Key Takeaways

- Degenerative Finance has launched an experimental design space that explores different derivative products and synthetic assets.

- The project’s first project is uGas, synthetic gas futures for Ethereum.

- Depending on a user’s profile, uGas can be a helpful tool to hedge and speculate on the rise or fall of gas prices on the number two network.

Share this article

uGas is the first project launched by Degenerative Finance, itself a partnership between last summer’s popular DeFi platform, YAM Finance, and UMA Protocol.

The uGas offering will be the focus of this week’s Project Spotlight feature.

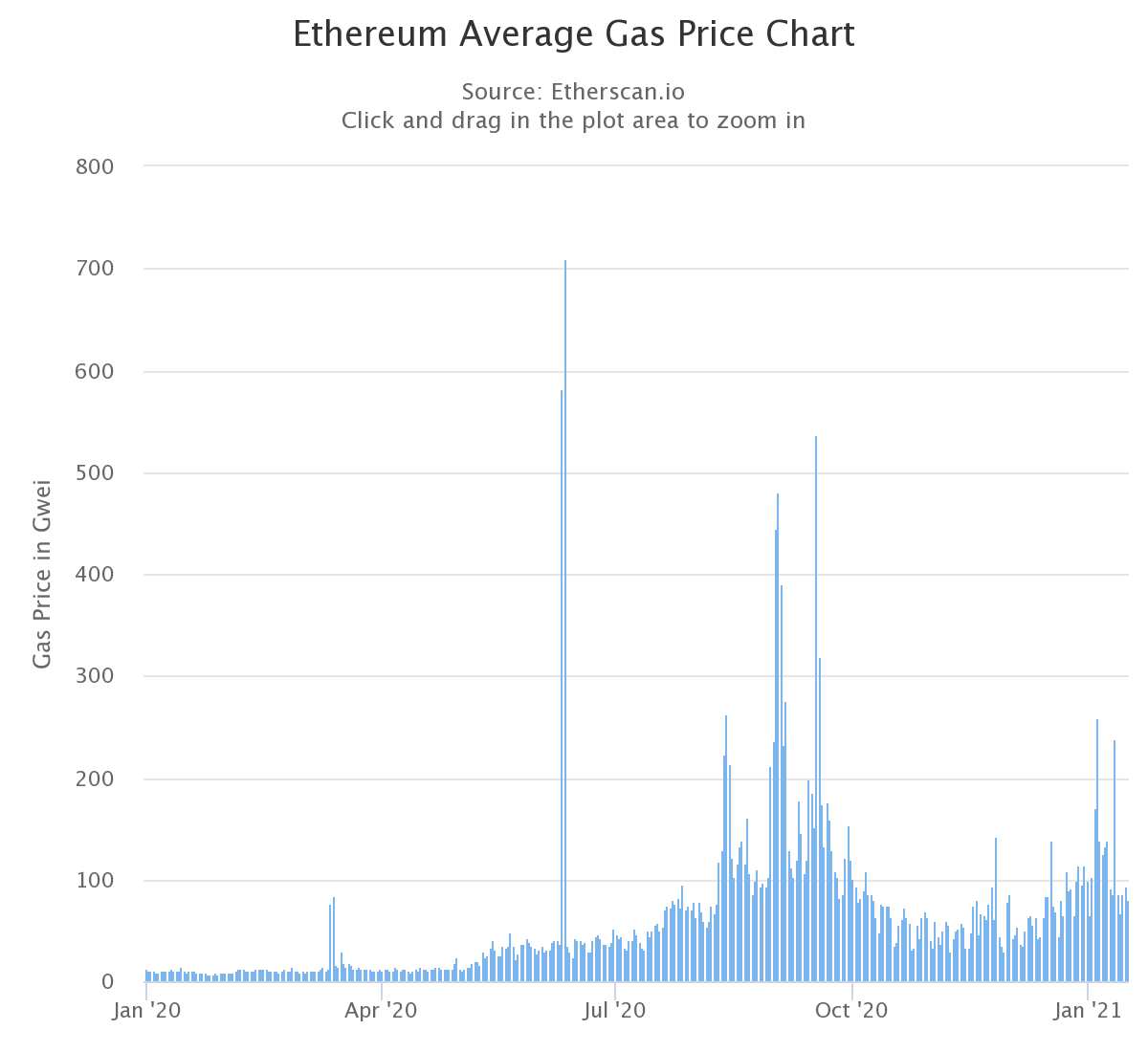

uGas offers decentralized gas futures for users within the Ethereum ecosystem. For the uninitiated, every transaction on Ethereum costs gas. Sometimes the network can be so congested that the cost to transact can make even simple operations prohibitively expensive.

