Key Takeaways

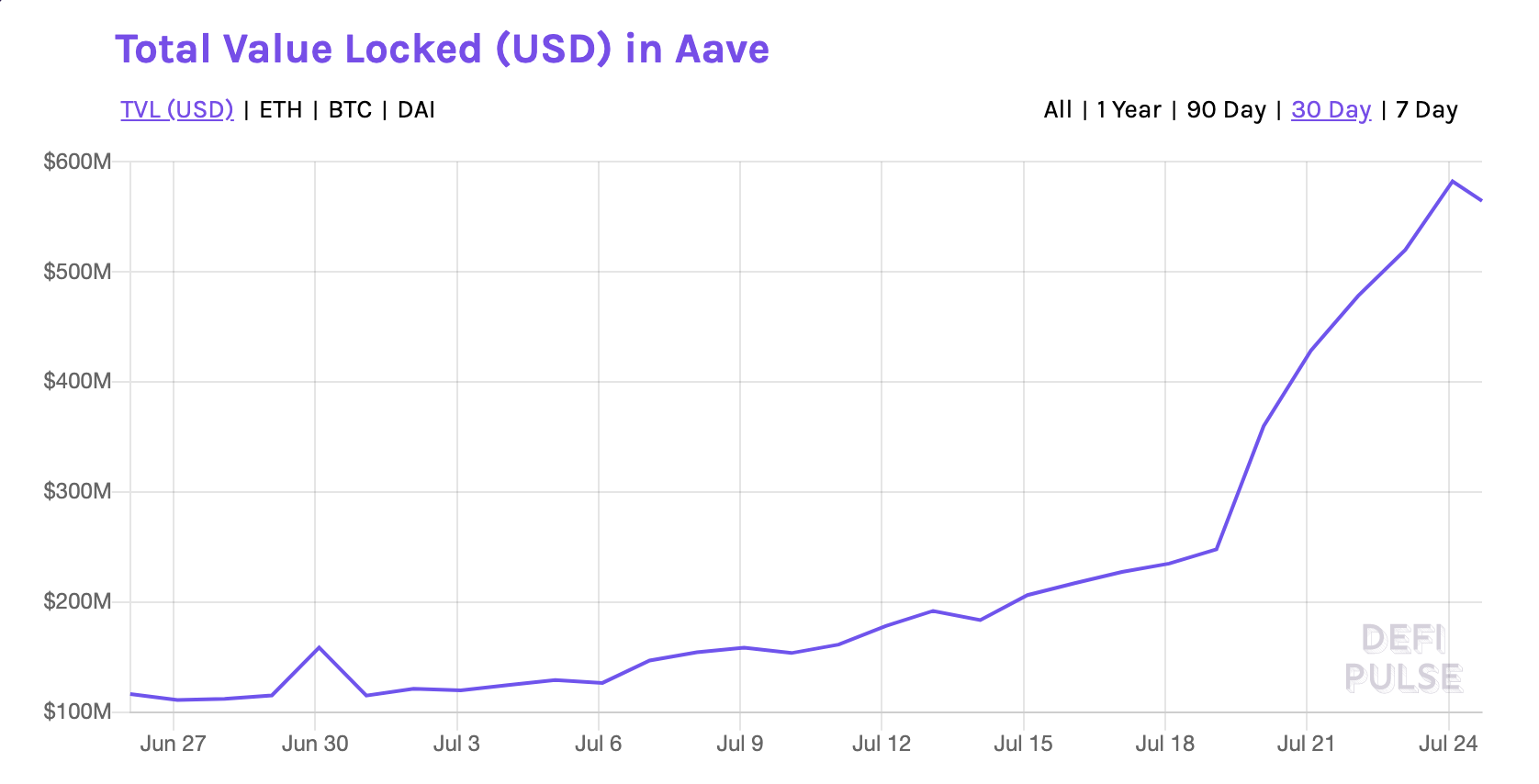

- The total value locked in Aave skyrocketed to a new all-time high of over $600 million

- LEND’s steady growth pushed it to the number two spot in DeFi Pulse’s protocol rankings

- If this trend continues, LEND’s price could follow despite stiff resistance at $0.30

Share this article

Aave is quickly capturing market share in DeFi as interest among investors continues to rise, helping LEND resume its bull rally.

Aave Takes the Lead in DeFi

Decentralized peer-to-peer lending protocol Aave continues to lead the charts in the DeFi market sector. Data from DeFi Pulse reveals that over the past week, LEND has been able to outperform some of the most popular DeFi tokens, such as Maker (MKR) and Compound (COMP).

