Key Takeaways

- yEarn was technically born in January 2020 as iEarn, until rebranding and launching new features last month.

- The platform automates much of the complexity behind yield farming and is controlled by holders of its native governance token, YFI.

- Andre Cronje has developed a cult-like following due to his software prowess, speed, and creativity in the realm of DeFi.

Share this article

yEarn Finance has quickly become one of the most popular DeFi protocols in 2020. It brings together many of the disparate tools, platforms, strategies, and tokens from throughout the ecosystem. In this way, yEarn resembles an amalgamation of the entire niche, which provides efficiency as well as pure innovation. It is an aggregator of aggregators.

The project has gained popularity due in part to this emerging utility, but also because of the meteoric price appreciation of its native governance token, YFI.

The following guide will walk through what yEarn is, how it works, the YFI token, how it offers improvements for DeFi, and introduce readers to the project’s founder, Andre Cronje. Along the way, readers will also pick up essential knowledge about many other projects, some of which have been featured in previous Project Spotlight editions.

Without further ado, let’s dig into DeFi’s original yield bouncer.

What Is yEarn.Finance?

The first signs of yEarn Finance came in February 2020 in the form of another project called iEarn Finance. The only difference between the two is the name. yEarn is iEarn rebranded by the same developer, Andre Cronje, and includes added capabilities.

We’ll discuss these capabilities shortly.

iEarn was perhaps the first attempt at aggregating yield. Instead of flipping between various DeFi sites, iEarn automatically allocated user funds to the platform with the highest returns. It made this subsection of crypto much more accessible to beginner users but also appealed to veterans due to its convenience.

In many ways, this was the first generation of what we now understand as yield farming. It began with attractive interest rates for different digital assets, which created a need for various aggregation platforms like the original iEarn.

As Andre has written himself, “this was a simpler time.”

It’s important to understand a few examples of yield farming and the different ways in which crypto users earn yield on their holdings. As mentioned above, depositing your digital assets on a yield-bearing platform like Aave, dYdX, Compound, or elsewhere is just the beginning. The rabbit hole is deep and getting deeper.

Another fast-growing way of earning on your returns is via participation as a liquidity provider.

Uniswap, Curve Finance, and Balancer are three popular platforms that allow users to do exactly this. Both are essentially decentralized exchanges (DEXes) that enable users to earn trading fees for creating pools of different assets. Like Binance’s trading fees, but decentralized so that the largest liquidity providers are making all the profits.

For those interested in learning more about Balancer Labs and its BAL token, we recommend readers dig into our Project Spotlight feature on the subject.

Synthetix, a DeFi platform offering users synthetic versions of popular crypto and traditional assets, pioneered yet another opportunity. It’s also slightly more complicated than the previous two strategies.

Users receive a token each time users supply liquidity to a pool on Uniswap or Balancer that represents their stake in that pool. It’s proof that a portion of the funds in the pool is indeed theirs. For the sake of this example, we’ll focus on Uniswap’s LP token design, as it is easier to understand.

There were few use cases for LP tokens beyond identifying pool ownership. Synthetix took this opportunity to create a unique incentive that would benefit its platform, specifically its synthetic version of Ether (sETH). If users helped add liquidity to an sETH/ETH pool on Uniswap, then took the LP token that represented this contribution and staked it on Synthetix Mintr, they could instantly earn a steady stream of SNX tokens, Synthetix’s native asset.

This stack allowed users to earn both trading fees via Uniswap for providing liquidity but also offered users the extra incentive to earn SNX. This design was a breakthrough and also highly attractive. Who doesn’t like free money?