There have been many examples of such limiting conditions. Each example has also been used to promote alternative blockchains and speed up development for various Layer-2 solutions.

The CryptoKitties boom in 2017 is perhaps the first severe case of extremely high gas fees, but the meteoric rise of DeFi in 2020 has proven to be as notable.

This is becoming a growing issue for the number two network and may limit the asset’s potential if not solved. Speculators are not the only demographic affected, however. Developers, users, and those looking to build companies on top of Ethereum must consider the high cost of operating.

Naturally, Ethereum developers have been hard at work to dissolve this pain point. The launch of Ethereum 2.0’s Beacon Chain last year and the “soft” launch of Optism’s Layer-2 solution have given the community hope.

These solutions, however, may take much longer than anticipated.

Instead of rebuilding Ethereum’s technical components, many emerging projects attempt to solve the scaling issue through economics. Archer DAO is one example of this; instead of eliminating Ethereum’s “Dark Forest” of predatorial arbitrage bots, the project illuminates the network’s mempool and rewards those who help identify attractive arbitrage opportunities.

More information on Archer DAO and its value proposition can be found here.

This approach accepts the limits of the network and the environments they create as inevitable. From this point, they build accordingly. uGas is not dissimilar.

Instead of solving high gas fees, they create a futures market for crypto’s hottest commodity: Ethereum gas.

This allows users, builders, and speculators to properly hedge for inevitably high gas costs.

What Are Futures?

Readers who are already aware of futures, how they work, and what they are used for, should skip this section. A deep dive into uGas and how it works follow below.

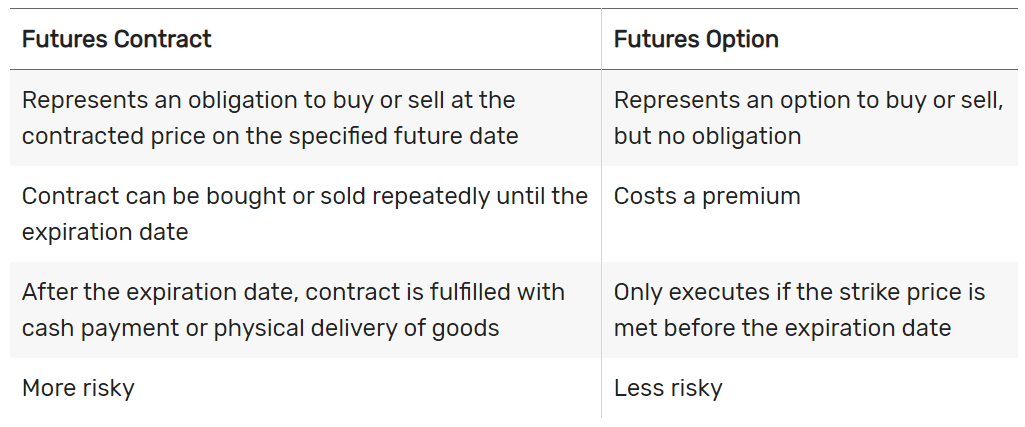

Futures allow holders to lock in the price of an asset for a specific moment in the future. They are also different, albeit only slightly, from options.

There are futures markets for commodities like wheat and frozen orange juice and markets for currencies. Each futures contract comes with an expiration date, at which point the contract is settled via the physical delivery of the underlying asset or settled in cash. Futures contract holders can buy and sell contracts all the way up until the expiration date.

Naturally, this market attracts speculators, but it can also be an important hedging tool for those interacting directly with the underlying asset. To better understand how futures work in action, it will be useful to unpack a specific example and examine the various relevant agents.

