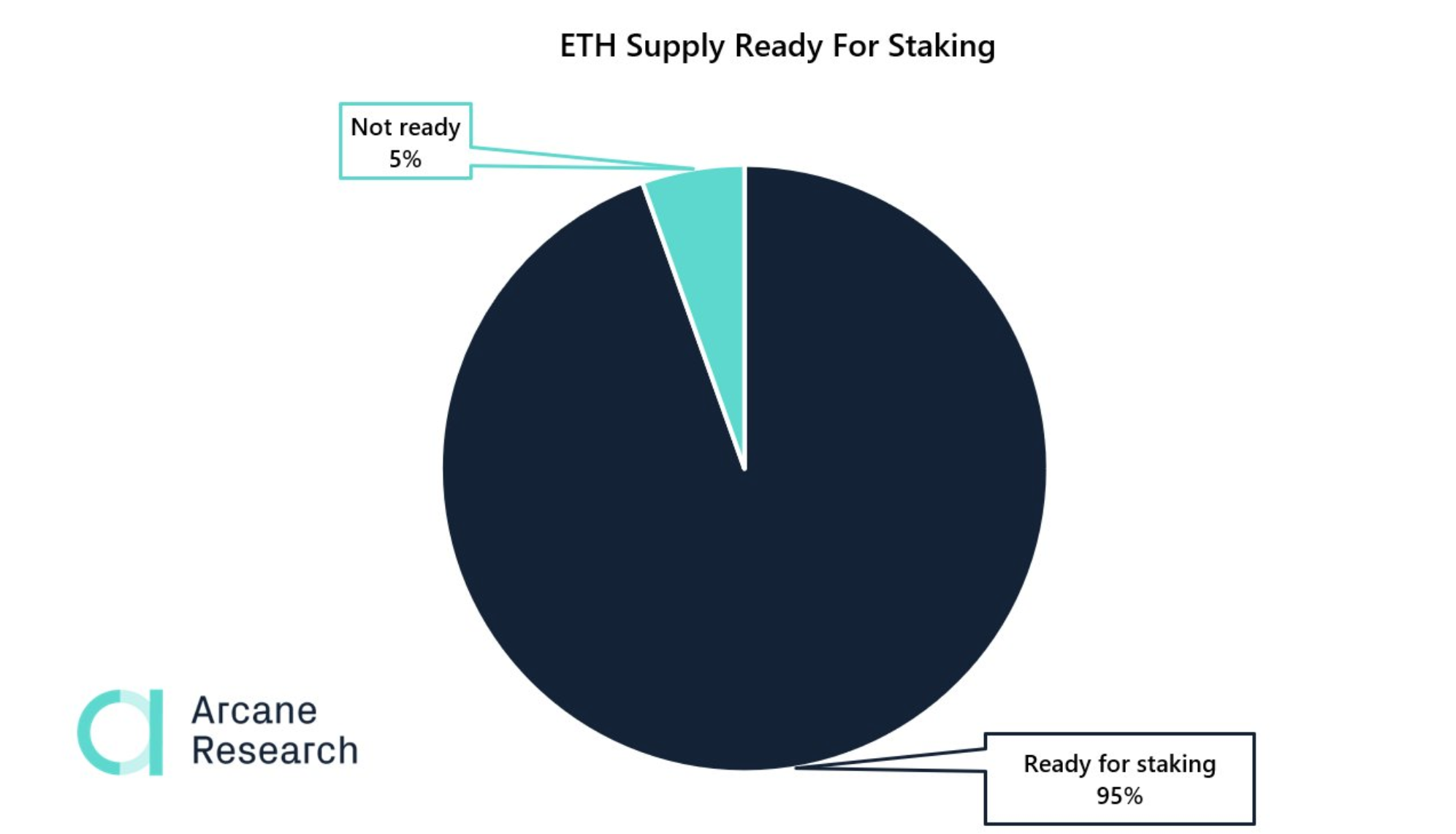

The study points out that the security of a PoS Ethereum network will depend upon the amount of ETH staked, the price of ETH, and its volatility.