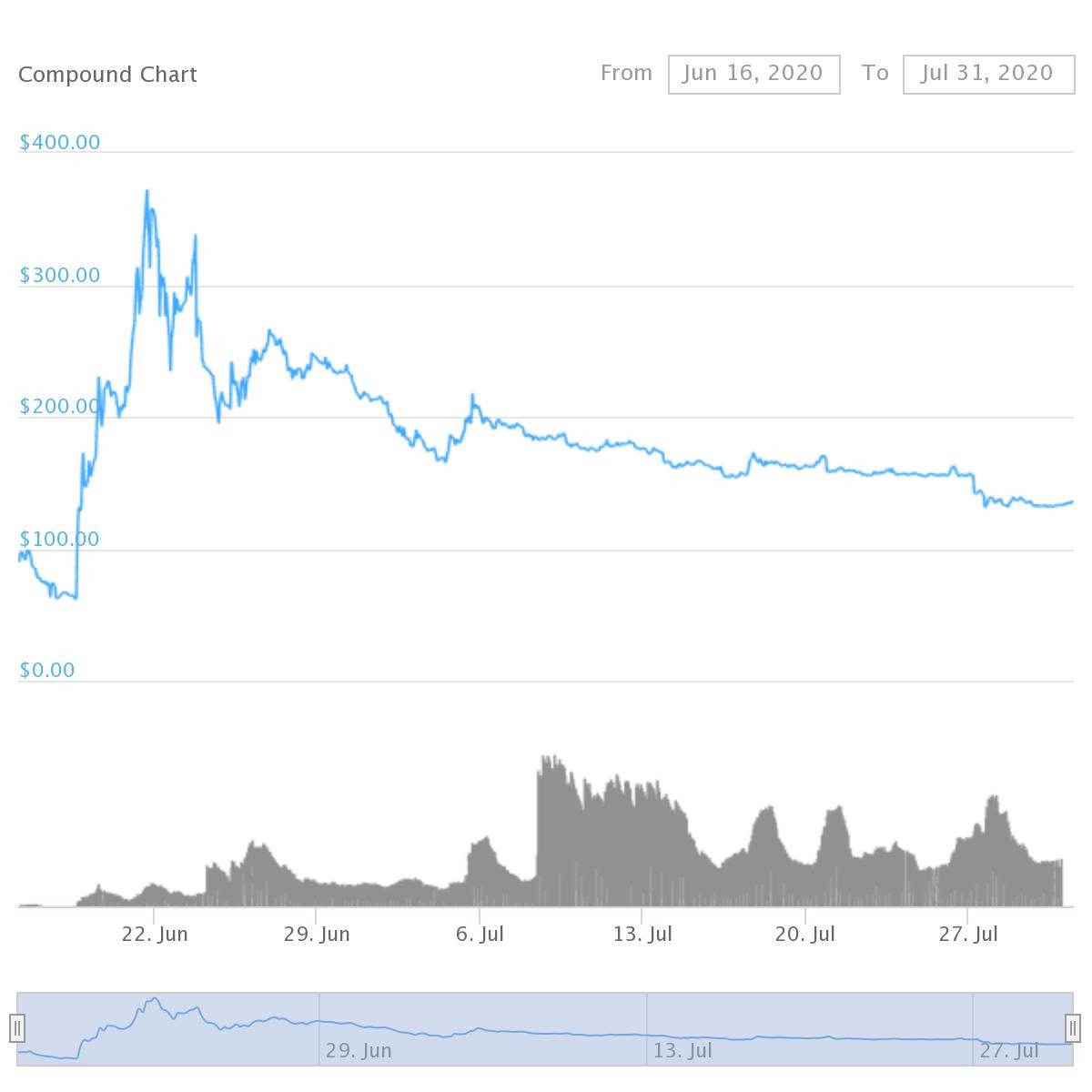

It wasn’t until Compound launched their token that the ingenuity behind the original Synthetix stack became clear. Like the incentivized pools, users who supplied and lent assets using the Compound protocol would receive a proportional amount of COMP tokens on top of the interest for the underlying asset. If you added more liquidity, you earned more COMP.

The COMP token also carried governance properties, which allowed users to vote on protocol changes. Though this is significant for the overall health of the project, user attraction was driven primarily by a near-vertical price appreciation in the COMP token.

