Key Takeaways

- The debate around DeFi token valuations has crypto investors divided

- One indicator suggests that LEND is trading a premium because the market values Aave’s product innovation

- By the same metric of innovation, SNX is also currently undervalued

Share this article

Is DeFi a massive bubble or fairly valued? Two valuation methods can help provide some answers, showing why protocols like Aave and Synthetix trading at a premium relative to MakerDAO.

Valuing Tokens is an Art, Not a Science

Investors and analysts are conflicted about how to value DeFi projects. However, this hasn’t stopped them from running the numbers on a relative basis. Two valuation methods stand out—by balance sheet and total value locked, or by innovation and potential upside. Both valuation methods should be applied to all DeFi tokens on a relative basis.

In light of the recent DeFi capitalization boom, there a variety of contrasting opinions on whether DeFi is currently undervalued or overvalued. Some investors believe the smart move is to ride the momentum while it lasts. DeFi has hit an all-time high number of mentions in publications, becoming the fifth most mentioned crypto-related topic in June, said Joshua Frank of analytics service TheTie. But, investors are wary of parking their capital in assets that are already up hundreds of percentage points in just a short few months.

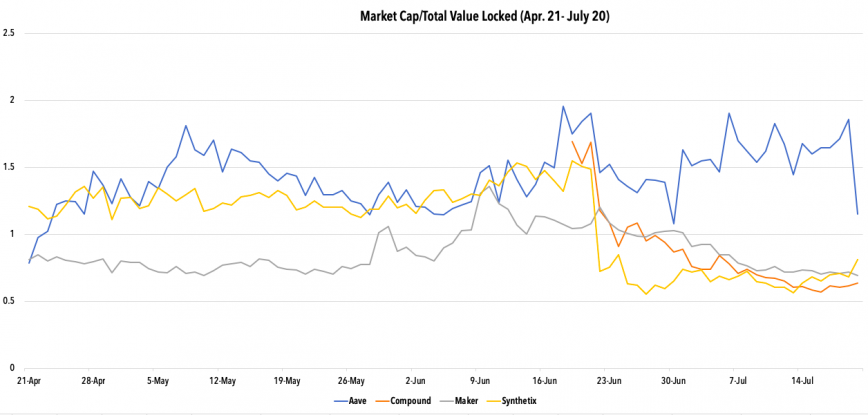

Crypto Briefing looks at Aave, Compound, Maker, and Synthetix from a fundamental viewpoint, evaluating them against each other with a rolling market cap/total value locked ratio.

Something to note is that total value locked (TVL) is not uniform across protocols. Compound’s TVL is a function of free collateral (total supply minus borrowing), while Synthetix’s TVL is the total value of SNX staked in the protocol. Nevertheless, it provides a broad overview of how the market values a token.

Evaluating the Top Four DeFi Tokens

From an innovation standpoint, Aave (LEND) and Synthetix (SNX) are certainly ahead of MakerDAO (MKR) and Compound (COMP). However, when it comes to the sheer size of assets on a protocol’s balance sheet, Maker and Compound stand out. But what does the market value more: a large balance sheet or innovation?

Looking at the market capitalization alone is not enough, because bigger balance sheets justify a higher absolute valuation. Dividing market capitalization by TVL helps adjust for this, as it shows how a token’s market cap moves alongside value locked in its protocol.

Maker and Compound have seen their ratios decline since Compound was launched. TVL for the Maker and Compound had some growth during this period. The ratio tanked as a result of poor token performance. After peaking above $400 in June, COMP has seen a strong downtrend, settling in between $150 and $180 for the better part of the last two weeks.

The ratio favors Aave, which has been on a roll recently with new features and booming token performance.

Aave, Compound, and Maker are all credit markets for DeFi, but Aave and Compound are in the same narrow category–DeFi money markets. But beyond liquidity mining, collateral on Aave can be put to more use. Flash loans, credit delegation, and the ability to take a loan against a wider variety of assets, including Uniswap LP shares, justifies the premium on LEND.

Synthetix’s ratio has been in decline since mid-June. It was around this time that Synthetix’s TVL started to increase rapidly, indicating that capital locked in Synthetix has grown much faster than its market cap. There are two ways to interpret this phenomenon. Either SNX is undervalued, or the market believes that SNX doesn’t capture as much of the upside on its protocol’s growth.

Given that Aave and Synthetix have both spent most of the last two months trading on a premium to Maker, it’s clear that the market puts a premium on innovation and functionality. Synthetix recently announced the first product to built on the protocol, with futures, limit orders, and margin trading set to go live in 2020. As a result, SNX trading at a similar ratio to COMP and MKR suggests it’s undervalued using the innovation framework.

Regardless of the boom in DeFi, it’s still very early. Compound, the hottest decentralized finance protocol of the quarter, still has fewer than 7,000 addresses belonging to COMP holders, according to eToro’s latest quarterly report. In all, even by generous estimates, analysts give the overall decentralized finance sector fewer than 25,000 monthly users.

Nevertheless, different valuation methods predict different token prices, and the upside is there if decentralized finance can break into the mainstream. Market cap/TVL ratio depicts a clear picture—investors are willing to pay more for a token that’s continuously shipping new features.

Disclosure: The author of this article is invested in some of the coins mentioned.