This week, transaction fees on the Ethereum blockchain grew to a level that made the decentralized applications (dapp) operating atop it practically unusable. In some cases, transferring as little as $5 across the second-largest public chain started costing as high as $300.

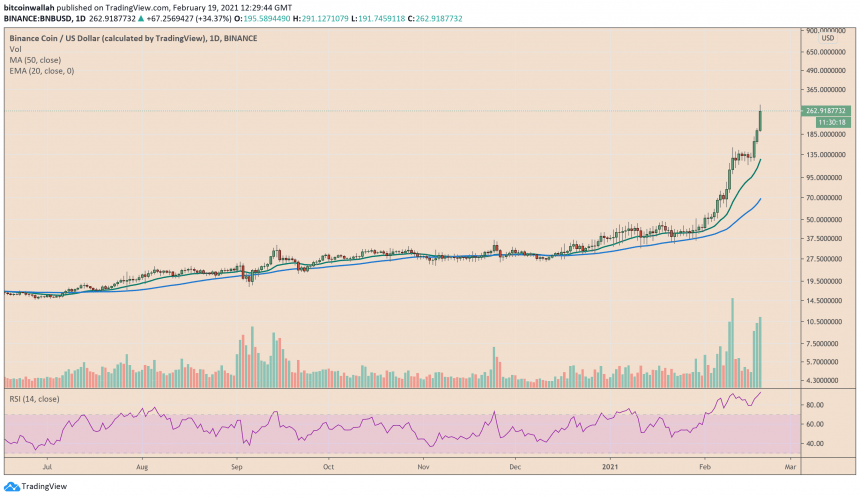

With no choice left, many of the dapp developers decided to run the same operations on a rivaling blockchain network, the Binance Smart Chain, a public ledger that offered to do the same tasks Ethereum does at 99 percent lesser costs. On Wednesday, the BSC blockchain processed about 2.12 million transactions compared to 1.26 million on Ethereum.

The strong shift also appeared as PancakeSwap, a UniSwap ripoff launched atop the BSC blockchain, rivaled Ethereum-based decentralized exchanges, driving a 1,000 percent-plus liquidity surge this year, accompanied by strong volumes—from $37 million on Jan. 1 to $1.68 billion on Feb. 19.

Meanwhile…

…Binance Advertisements