The above varieties of earning yield in DeFi are introductory compared to the ever-changing swath of strategies that emerge each day. It is complex and demands a much richer base knowledge of finance and economics.

So long are the days of buying and holding a token, hoping the price goes up.

Exemplary of how this niche is developing, consider yet another collaboration between Synthetix, Ren, and Curve, which sought to onboard Bitcoin into DeFi.

When users added RenBTC, sBTC, or wBTC to the designated Curve pool, then took the LP tokens from this pool, and staked them on Synthetix Mintr, they were eligible to earn SNX, REN, CRV, and BAL tokens on top of the exchange fees from the Curve pool.

Though difficult to understand at first glance, understanding the primary incentives that stimulate yield farming activities provide a lifeline for digging deeper into these strategies. With this understanding, users can also begin to appreciate the value proposition of yEarn.

Like it’s predecessor, yEarn helps users corral a variety of strategies into a single, easy-to-use platform. Users can farm various top DeFi tokens, earn trading fees for supplying pools, enjoy the highest interest rates on deposits, and contribute to the further development of the protocol.

Using yEarn.Finance and the YFI Token

Using yEarn is not dissimilar from using many other DeFi platforms. The UI is also relatively straightforward, offering yield farmers four buttons: Earn, Zap, APR, and Vaults.

The Earn button is self-explanatory. After connecting your crypto wallet, you can see the rates for DAI, USDC, USDT, TUSD, SUSD, and WBTC in the Curve pool. There are two curve pools available: y.curve.fi and busd.curve.fi.

Users earn so-called “y-tokens” in exchange for depositing their assets. DAI deposited becomes yDAI, for instance, thanks to a pool created within Curve. These y-tokens also accrue additional trading fees.

There are three main ways to earn yEarn’s native governance token, YFI. Users can either go to Curve, stake their y-tokens, and earn YFI, or they can leverage one of two Balancer pools and supply liquidity in exchange for LP tokens, called BPT on Balancer. From there, BPT holders would need to stake these tokens on yEarn’s governance platform to earn YFI.

This distribution mechanism quickly took flight, earning yield farmers over 1,000% APY at its peak. And much like the COMP token, the YFI token reached an all-time high of $4,915 just 11 days after its launch.

This DeFi stack isn’t entirely novel. We have already seen platforms that earn yield, stake assets, and farm governance tokens. And though yEarn offers each of these operations on site, it also adds new features to the stack through its v2 iteration.

These additional features include yVaults, Controllers, and Strategies.

yVaults are asset-specific liquidity pools, not unlike what we see on Uniswap, Curve, and Balancer. Users deposit any number of crypto assets and earn interest-bearing tokens that represent this pool.

The Controller is the agent that leverages this pooled liquidity to maximize yields for the asset. It is essentially an automated yield farmer, constantly on the hunt for the sector’s highest yield in the form of deployed Strategies.

These Strategies have been predefined for optimal returns, but anyone can submit new ideas. This allows the platform to evolve alongside the broader DeFi space. If you provide a Strategy that a Controller selects as optimal, you will also be rewarded.

One Man Army

A single developer created yEarn.Finance. Andre Cronje is one of DeFi’s most creative and respected developers. He single-handedly created the protocol in January 2020 and is responsible for all the upgrades since.

With over 15 years of experience creating software, Cronje has worked with traditional technology companies and crypto projects alike.

In particular, Cronje is known for his speed of deploying code and iterating. He emphasizes that he isn’t big on audits and prefers to test in production and allow bugs to be discovered in real-time with real money. While this is more dangerous for users, it is a lot more effective because real money is at risk.

Protip: back in Jan/Feb I was really struggling to be able to pay for audits (or even get anyone with time to do it), just have ~$300m TVL, then everyone audits you for free (and will explain in detail how shit the stuff you built is).