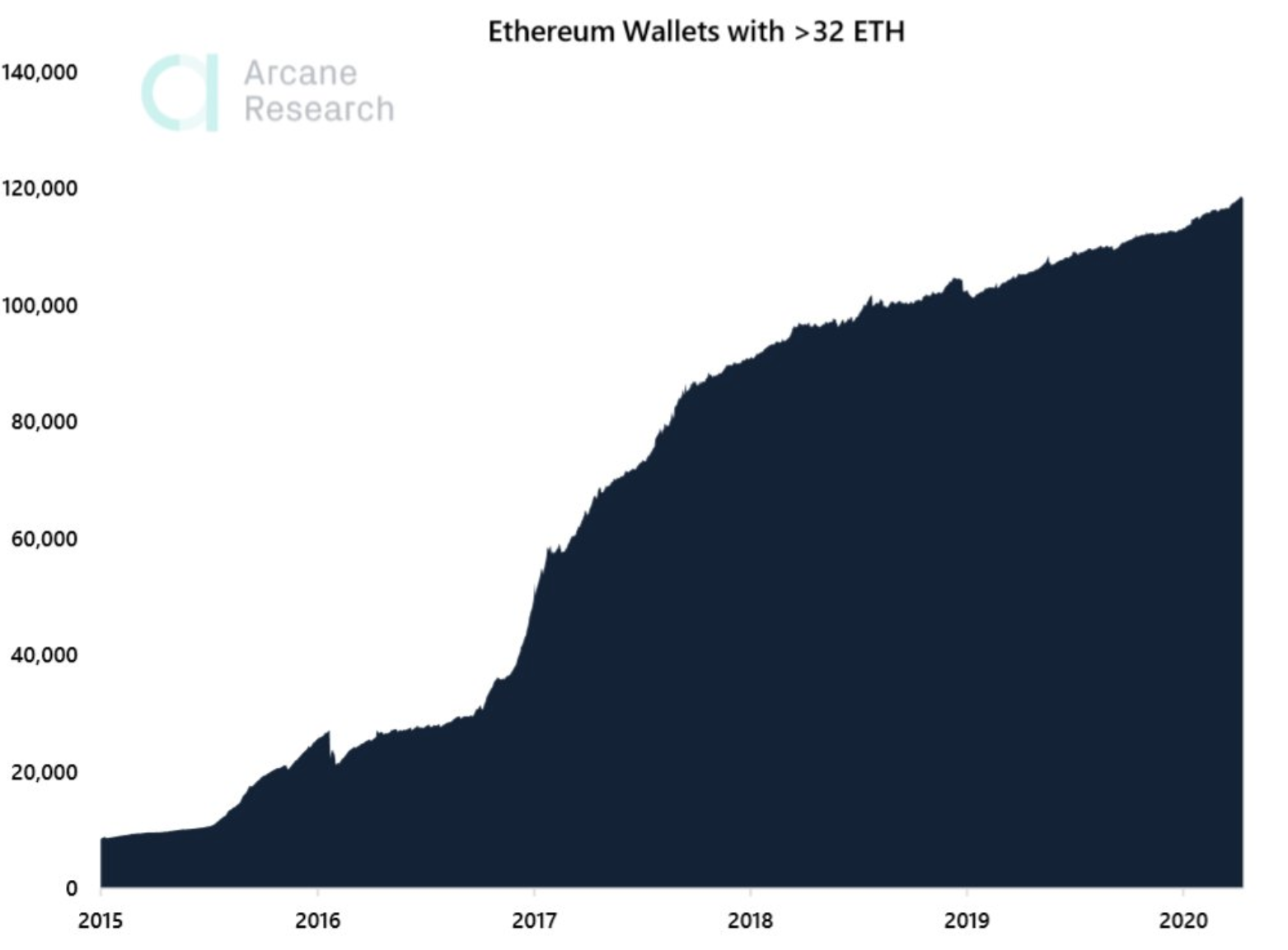

The minimum amount of Ether needed to become a validator is 32, which qualifies most of the current holders. At the time of writing, there are over 120,000 addresses holding 32 or more Ether.