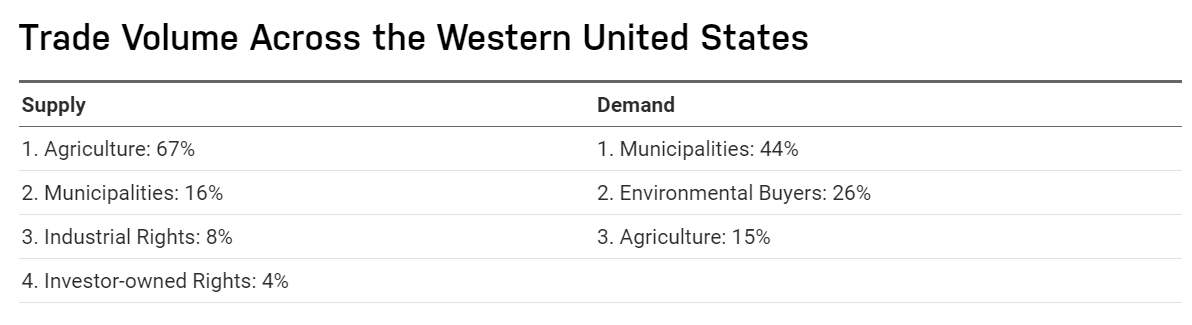

The easiest futures market to understand is that of water futures in California.

Despite its abysmal reality, that of betting on the scarcity of resources necessary for life, California officially opened water futures trading in December 2020. Interestingly, Michael Burry, the market savant that predicted the sub-prime mortgage crisis in 2008, also predicted the arrival of such products in 2010.

Because water is critical for just about every industry, there is a much wider range of market participants beyond speculators.

Almond farmers in California, for instance, will likely be key players in the water futures market. That’s because almonds demand an exorbitant amount of water to grow. This fact, plus the state’s water scarcity concerns and the global popularity for California almonds, make agriculturalists a prime agent in the water futures market.

Thus, with so many almond farmers concentrated in an area with historically limited access to water, water futures offer a means of softening financial downside.

If, for instance, a farmer suspects that the 2021 summer will be an arid season, they may buy water futures contracts that expire in June. Because water is more abundant during the cooler winter months, the cost of water is slightly cheaper. A farmer can thus “lock-in” the cost of water now so that when prices inevitably skyrocket, they can continue to pay winter prices.

The above offers a broad definition of how one specific futures market works. Though agriculturalists are the largest party in this market, they are not alone.

The Nasdaq Veles California Water Index futures (NQH20) are traded on the world’s largest derivatives exchange, the Chicago Mercantile Exchange (CME). They are settled financially rather than via the physical delivery of water.

For more details about NQH20, readers are encouraged to visit CME’s explainer.

With the above example in mind, it’s not difficult to extend futures markets to other assets besides commodities. Jack Tao, the CEO of derivatives exchange Phemex, told Crypto Briefing:

“What started as a practice centered around agricultural producers to hedge the price of their goods against unfavorable conditions, has now transformed into a vital component of financial markets.”

He explained how futures could assist in risk transfer and price discovery for well-established markets like currencies and stocks, too. Ultimately, Tao said that:

“Hedging or price discovery goals can be achieved in a much cheaper, faster, and efficient way through futures. It is simply much easier for a user to perform sell transactions as they do not need to possess the underlying asset first.“

Instead of holding physical bars of gold, bundles of euros, or buckets of water, futures allow interested parties to quickly buy and sell these commodities with ease. Futures contracts also open up leverage tools for margin trading.

Needless to say, these tools and markets also apply to cryptocurrencies, concludes Tao.

Instead of holding Bitcoin, CME traders can buy and sell Bitcoin futures on a fully-regulated derivatives exchange. The exchange has also announced the launch of Ethereum futures in February 2021.

These products are only the tip of the crypto finance iceberg, however.

Introducing Degenerative Finance

Like Nasdaq’s water futures, uGas offers futures on Ethereum gas. And for an industry rife with pure-play speculation, gas futures offer real utility for those building and working within the Ethereum network.

uGas is the first product of an alleged suite of crypto products created and managed by a partnership between YAM Finance and UMA Protocol.

UMA is one of the first crypto protocols to allow users to mint synthetic assets backed by any mixture of other crypto assets. Examples of their work include the launch of a so-called “yield dollar” and a synthetic asset that lets holders short the price of Compound’s COMP token.

1/ Synthetic $COMP (yCOMP) is live on mainnet.