Indeed, the total number of Ether locked within LEND’s protocol surged by more than 90% to nearly 60,000 ETH. Meanwhile, the total value locked (TVL) in this smart contract skyrocketed 150% to hit a new all-time high of more than $600 million.

The blitz in growth in TVL allowed Aave to momentarily take the second spot in DeFi Pulse’s DeFi protocol rankings. Compound has since reclaimed the second spot on DeFi Pulse’s list, but this doesn’t marginalize the bullish potential of Aave.

Prices Poised to Rebound

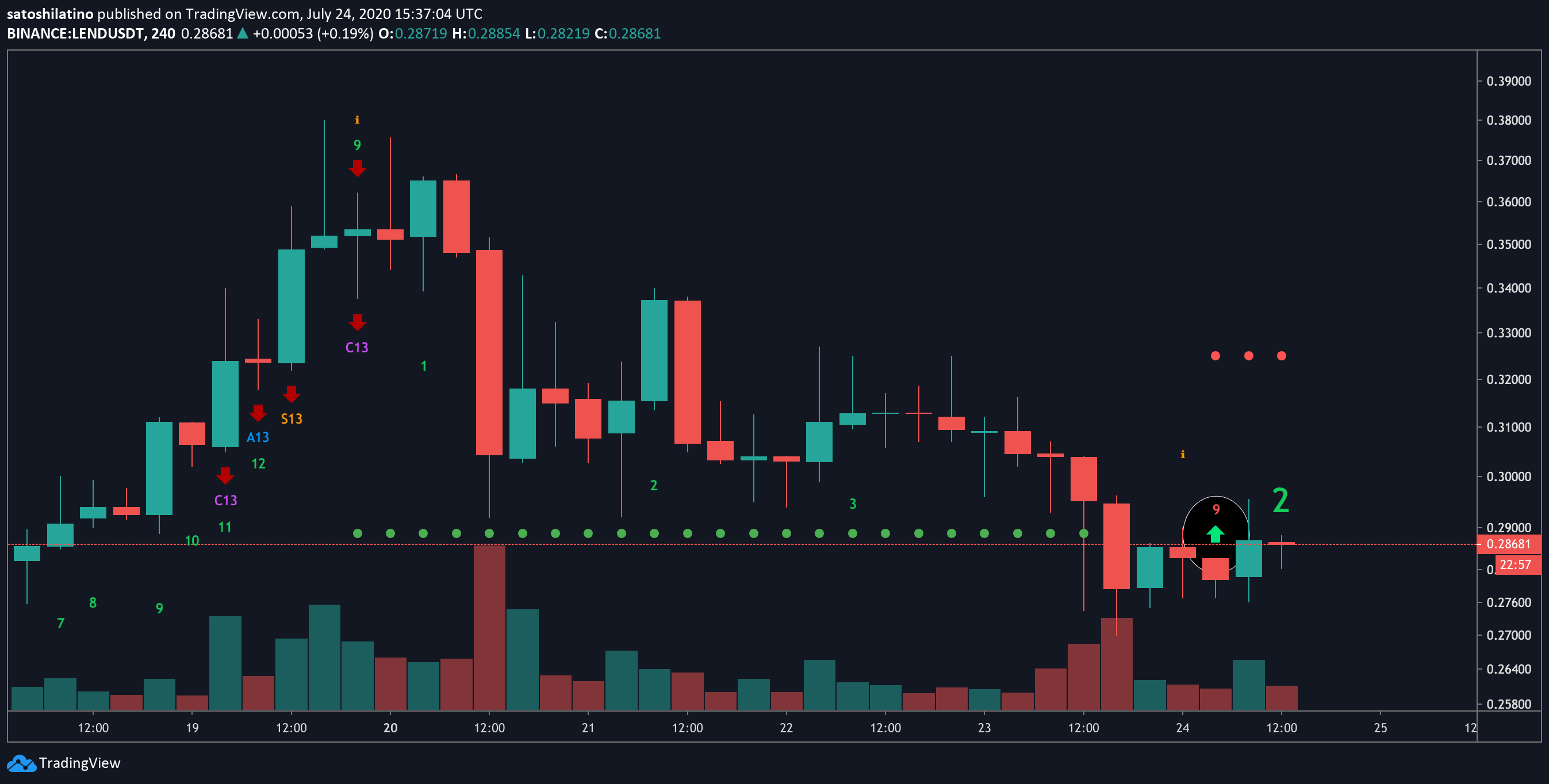

Despite being one of the fastest-growing DeFi tokens in the space, LEND’s price recently took a nearly 30% nosedive. The bearish impulse appears to have been triggered by investors realizing profits following the 185% bull rally that this cryptocurrency experienced this month. As a result, Aave saw its price plummet from $0.38 to $0.27.