The amount of ETH that can potentially be staked is the only variable under relative control of the network. The study explores a few models dealing with network security when prices go up or down. It also studies the implications of price volatility with regards to validator incentives.

At a time when crypto investors are looking for high yields on their digital assets, this is a notable concern for future investment in the evolving crypto-asset.

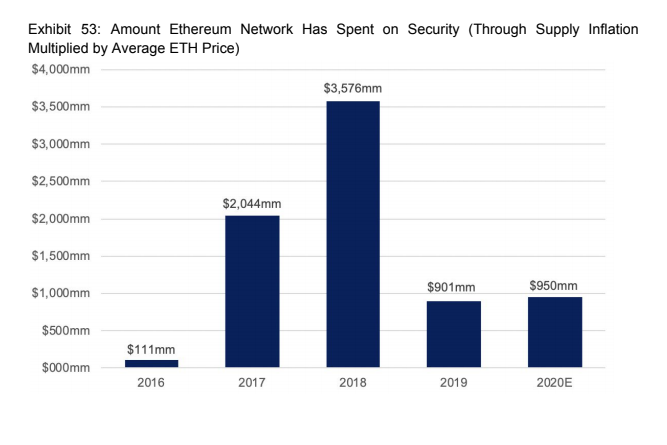

One of the upsides of Ethereum 2.0 is that its security will cost significantly less than Ethereum 1.0. Hoban and Borgers estimate network inflation of about 0.55% per year, compared to the current 4 – 4.5%.

At historical prices, targeting just 13.8% of ETH staked would match current levels of security. But it’s not all rainbows and unicorns.

Ethereum Security Concerns

There are two main concerns exposed in the study. One is that it will be relatively easier to scale an attack on Ethereum 2.0 than it is on the current network. This is a consequence of moving to a less-intensive validating system.

Proof-of-Work networks like Bitcoin or Ethereum 1.0 are secure because they are very resource-intensive. You need a lot of computing power to attack Bitcoin, and the ability to convince other nodes to join in on your attack.

With Proof-of-Stake, you ‘only’ need lots of money. Due to price volatility, there are risks from malicious actors manipulating prices in order to take over the network.

While this may be true for any PoS network, Ethereum 2.0 is particularly in the spotlight. Other projects rely on it and may have the clout to influence the price. This will be a challenge when the growing DeFi sector moves to Ethereum 2.0.

The study also mentions the risk of “derivatives attacks”. As reported by Borgers in this Medium article:

“The Ethereum ecosystem is rapidly evolving and so is Ether as an asset class, with options volume increasing and unique financial instruments like “flash loans” being used in malicious exploits. With this momentum, derivatives could become the favored avenue of attack for adversaries.”

Better Safe Than Sorry

Some investors, and speculators, argue that the continuous delays are damaging Ethereum’s reputation, as well as providing valuable time for competitors like EOS or Polkadot to grow. These dissident voices might be overlooking the gigantic size of the project, though.

After all, Ethereum’s original value proposition is to become “the world’s supercomputer”. The Serenity upgrade is arguably the most ambitious update in the history of cryptocurrency. There are literally hundreds of developers working on it.

Thousands of projects and billions of dollars depend on a better and safer Ethereum network. Addressing the concerns exposed in this economic model review is fundamental for Ethereum’s future.

If these issues require further delays in the Serenity timeline, that may be a fair price to pay. Maybe, just maybe, the whole of the crypto space depends upon on it.

The post More Delays Ahead? Ethereum 2.0 Economic Model Under Scrutiny appeared first on BeInCrypto.