It is now possible to permissionlessly short $COMP.

— UMA (@UMAprotocol) June 26, 2020

The partnership between YAM and UMA is called Degenerative Finance. It is essentially an experimental design space for novel derivatives products. Documentation on the tie-up reads:

“We hope to fill a market need that allows for new forms of speculation and hedging in DeFi that can cater to individual and institutional investors alike.”

uGas is the first example of the partnership’s ambitions. UMA first created it before YAM took over the project’s maintenance. The latter will oversee the uGas interface, branding, and manage risk bound in the uGas product.

📣 uGAS Logo Design Contest $uGAS is set to make waves as DeFi’s first native gas futures. We’re excited to launch a logo design contest so our community can create a bold new visual identity for us!

Total Rewards $1000 in $YAM

Due: January 31https://t.co/z2QZVHfdlZ pic.twitter.com/Ah8TwFd0PG— Yam Finance (@YamFinance) January 14, 2021

Unpacking uGas, Ethereum’s Gas Futures

uGas are synthetic tokens backed by Ethereum. One uGas token represents one million gas. “Gas” in this context does not refer to an actual Gas token, though many tokens on the market take the same name. The term is simply a moniker.

There are currently only three varieties of uGAS tokens: uGas-JAN21, uGas-FEB21, and uGAS-MAR21.

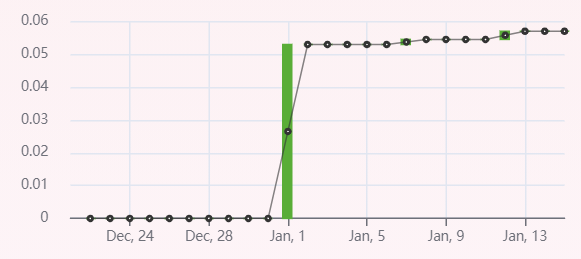

Each variety comes with a corresponding month and year, not unlike traditional futures. These indicators let holders know when the token will expire and settle. They are settled in ETH on the first day of the month following expiration. A uGAS-JAN21 token will thus settle on Feb. 1, 2021.

The amount settled is determined by the median gas price for all Ethereum transactions 30 days before expiry.

If the median gas price for the 30 days before the Feb. 1 settlement is 80 Gwei, then 1 uGAS-JAN21 token will settle at 0.08 ETH, roughly $97 at today’s price. Users can buy uGas tokens on Uniswap or mint the token directly on the uGas platform.

Minters must also be aware of the protocol’s liquidation level, or Global Collateralization Ratio (GCR). Like many DeFi protocols, uGas assets must be overcollateralized. What’s more, the GCR can change and follows this equation: Total collateral per contract divided by the total number of outstanding synthetic tokens.

This is why the GCR is different for each of the three varieties of uGas tokens. At the time of press, the lowest ratio is for the uGAS-MAR21 token. It is 2.2917.

If the collateral price falls below this level and isn’t quickly replenished, a user’s position will be liquidated.

Due to the volatile nature of cryptocurrencies, keeping this in mind is critical for any risk management strategy.

How to Use uGas

The uGas token allows users to short and long the price of Ethereum’s gas. This is attractive for traders but also yield farmers and ETH miners too. Like water futures, uGas offers a new tool to help anyone interacting with Ethereum to hedge their position or business.

To understand how one can hedge their position using uGas, it’s useful to examine how an active DeFi user might leverage this token.

At the time of press, one uGas-FEB21 token costs ~0.057 ETH. At the same time, this past weekend has seen various popular DeFi tokens rise double-digit percentages.

Gas prices remain low for now, but once the buying spree ends, many new entrants will likely want to put their DeFi tokens to use via yield farming or a lending protocol like Aave. This means that gas prices will likely rise.

One way to bet on this thesis and lock in current gas prices would be to determine roughly how much gas one typically uses in a month to manage a portfolio.

For the sake of simplicity, this trader spends .5 ETH per month on gas.

The trader also assumes that the price of gas is going to increase. Thus to cover her gas costs for February 2021 and bet on gas prices increasing, she will need to purchase ~8.77 uGas-FEB21 tokens.

