The third quarter of 2020 has seen the strong resurgence of decentralized finance (DeFi) on Ethereum. With it, the demand for decentralized exchanges (DEXes) surged, causing Uniswap to briefly overtake Coinbase Pro at one point.

Heading into 2021, Ethereum and decentralized exchanges would likely perform even better, quant trader Qiao Wang said.

Two Reasons an Ethereum and Decentralized Exchange Take Off in 2021 is Likely

From July to September, DeFi and decentralized exchanges saw a massive spike in demand.

The frenzy around yield farming, which mostly revolves around staking various cryptocurrencies including Ethereum to earn governance tokens, caused DEX volume to spike.

Since centralized exchanges undertake a rigorous verification process to list tokens, newly-emerging DeFi tokens typically do not get on exchanges in time.

Consequently, traders and DeFi users flock to decentralized exchanges, like Uniswap, to trade DeFi tokens.

When the yield farming craze was at its peak in September, the high user activity on decentralized exchanges clogged Ethereum. There was significant genuine demand from real users, a level that Ethereum had not seen before.

In 2021, Wang said the demand for decentralized exchanges could rise further due to the uncertainty around centralized exchanges.

In the second half of 2020, the cryptocurrency market saw KuCoin, BitMEX, and OKEx suffer negative events. KuCoin fell victim to a large-scale security breach, BitMEX was charged by the U.S. Commodities and Futures Trading Commission (CFTC), and an OKEx private key holder has been investigated.

According to Wang, the uncertainty around major exchanges could lead to a decentralized exchange activity increase. He said:

“Hard to overstate the importance of 1) Ethereum L2s and scalable L1s coming online 2) What happened to Kucoin/Bitmex/Okex over the last 2 weeks Timing cannot be better for decentralized futures/swap exchanges to finally take off in 2021.”

Such a trend would naturally benefit Ethereum for two reasons. First, that would further increase the network activity of Ethereum, strengthening its fundamentals. Second, that would cause the demand for scaling to increase.

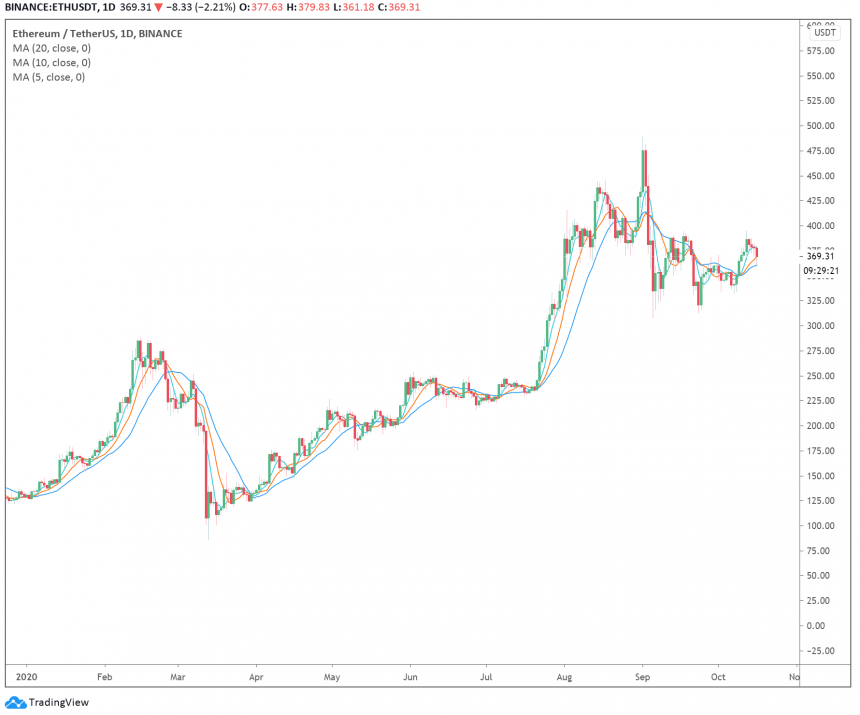

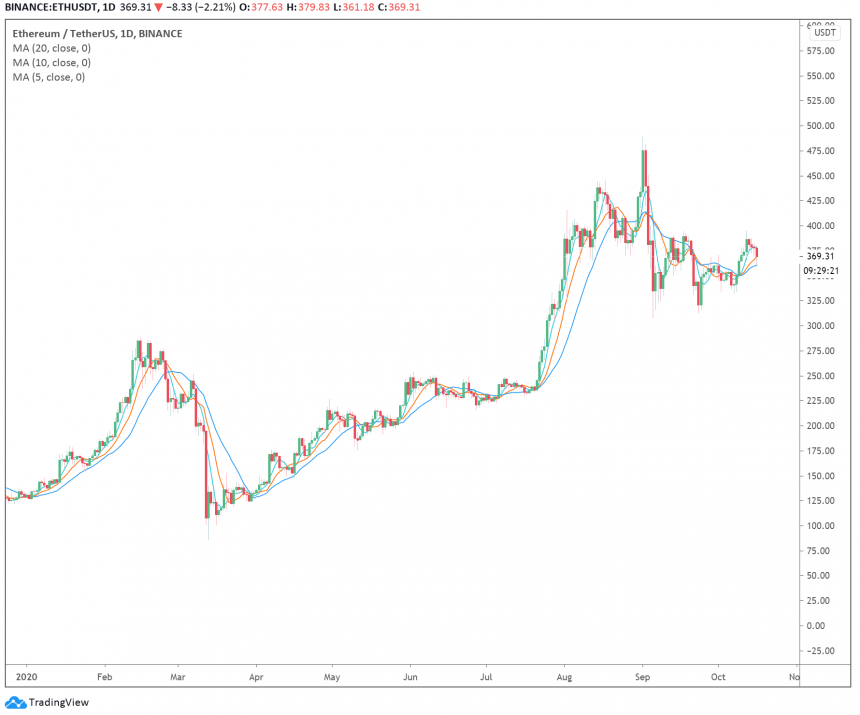

The year-to-date price trend of Ethereum. Source: ETHUSDT on TradingView.com

Would ETH 2.0 Come in Time?

Based on the struggle of the Ethereum network to handle the significant volume coming from decentralized exchanges in the third quarter, ETH 2.0 is highly sought after.

ETH 2.0 is a major network upgrade that would shift Ethereum to the proof-of-stake (PoS) consensus algorithm. Unlike the proof-of-work (PoW) algorithm, PoS eliminates its dependence on miners and incentivize users to verify transactions through scaling.

Especially if derivative decentralized exchanges take off, Wang said scaling could become even more critical.

“Key ways in which derivative DEX is different from spot DEX: 1) Derivatives smart contracts are more complex and expensive to execute. 2) Derivative traders are more sensitive to slippage and fees as they are more short term. Hence scaling is more critical for derivatives,” he added.