— Andre Cronje (@AndreCronjeTech) July 23, 2020

Cronje’s twitter and yEarn’s interface have disclaimers not to use the protocol if they cannot handle this risk. Over time, as new changes slow down, and more community members audit the codebase and try to exploit the protocol, this risk will diminish.

Governance Model

The entire DeFi community is watching yEarn Finance and YFI intently. yEarn’s product suite is one of the most interesting experiments in DeFi, but its governance and token issuance are what’s attracting most participants.

It’s the first truly decentralized crypto issuance since Bitcoin. No pre-mine, no allocation to founders, and no priority sale to investors. Everyone was put on a level peg and given a chance to earn YFI by using the yEarn Finance protocol.

Many DeFi community members weren’t happy that a single person was in charge of the admin key of a protocol. At one point, people realized that Cronje could mint YFI tokens at will. To ease everyone’s mind, Cronje transferred the admin key to a multi-sig address secured by nine unique signers. Notably, he is not one of these nine signers.

I am NOT one of the signers of @iearnfinance governance multisig.

— Andre Cronje (@AndreCronjeTech) July 21, 2020

The multi-sig requires only six of nine people to give the go-ahead to push changes to the protocol. Anybody can pitch a proposal to change the protocol on yEarn’s governance forum.

As the risk of a regulatory attack starts to mount, ensuring a protocol doesn’t have a single point of failure is becoming a necessity for any crypto network that wants to exist and thrive in the long term.

It usually takes years for a protocol to transition governance into the hands of the community entirely. Maker did so 2.5 years after launching on mainnet, and Synthetix took 1.5 years for the same. But yEarn.Finance incentivized a community and gave them total control of governance in just one week.

Closing Remarks

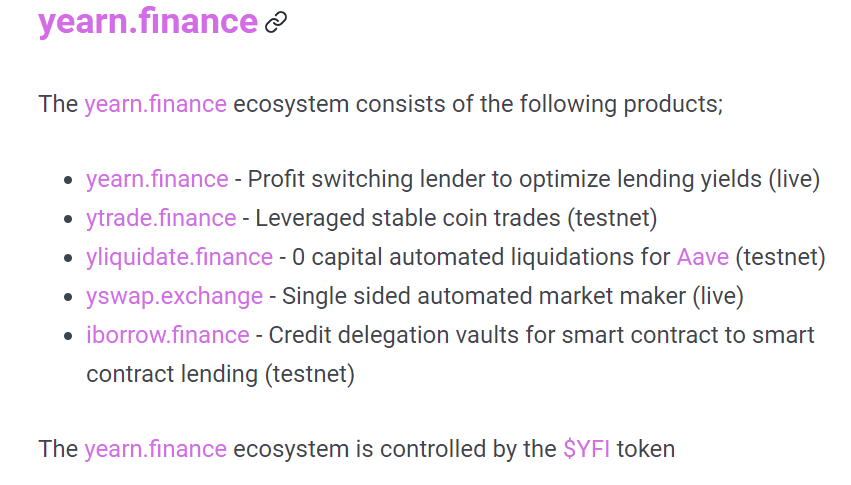

yEarn’s closest competitors are RAY, Idle Finance, and Rari Capital. However, differentiation in the form of an extensive range of different services set yEarn apart from the rest.

Leverage trading stablecoins, a liquidation tool for Aave, and a yield aware automated market maker bring yEarn’s value proposition to more complex DeFi users as well.

But yEarn’s core product, the yield aggregator, abstracts a ton of complexity from using DeFi while securing the best rates in the space.

Aggregators in DeFi are all the rage now. Using a service like Matcha or 1inch.exchange splits an order across DEXes to minimize slippage. This guarantees a better exchange rate than any standalone liquidity pool.

Yield aggregators can step in and do the same for DeFi’s money markets by tapping into existing liquidity to optimize for the highest yields.

Disclosure: Andre Cronje is an equity-holder in Crypto Briefing.