Key Takeaways

- SushiSwap is a fork of the popular DEX, Uniswap, and adds a token to the mix.

- The DeFi Experiment revealed some of the core principles operating in the crypto sector.

- Far from dead, SushiSwap is now taking life on the Solana blockchain.

Share this article

The SushiSwap saga and its native token, SUSHI, will go down in crypto history.

What began as a tokenized version of Uniswap has spiraled into something much more. It reminds crypto users of the power of open-source protocols, 24/7 economic incentives, as well as the sheer power of online communities. Even now, after most of the dust has settled, the lessons from this fascinating experiment continue to unveil themselves.

As a protocol, SushiSwap is a decentralized exchange (DEX) like many others. It’s ambitions, however, are entirely unique.

This week’s Project Spotlight feature will unpack the twists, turns, and lessons learned. Ultimately, readers will gain a new appreciation for the power of decentralized, Internet-based money.

None of the events that follow would have been wholly possible in traditional markets.

Unpacking Uniswap

One must first begin with understanding how Uniswap functions as a DEX, as well as what led to the overflow of so-called “food tokens.”

Uniswap has been a mainstay within the DeFi community. It offers traders unique token pairs, is non-custodial, and, before SushiSwap arrived, billions of dollars in liquidity. The way the platform works is simple: Traders trade, and liquidity providers (LPs), well, provide liquidity.

In providing liquidity, LPs can also earn fees. Each time a user arrives and interacts with an LP’s pool, either through buying or selling an asset, the LP makes 0.3% of that trade. They also receive tokens that behave like receipts of their activity on Uniswap.

These are called LP tokens, and they represent the amount of liquidity the LP has provided.

These points may seem insignificant, but in the context of this article, they’re critical to remember.

For a deeper dive into how Uniswap defines asset prices as well as a broad comparison with other DEXes, readers are advised to read Crypto Briefing’s previous coverage on the subject here.

Essentially, Uniswap has unbundled the work of centralized exchanges and handed it over to users by offering them money. This is in the way of trading fees, liquidity provision, token listings, market making, and arbitrage opportunities.

For the sake of this article, though, one must only keep in mind that Uniswap is an open-source protocol, it offers users LP tokens for contributing liquidity, and, perhaps most importantly, it is backed by large venture capitalists.

Who’s Hungry for Tokens?

In August, Uniswap raised $11 million from notable investors, including Andreessen Horowitz, USV, Paradigm, and others. The investment was made via the purchase of shares in Universal Navigation, the company behind Uniswap.

These shares are thought to eventually earn money for investors once Uniswap activates a protocol fee of 0.05%. Currently, this fee is not active, but it is a serious consideration. And though it has not been a point of serious controversy, the return to VC capital and centralized shareholders is not a core tenet of the crypto community’s original ethos.

At roughly the same time that this investment was made, the crypto space was in the heat of the yield farming, sometimes called liquidity mining, trend.

Ignited by Compound Finance in June, token holders could lend and borrow their tokens to a protocol and earn a healthy return, plus a governance token in proportion to the amount a user lent or borrowed.

In Compound’s case, they began offering users its COMP token for supplying liquidity.

The newly-launched mechanism worked like a charm. Not only did holders rush to the platform to earn free COMP tokens, but the price of COMP also skyrocketed, making some holders millions of dollars. Emerging protocols throughout the DeFi space adopted the mechanism nearly immediately.

Some protocols, like yEarn Finance, aligned the incentives well, but the majority became quick “farm-and-dump” schemes reminiscent of the airdrops and initial coin offerings of yesteryear. Perhaps the lowest effort manifestation of yield farming came via the rise of food coins and various forks.

🔥HOTDOGSWAP – An evolution of Uniswap with HOTDOG tokenomics.@iearnfinance @FinanceYfii @SushiSwap @compoundfinancehttps://t.co/HunloT2gxH pic.twitter.com/UOUr6IKFIw

— Hotdog.Swap (@SwapHotdog) September 2, 2020

This was the environment in which SushiSwap and SUSHI emerged. And due to its name and the context of its launch, many shrugged it off as a get-rich-quick project.