As she trades and interacts within the DeFi space, an unexpected airdrop and a hugely popular yield farm also emerge, skyrocketing gas prices. This results in the trader’s gas fees for the month to also increase. Fortunately, she continues to hold her ~8.77 uGas-FEB21 tokens. And because the median gas price for the past 30 days has increased, so too has the value of her uGas tokens.

Upon expiry, the median gas price settles at .1 ETH per token, netting her a profit of .877 ETH.

For more elaborate examples of how one can use the uGas token, it is recommended to visit the Degenerative Finance documents page.

Risks, Competitors, and Pitfalls of uGas

The risks of using uGas boil down to its experimental nature. Warnings of this nature are found throughout the uGas platform and on Uniswap when purchasing this token.

One must also keep in mind the issues that brought YAM Finance to a grinding halt in August 2020.

Though Open Zeppelin, a household name in the crypto auditing community, has verified the relevant smart contracts, the Degenerative team warns:

“The application of this contract on a volatile price identifier such as Ethereum gas prices is novel and unpredictable in a live market.“

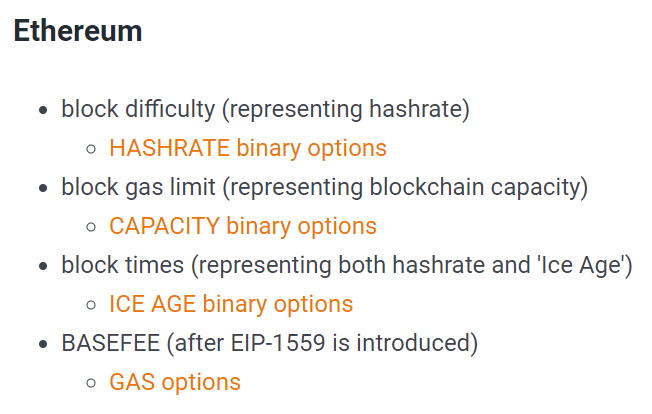

In terms of competition, Oiler Network is perhaps the only similar offering at the time of press. Oiler Network isn’t futures either, but they let users bet on different changes to Ethereum via options.

The final consideration is that of scaling solutions. Though unlikely, mass migration to any Layer-2 solution would render gas-specific economic protocols obsolete.

But based on how long it took for Ethereum’s Beacon Chain to launch, these solutions don’t pose any major risks for uGas in the near-term.

Final Thoughts on uGas

Futures contracts are a critical part of all financial markets, and bringing them to the world of crypto is a no-brainer.

Though many forms already exist, uGas offers a necessary tool for safely interacting with Ethereum. Like the Almond farmers of California, DeFi’s yield farmers also need ways to hedge against exorbitantly priced commodities.

uGas is also a relatively advanced product and demands a clear understanding of gas prices and how they may affect a portfolio’s management. Thus, a user that doesn’t spend much in gas fees in a given month may not find real use with this product (outside of pure speculative interests).

For more active users that leverage larger sums of money, the risk lies in the underlying code. Due to uGas’ novelty, the underlying smart contract could break down one way or another. This is a risk for any DeFi protocol.

If anything, uGas reminds users of the potential for experimentation in the DeFi space.

Though the protocol may be vulnerable to code malfunctions, it earns points for creativity. Capitalizing on volatile gas prices is a hugely untapped market.

Whether uGas emerges as the dominant custodian of this market remains to be seen.

Disclosure: At the time of press, this author held ETH. Phemex is a sponsor of Crypto Briefing.

Share this article

DeFi Project Spotlight: Archer DAO and Ethereum’s “Dark Forest”

Archer DAO is building a community of on-chain analysts to generate new revenue streams for Ethereum miners. Though nascent, the project has already gained attention within the DeFi community due…

DeFi Project Spotlight: B.Protocol, Decentralized Backstop Liquidity

Decentralized crypto lending kickstarted the DeFi craze of 2020. The launch of Compound token COMP in June 2020 attracted the market’s attention and provoked the expansion of the DeFi ecosystem….

Using futures term structure and basis as an indication of sentiment, …

In this article we are going to talk about how futures term structure and basis can be a useful tool to traders for directional advantage and identifying a potential bottom….

Ethereum’s Top Gas Guzzlers are Ponzi Schemes

Ponzi schemes are among the biggest consumers of gas on the Ethereum network, heightening already bad congestion and jacking up transaction fees. Uniswap and Tether are the top gas consumers…