Now, the Tom Demark (TD) Sequential indicator estimates that the open-source and non-custodial token could be bound for a bullish impulse. This technical index recently presented a buy signal in the form of a red nine candlestick on LEND’s 4-hour chart. The bullish formation forecasts a one to four candlesticks upswing or the beginning of a new upward countdown.

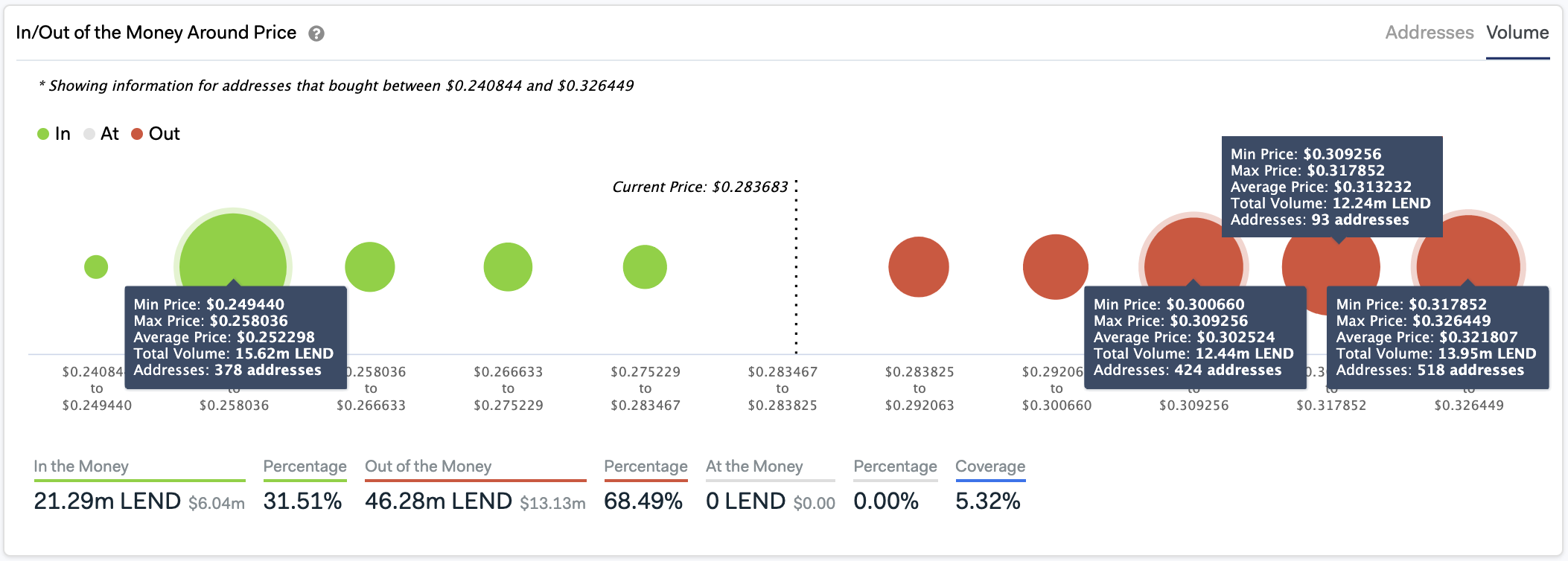

A spike in the buying pressure behind Aave may help validate the optimistic outlook presented by the TD setup. But on its way up, the DeFi altcoin could find stiff resistance between $0.30 and $0.33. IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that over 1,000 addresses had previously purchased roughly 38.6 million LEND around this price level.

Holders within this range will likely try to break even in their long positions if prices start trending up. The selling pressure around this level could be significant enough to reject Aave from advancing further.

On the flip side, the IOMAP cohorts show that if sell orders continue to pile up, the most significant support level ahead of Aave sits at $0.25. Around this price level, approximately 380 addresses bought over 15.6 million LEND. While Aave continues to expand its user base, it remains to be seen whether its native token will resume the 2,265% uptrend it entered at the beginning of the year.