SushiSwap and Fair Launches

SushiSwap pitched itself as a more fair version of Uniswap. Instead of a small group of VCs, the broader crypto community would sustain and profit from the platform’s success, thanks to a decentralized token. It also included an adversarial component.

Instead of merely competing with Uniswap for ideological favor, it sought to bring liquidity directly from Uniswap over to SushiSwap. Called “Vampire Mining,” SushiSwap attempted to offer slightly better incentives to users who decided to participate in the fork.

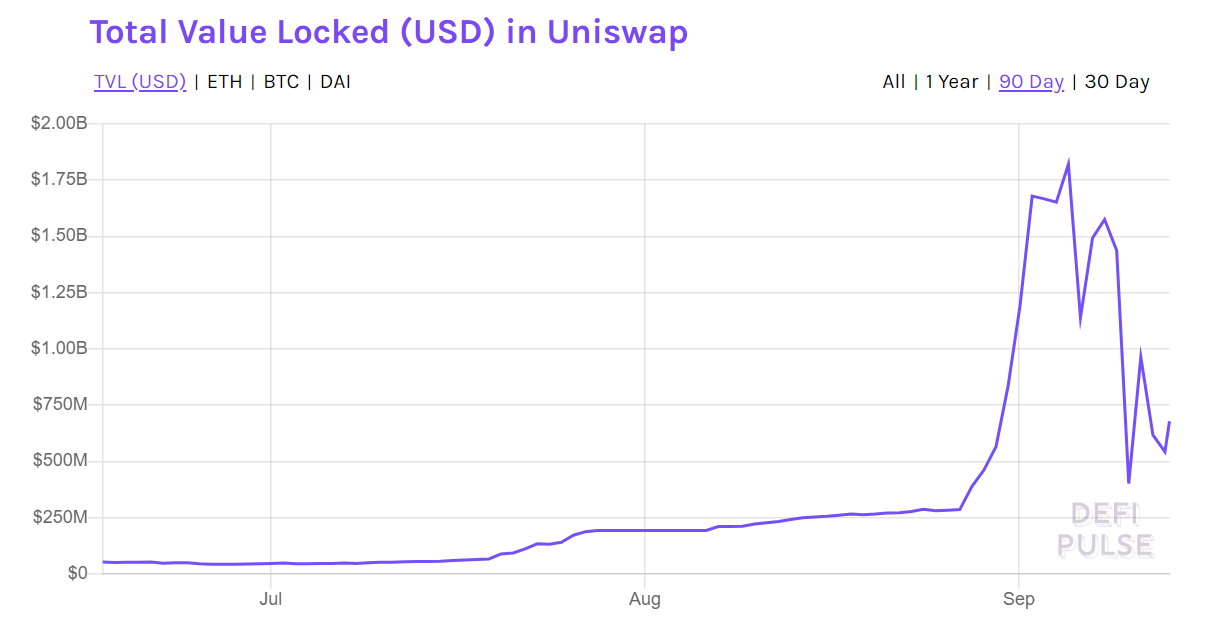

And thanks to the mouth-watering returns on yield farms and food coins, users were quick to follow along. Soon, SushiSwap had attracted almost 90% of all the liquidity on Uniswap. And once concluded, this liquidity would be migrated to SushiSwap.

It’s important to remember that the liquidity that would move to SushiSwap was not additional liquidity. Instead, it was directly harvested from Uniswap. As such, the experiment earned a wide variety of critics.

my take on the $sushi @SushiSwap debacle 👇

tl;dr – it takes longer than a week to build a community

it takes love😘 pic.twitter.com/7cllVRHksJ

— ameen.eth👹is out of melee range (@ameensol) September 5, 2020

The clear contention is, of course, that SushiSwap essentially rode on the back of three years of hard work, added a token, and made millions within a week. Conversely, this tactic, be it vampire mining or forking liquidity, is gaining traction as a viable bootstrapping mechanism for new projects.

