Key Takeaways

- Revenue for Bitcoin miners fell by 30% after the block reward halving in May 2020.

- Ethereum miners saw revenues triple since March as DeFi pushed transaction fees to new highs.

- By year end Crypto Briefing projects total annual mining revenues of $4.6 billion for Bitcoin and $2.2 billion for Ethereum.

Share this article

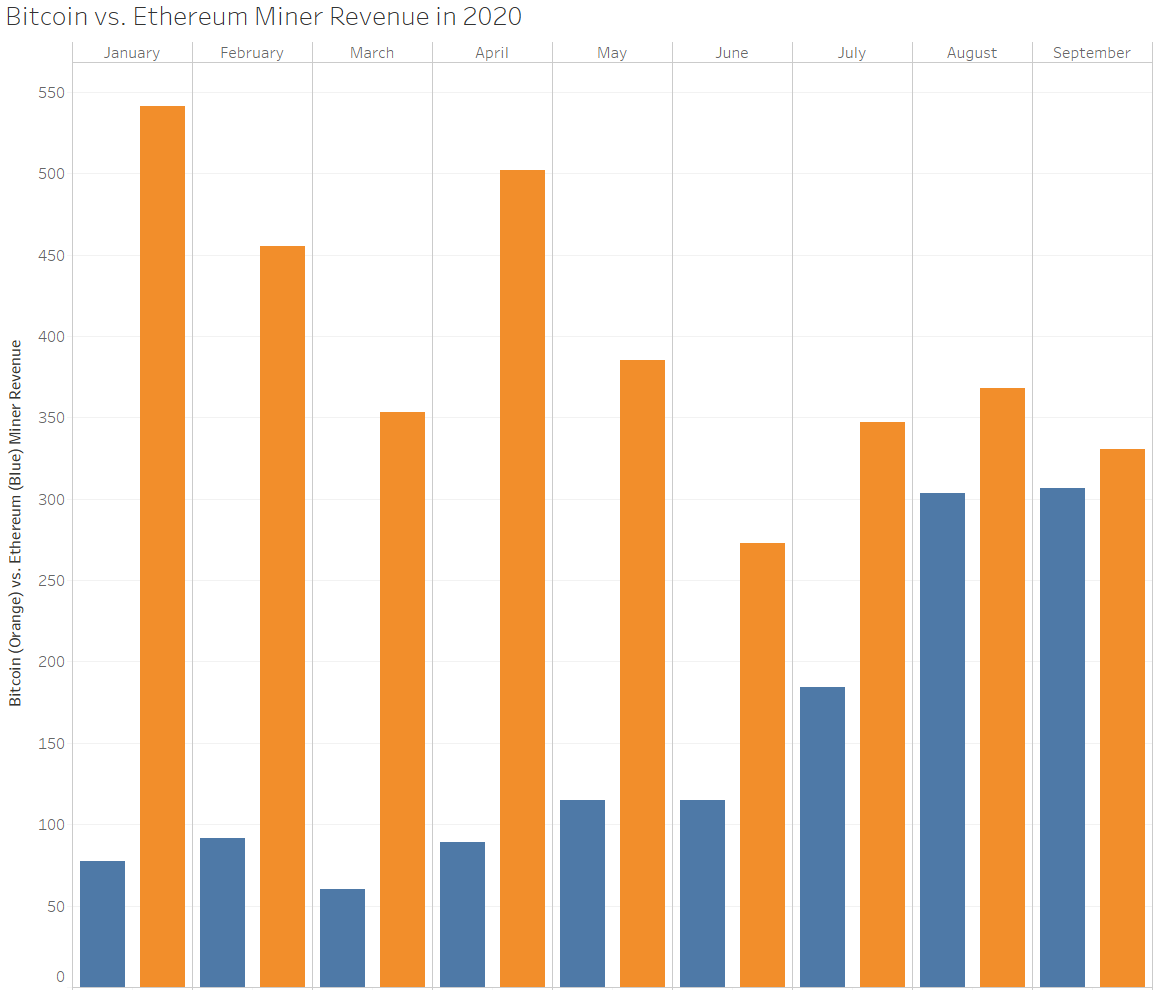

This year saw drastic changes in the mining industry, with the halving and DeFi shaking up the sector. Ethereum miners saw their incomes triple since February, while revenues for Bitcoin miners fell by 30% following the halving.

Ethereum Mining Approaches Profit Parity with Bitcoin

Cryptocurrency mining this year is divided into two distinct eras: before and after the halving. Around the same time as the halving is when the decentralized finance trend started to take off.

Before the halving and DeFi, Bitcoin miners made four to five times more than Ethereum miners in the first quarter of 2020. Bitcoin miners earned $400 million on average in the first nine months of 2020, while those mining Ethereum made $150 million in all, according to data pulled from blockchain data firm Glassnode.

Total BTC mining revenue fell by roughly 30% after halving. June was a sluggish month for Bitcoin miners, with block rewards and fees bringing in $272 million. Once hashrates stabilized after the halving, miners earned an average of $350 million in revenue each month.

ETH Miners Profit from DeFi

The DeFi boom caused Ethereum mining revenues to triple since the beginning of the year, nearly reaching parity with Bitcoin in August and September—despite the Ethereum network having just one-fifth of the market capitalization of Bitcoin.

Congestion on the Ethereum network reached unsustainable levels beginning in August, with gas fees reaching all-time highs. Congestion resulted in miners collecting more transaction fees, increasing revenues. Miners earned an average of $305 million per month in ETH, compared to a monthly $90 million over the first two quarters of the year.

In all, Bitcoin miners made $3.55 billion compared to Ethereum’s $1.34 billion year-to-date. Projections by Crypto Briefing predict total BTC mining revenue of $4.6 billion for 2020. Assuming gas prices stay above 100 gwei, Ethereum miners should make around $2.2 billion by year-end.

Share this article

Bitcoin’s Transaction Fees Soar Post-Halving

Transaction fees on Bitcoin have increased by close to 250% since the network’s third block reward halving on May 11. If this is the start of a sustained fee market,…

Ethereum Gas Usage Reaches All-Time High, Congestion Intensifies

Ethereum has been putting its foot to the pedal over the last two months, generating new record-breaking usage numbers that paint apparent demand for the platform. Can the network keep…

Understanding Position Sizing

Let’s briefly examine the most important aspect of any trading system, position sizing, or specifically how much we will bet on any one given trading idea.

Exorbitant Gas Fees on Ethereum Force UniLogin to Shutter Operations

UniLogin, an Ethereum onboarding solution and wallet, is shutting down due to high gas fees, an inability to scale, and browser issues. DeFi has been the main culprit behind rising…