- The CEO of Pantera Capital has pointed out that EIP1559 will make Ethereum a more deflationary asset than Bitcoin

- He believes Ethereum is undergoing a market re-rating for EIP 1559 and proof of stake

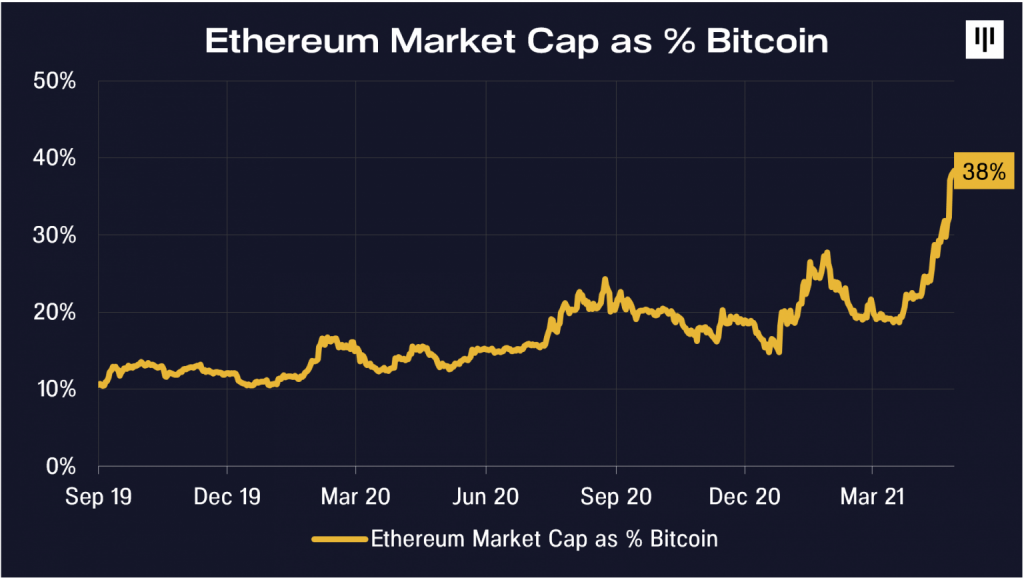

- The ratio of Ethereum’s market cap to Bitcoin’s has doubled in the last year

- Ethereum will keep gaining due to DeFi and rapidly growing adoption

The CEO of Pantera Capital, Dan Morehead, has shared a brief analysis of the effects of EIP1559 on the market value of Ethereum. According to Mr. Morehead, the implementation of the Ethereum Improvement Proposal will make ETH more deflationary than Bitcoin. He also pointed out that the market is currently re-rating Ethereum for the EIP implementation and staking. He explained:

We think this is the beginning of the market re-rating Ethereum for EIP 1559 & Proof of Stake. A deflationary asset – where each block, negative Ethereum are issued. This means ETH will be a more deflationary asset than bitcoin.

The Ratio of Ethereum’s Market Cap to bitcoin Has Doubled in the Last Year

In addition, Ethereum’s success in the crypto markets has resulted in the ratio between its market cap and Bitcoin’s, doubling in the last year as visualized through the following chart.

DeFi and Growing Adoption Will Allow Ethereum to Gain Market Share

In conclusion, Mr. Morehead went on to forecast that the rising DeFi ecosystem on Ethereum and the adoption of ETH, will ultimately lead to the digital asset gaining market share relative to Bitcoin.

Ethereum has a massive ecosystem of decentralized finance use cases with rapidly growing adoption.Combine these two dynamics and we think Ethereum will keep gaining market share relative to Bitcoin.

Ethereum’s $3.6k and $3.5k are the Levels to Watch During the Weekly Close

At the time of writing, Ethereum is trading at $3,800 after a brief dip to $3,620 earlier today.

The latter price area has created a double-bottom pattern with the May 13th low of $3,540 when Elon Musk announced that Tesla will no longer be accepting Bitcoin for car payments.

Therefore, with the weekly close only hours away, $3,600 and $3,500 will be two levels to watch leading up to the event. They will determine whether Ethereum continues on its bullish path above $4k.