For more examples of this, readers are advised to investigate Swerve Finance, C.R.E.A.M, and Harvest Finance. Though the dynamics are slightly different, each of these forks is tinkering with the economic incentives behind Curve Finance, Compound, and yEarn, respectively.

With tensions boiling and factions forming, the SushiSwap saga took a much darker turn.

The pseudonymous creator, Nomi Chef, sold $14 million worth of SUSHI from the project’s development fund.

“I F*cked Up. And I Am Sorry”

At the peak of the week-long community building, the project’s token plummeted more than 50% following Nomi’s market dump. And though they claimed to continue working on Sushi to help it migrate liquidity from Uniswp, the damage had been done.

The community began labeling the move as a clear exit scam.

I did the recent move because I care about the community. I’m taking IL for you. But all I received was blaming and FUDing.

Here’s what happened. The devshare part of me. I converted them to $ETH. I stop caring about price and I will focus on the technicality of the migration.

— Chef Nomi #SushiSwap (@NomiChef) September 5, 2020

The following day, he handed over the keys to the contract to Sam Bankman-Fried, the CEO of Alameda Research and crypto derivatives exchange, FTX.

A week after handing off the project, Nomi then returned all $14 million back to the SushiSwap treasury.

To everyone. I fucked up. And I am sorry.

— Chef Nomi #SushiSwap (@NomiChef) September 11, 2020

The Migration and Aftermath

After Bankman-Fried took over the project, SushiSwap’s supporters could finally sigh a breath of relief. Once Nomi transferred admin control of the SushiSwap contract, the FTX CEO jumped into action and began to outline a migration plan.

Bankman-Fried intended to keep the community in the loop with how the migration would go down. Nomi themselves activated the migration, and Bankman-Fried decided to cancel this and slightly postpone the event to double-check the code.

Several verifications later, it was announced that the migration would finally be activated, and it would be executable after the 48-hour time lock had passed.

While waiting for the migration to go through, Bankman-Fried tried to incentivize more LPs to stick around with SushiSwap. He announced a reward of one million SUSHI for LPs that migrated their liquidity to SushiSwap. This reward would come from Bankman’s (or Alameda’s) personal stash of tokens.

The community responded well to this, eventually voting for the Sushi treasury to match Bankman’s reward. Many proposals followed, including one to reduce token emissions and make SUSHI issuance sustainable.

Governance was another notable problem that needed to be solved. Though Bankman-Fried has so far created a spotless reputation, it was far from ideal to hand him sole control over the smart contract.

Bankman-Fried decided that distributing control to a 6-of-9 multisig wallet made the most sense.

While SushiSwap was waiting for the 48 hour time lock to elapse, the community got to voting. People nominated themselves on Twitter, and SUSHI holders voted for each of those nominees on-chain.

Some very notable names have been elected to SushiSwap’s multisig. This includes Matthew Graham (Sino Global Capital), Robert Leshner (Compound), CMS Holdings (hedge fund), 0xMaki (protocol’s original community manager), Larry Cermak (The Block), and Bankman-Fried himself.

The #SushiSwap Election has concluded and the results are in:@SBF_Alameda @rleshner @0xMaki @lawmaster @cmsholdings @mattysino @mickhagen @AdamScochran and finnally @zippoxer who also created the dashboard!https://t.co/GiCMQs4bsR pic.twitter.com/W645pz6NKs

— SUSHI POWAH – sushipowah.eth (@SushiPOWAH) September 9, 2020

The migration finally began, and Bankman-Fried’s team began slowly migrating pools one by one, then tested each of them to see if it actually works before migrating others. They started with the CRV-ETH pool, moved on to the YAMv2-ETH pool, and continued until everything was migrated.

Notably, SushiSwap’s BASED pool would not support rebases. The team announced this pool wouldn’t be migrated, owing to this risk.

