Key Takeaways

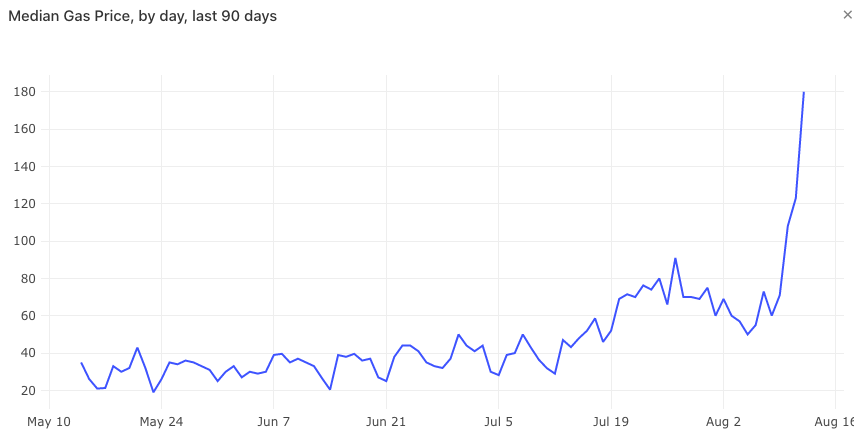

- Ethereum transactions fees breached 200 gwei today per unit of gas today.

- DeFi protocols will lose a lot potential usage if non-power users cannot afford to use Ethereum.

- Between ETH 2.0 and layer two, the latter offers less negative trade-offs for the Ethereum ecosystem.

Share this article

Transactions fees on Ethereum crossed 200 gwei today, posing a real threat to the mass adoption of DeFi. Previous moves to increase the gas limits did nothing but enrich the network’s miners.

The push for layer two is the most viable solution to reduce the cost of using Ethereum.

Ethereum Fee Woes

DeFi protocols rely on high levels of usage to generate fees and eventually profits for token holders. But transaction fees have reached a threshold where the cost of using Ethereum offsets potential profits.

At 200 gwei per unit of gas, using Ethereum is more expensive than ever.

This is paving the way for DeFi protocols on other blockchains, such as Cosmos and Solana. However, the majority of DeFi users and liquidity is still on Ethereum.

Whales, who account for most of DeFi usage, have no problem paying $10 fees to swap tokens or $20 to supply tokens in a money market.

But if DeFi wants to steal market share from CeFi, cheaper transaction costs are the need of the hour.

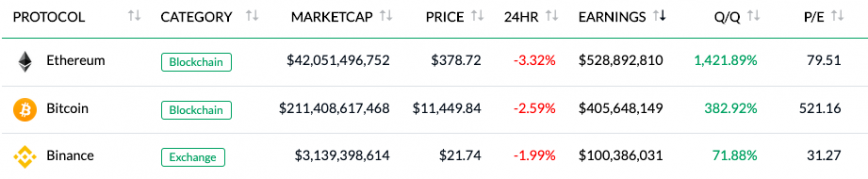

The only real winners here are Ethereum miners who are making bank through exponentially rising income from fees.

Total revenue to Ethereum miners increased over 1,400% this quarter, which pushed Ethereum ahead of Bitcoin in terms of miner revenue.

However, there is evidence that miners themselves are spamming the blockchain with transactions to keep fees artificially high.

Miners also unilaterally passed an increase in the blockchain’s gas limit, which isn’t a real solution. All this does is increase the workload for those operating Ethereum nodes while putting money in miner pockets.

Solutions to the Problem

Layer two solutions build a sub-network on top of an existing blockchain and promise to bring transactions costs to sustainably low levels.

Loopring, DeversiFi, and a few other DeFi products exist on layer two ecosystems, but they account for a tiny portion of total DeFi usage.

Two other remedies exist in the form of EIP-1559 and ETH 2.0. While EIP-1559 won’t reduce gas fees, it can make fees more predictable and reduce the possibility of miner manipulation. ETH 2.0 will bring sharding to Ethereum, which enhances the scalability of the base blockchain.

However, considering the trade-offs between ETH 2.0 and layer two solutions, the latter is far more viable as it doesn’t exponentially add to the size of the Ethereum blockchain.