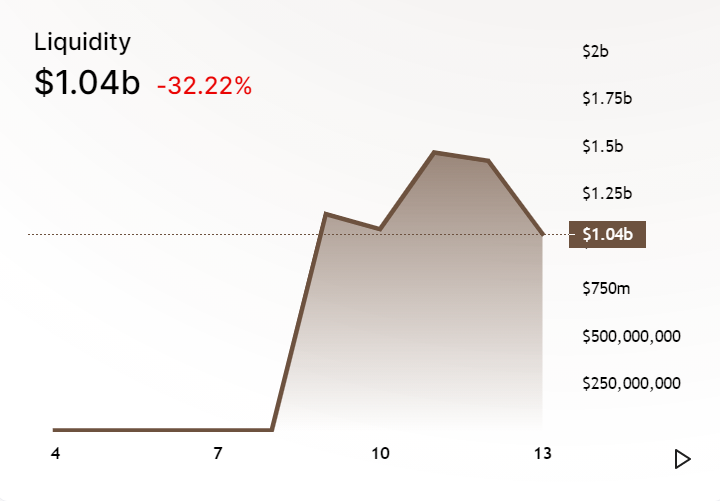

According to SushiSwap’s analytics interface, $1.14 billion migrated to the forked protocol. This is quite the feat, as it trumped yEarn Finance to become the youngest DeFi project to hit $1 billion in total value locked.

Different Perceptions of SushiSwap

As always, the DeFi community is split when it comes to SushiSwap.

Supporters of the fork believe it is a fair concept that gives power and rewards to the community. With no tangible way for DeFi’s users to participate in Uniswap’s upside, they were drawn to the concept of a Uniswap fork where community members owned 90% of the tokens.

Others see SushiSwap as a clear failure. A fork of a successful product will not be able to innovate the protocol more than the original developers. Uniswap v3 details are expected to be announced soon, and it could put an end to SushiSwap.

There are also concerns regarding Sam Bankman-Fried’s role in all this. FTX is helping bootstrap Serum, an orderbook-based DEX that runs on Solana. Some theories – all conspiratorial as of now – believe this is just a marketing ploy for Serum.

Many a time, Bankman-Fried has remarked upon the lack of efficiency with automated market makers (AMM) like Uniswap. The FTX chief submitted a proposal to migrate SushiSwap, also an AMM, to Solana, as a supplement to Serum.

His sudden excitement with SushiSwap is in direct contradiction to this.

One side question: Why does Serum need AMM all of sudden?

Serum’s WP claims CLOB > AMM and the only reason AMMs thrive now are the limitations of Ethereum. pic.twitter.com/lpulgWz4Lg

— キノ丂ズム刀イ乇丂 (@Fiskantes) September 6, 2020

Ultimately, Bankman-Fried cannot single-handedly move SushiSwap to Solana, unless he owns SUSHI tokens to influence a vote in that direction.

The Future of SushiSwap

Considering everything that continues to play out, SushiSwap has two potential paths it can pursue. Either migrate to SushiSwap and help build liquidity on Solana’s DeFi stack or stay on Ethereum and fight against the likes of Uniswap and Balancer.

The first option is compelling because it gives the Sushi community a fresh start and the chance to build out new features from scratch. But the second option, while entirely viable for now, risks SushiSwap fading into irrelevance if Uniswap announces a token.

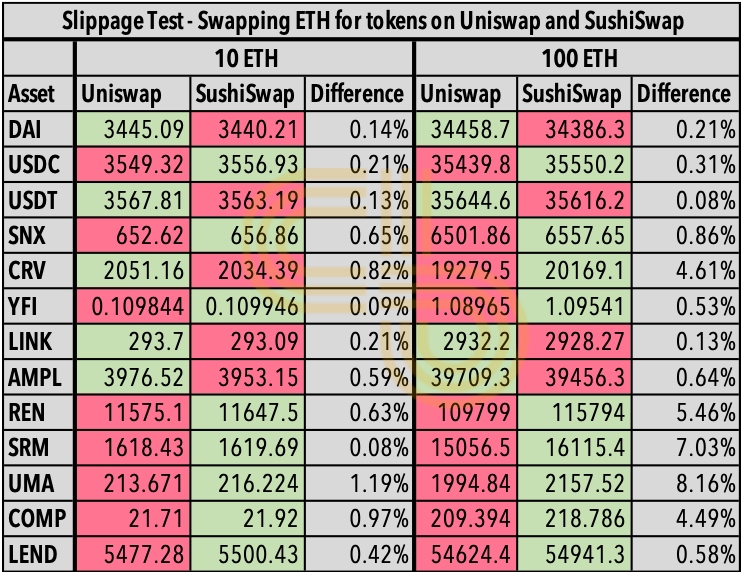

A swap test between Uniswap and SushiSwap revealed that the latter has superior liquidity for the tokens listed on the DEX. SushiSwap offered traders a better rate for every asset except DAI, USDT, LINK, and AMPL.

This data isn’t all that surprising. Yes, Uniswap has many more tokens to trade than SushiSwap. But for the few they share, SushiSwap was bound to offer better rates as its liquidity is 4x that of Uniswap.

Sushi’s dominance is purely thanks to the power of incentives. Giving LPs a shiny, new token, and directing some cash flows to the token, so it captures value, creates strong incentives to deposit tokens in SushiSwap, and buy SUSHI.

It’s simple yet effective. But it’s also vulnerable to mimicry.

Imagine Uniswap announces a token called “UNI” tomorrow, and the distribution resembles Curve’s. Founders and investors receive an allocation, a chunk of tokens is retrospectively rewarded to anyone who has ever provided liquidity to Uniswap, and the rest is for a future liquidity mining program.

Leaving aside the fact that Uniswap’s token would list and sustain above $1 to $2 billion in market cap, the incentive to mine the hypothetical UNI token would almost certainly spell the end of SushiSwap.

In light of this, migrating to Solana seems like a more sustainable option. Instead of competing with Uniswap on Ethereum, it can try to become the Uniswap of Solana.

What @SBF_Alameda is doing/proposing is really the right way forward.

Sushiswap as a uniswap fork, will always be just that.

Sushiswap as a new AMM on Serum (built from ground up), can differentiate itself.On Serum it also has SBF backing, which cannot be understated. https://t.co/FoaxIWsl1S

— Andre Cronje (@AndreCronjeTech) September 6, 2020

Just to reiterate, the future of SushiSwap lies entirely with token holders. Which path the protocol pursues is up to them, but they should carefully consider the ramifications of each before making a decision.

Staying on Ethereum requires them to compete with existing protocols head-on. And if Uniswap launches a token, the incentive to use and provide liquidity to SushiSwap will take a massive hit.

But migrating entirely to Solana is just as risky, as the blockchain has been live for just a few months and is just starting to build out the framework for its DeFi ecosystem.

Disclosure: One or more members of the Crypto Briefing Management team hold SUSHI tokens.

Share this article

SushiSwap Founder Chef Nomi Returns $13M in Hijacked Ethereum

SushiSwap founder Chef Nomi drained his creation’s development fund for 38,000 Ethereum on Sept. 7, just one week after creating the project, and transferred control over to FTX Exchange’s Sam…

DeFi Forks Will Struggle Because You Can’t Fork a Community

DeFi forks are popping up everywhere. Unfortunately, they fail to become anything more than a “farm and dump” scheme due to a lack of genuine community. And even the few…

Uniswap’s Daily Volume Just Overtook Coinbase by More than $80 M…

Uniswap’s 24-hour trading volume of $479 million outpaced Coinbase’s $397 million. This is the first instance of a decentralized exchange (DEX) facilitating more volume than crypto incumbent Coinbase. What Drives…

July BTC Market Analysis

After roughly 2 months of price consolidation following its rapid recovery from Black Thursday (March 12th), Bitcoin broke out of its range following an extended period of muted volatility. Currently…